Jerome Powell’s hawkish Fed stance didn’t seem to be able to destroy our little crypto parade for once. We’re holding above $20k but haven’t made any meaningful moves in any direction and are still in the same range we’ve been in since summer. NFP came in middle-to-soft. We saw +261k payrolls added, the lowest since Dec2020, but also above the pre-pandemic jobs gain rate. Post NFP, we saw yield curves steepen; copper, cryptos, and precious metals rally. Stocks were soft. China is rumored to ease COVID lockdowns, which could be another bullish catalyst. BIG themes to look for in 2023 are more hikes BUT an inflation target adjustment from 2% → 3%: this would be huge.

GM! Sharing is caring. Be a chad and share this newsletter with your colleagues.

Interesting Stuff:

JP Morgan's first crypto trade:

Last week, history was made. JPMorgan successfully tokenized Singaporean dollar & Japanese yen deposits for a foreign exchange trade. It was the first time traditional banks completed a Defi trade on a public blockchain, including DBS Bank and SBI Digital. Next, DBS and SBI traded government bonds using the tokenized assets, while JPM used on-chain verifiable credentials (VC) to provide compliant access. This was part of “Project Guardian.” Two more pilots are around the corner. This a field to watch in the future since the forex market has more daily volume than the NY Stock Exchange, Tokyo Stock Exchange, and London Stock Exchange combined.

BTC Mininig Capitulation

Hash rate measures the total amount of computational power being summoned to process transactions and power Bitcoin’s network. The higher the hash rate, the more robust and desirable the blockchain becomes for users and investors. In exchange for doing so, individuals and entities are compensated with BTC.

Higher hash rate = more challenging to earn BTC = more energy costs / fewer rewards.

The difficulty is less of an issue when the price of BTC is high because profits offset costs, but since BTC has been stuck at $20k since June, difficulty has become a significant pressure point. The average energy cost miners require to produce 1 BTC hovers around $17,000, depending on specific energy, capital, and operational expenses.

Skyrocketing costs of energy paired with serious difficulty and low BTC price is bringing miners on the brink of total destruction as we saw recently in the news:

The world’s largest Bitcoin miner (~4% of the hash rate), Core Scientific, announced it wouldn’t make payments due to month. Likely claim bankruptcy by December.

Compute North already filed for bankruptcy, despite selling over $100m of equity last month.

Iris Energy has announced they are nearing default on over $100m loaned by NYDIG.

Argo Blockchain will need to curtail or cease operations eventually.

Poolin (China) cut their hash rate by over 50% and froze withdrawals.

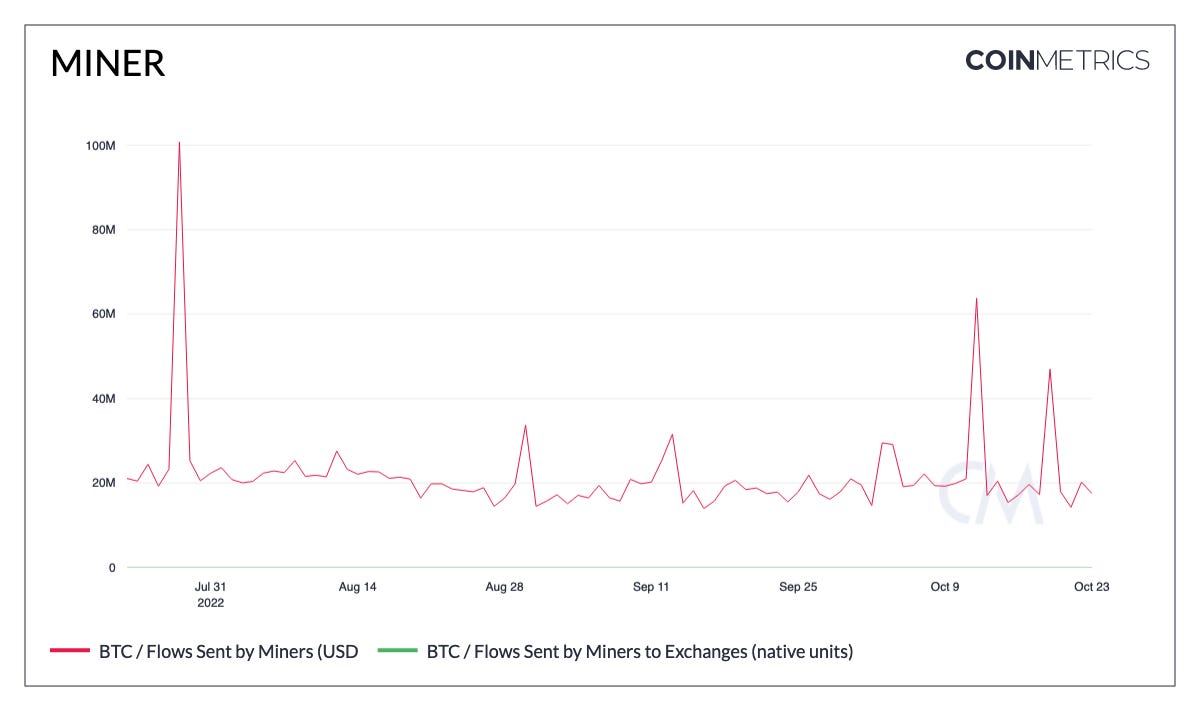

Revenue by miners is down over 65% since last year, and zombie companies like Core are net negative for Bitcoin. Shrinking profit margin forces under-capitalized miners to sell their freshly mined supply asap despite the price being down over 70% from ATH. A steady flow of ~$20m in BTC sell pressure has been sent to exchanges daily since June as distressed miners struggle to remain solvent. Making it difficult to sustain any rallies until they are fully purged.

This leads us to the elephant in the room: what will happen to Bitcoin’s price when these failed miners finally capitulate? In addition to that, at present, miners own less than 1.75 million BTC in aggregated reserves. Over 90% of it is believed to be permanently lost as it hasn’t moved in over 7 years. The lowest amount they’ve held since early 2010. This data implies that most miners capable of being squeezed out of their BTC supply have already capitulated or are at the brink of it.

Why we love Crypto Twitter:

While Binance has broken more laws in various jurisdictions than America has States, CZ is having a go at FTX again. Binance wants to remove roughly $500m of FTT from their books and do it in good old pr fashion. No surprise here since FTX bought out Binance shares in its company in July 2021 because “there are some differences between how we run our businesses,” according to Sam Bankman-Fried.

Alameda did not have it. Casually mentions in a tweet they will buy back half a billion without ease. Stuff you only see on CT.

The back story was already published in our last newsletter. Where there's smoke, there's fire?

Crypto News:

Over 1000 Solana validators hosted on Hetzner have seen their server access blocked by the cloud provider. The Solana network seems to be unaffected despite having 22% of the network’s security vote offline.

Goldman Sachs is working with index provider MSCI and crypto data firm Coin Metrics to develop a crypto classification service called Datonomy.

Global payments giant Mastercard continues supporting cryptocurrency and blockchain startups as part of its fintech accelerator, adds seven blockchain startups to its crypto accelerator.

Payments firm Stripe is letting go of 14% of its workforce, following in the footsteps of other fintech and crypto companies.

The founders of crypto investment platform Bitpanda have quietly set up a venture capital firm, founded already back in May last year.

Bakkt is set to acquire Apex Crypto from Apex Fintech Solutions for up to $200m (55m in cash, 145m in stocks, and dependent on targets) to bolster its cryptocurrency product.

Investment powerhouse Fidelity opened up a waiting list for Fidelity Crypto, which will offer commission-free trading of bitcoin and ether alongside traditional stock investments in one app.

Binance founder and CEO Changpeng Zhao is looking into potentially buying banks to bridge the gap between the worlds of traditional finance and crypto.

Aave governance approved Matter Labs' proposal to deploy the decentralized lending protocol on zKsync. Matter Labs is the development team behind the layer-2 scaling solution.

NFT & Metaverse:

Revolut's new instant messaging feature launched recently in the UK and the European Economic Area will integrate NFT profile pictures.

BAYC owner Yuga Labs is working on an open standard to enable NFTs to migrate between Otherside and other metaverses.

Funding Highlights:

Magdalena “Mags” Kala, a self-described “lifetime degen,” launches a $30m web3 consumer VC fund. Double Down’s backers include crypto and venture heavyweights such as Chris Dixon and Marc Andreessen of a16z and Paradigm co-founders Matt Huang and Fred Ehrsam.

WalletConnect has raised $12.5 million in what it calls an "ecosystem round" from previous lead investors 1kx and Union Square Ventures, along with companies and projects such as Shopify, ConsenSys, and Gnosis.

Crypto Twitter: