Crypto Alpha Recap

16.03.2023: Arbitrum token confirmed. DeFiance Capital completes $100M token fund. Fidelity Crypto went live. Coinbase introduces Wallet-as-a-Service products. Cosmos launches Replicated Security.

Wild couple of days. The US Fed announced $25B in funding to backstop banks after we saw the collapse of Silvergate, followed by the closing of Silicon Valley Bank (second largest failure in US history with $209B) and Signature Bank New York on Monday. All three institutions are expected to return full deposits, whether held by reserves or FDIC and US regulators' deposit guarantees.

It allowed USDC to regain its peg after it went as low as 0.88 cents over the weekend, as it led to doubt in the ability of Circle to process withdrawals and maintain the 1:1 peg. Circle was custodying around $3.3B in SIVB, 8.25% of USDC's $40B market cap. Fiat-collateralized stablecoins are tokens issued on public blockchains that aim to track an underlying fiat currency. For every 1 USDC issued, a promise of $1 is kept in reserve off-chain to back these tokens and handle redemptions accordingly.

This is a friendly reminder that systemic risk goes both ways and highlights the dangers of excessive reliance on centralized infrastructure. It was ironically making a bullish case for crypto again and why the basic primitives like self-custody, on-chain transparency, and disintermediation are more acute than ever.

Macro: CPI came in as expected with Core YoY: 5.5% (Est. 5.5%), CPI YoY: 6% (Est. 6%) and has fallen for the eighth consecutive month. PPI came in cool.

PPI -0.1% M/M, Exp. 0.3% / PPI 4.6% Y/Y, Exp. 5.4%

PPI Core 0.0% M/M, Exp. 0.4% / PPI Core 4.4% Y/Y, Exp. 5.2%

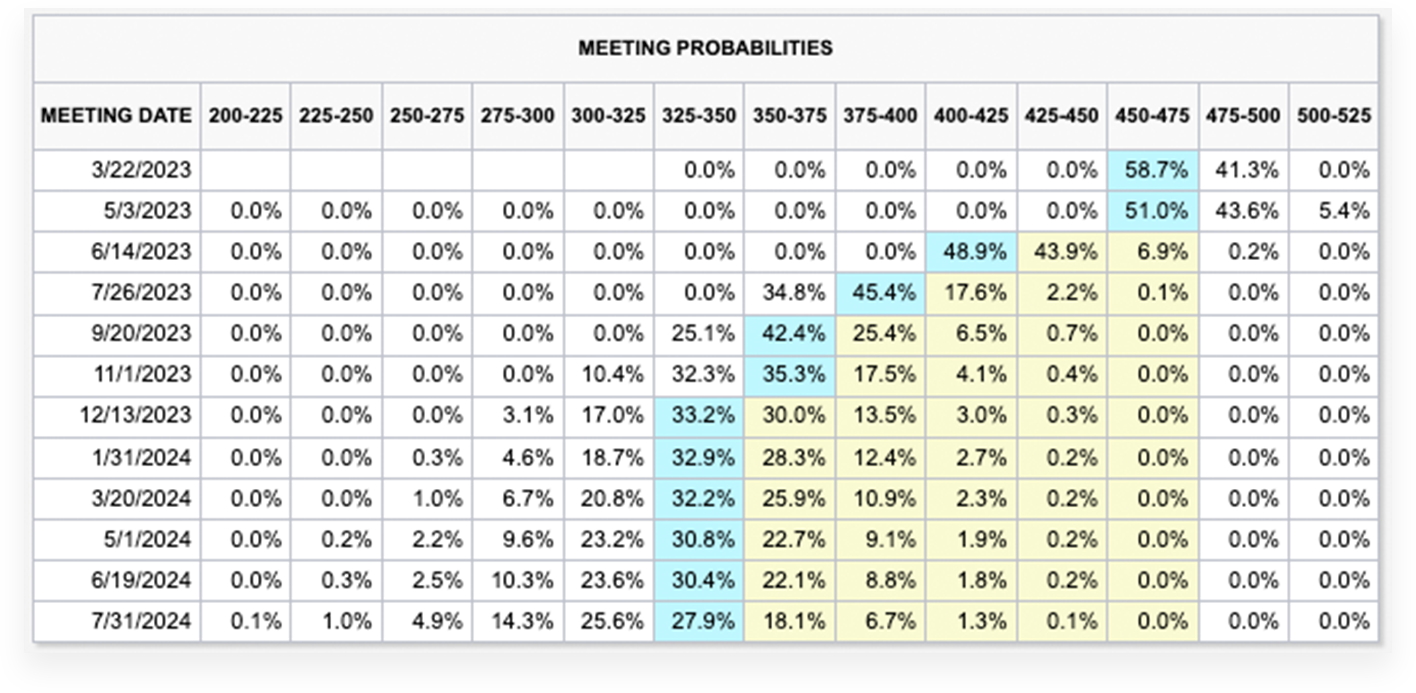

Markets are now pricing in one more rate hike (25bp priced in around 71%) as the base case, with a pivot in 3 months and 100-125bps of cuts by EOY. ECB raised rates 50bps - more trouble for banks?

GM! Sharing is caring. Be a chad and share this newsletter with your colleagues.

Special Nugget:

Quo vadis USDC?

The digital asset industry is short three crypto-friendly banking institutions in the US and finds itself within an increasingly hostile regulatory environment. New York-based Signature Bank was shut down by state regulators, citing systemic risk. It's the third bank collapse, following Silvergate Bank's voluntary liquidation and Silicon Valley Bank's shutdown. The FDIC took receivership of the bank to protect depositors. Full deposits are expected to be returned, whether by reserves held or via FDIC and US regulators' deposit guarantees. Crypto-only banks Silvergate couldn't recover and is another victim of the FTX contagion, while Signature Bank was closed for not providing data.

But why should you care about silly banks if you are fully on-chain, is it connected? Everywhere. Unlike USDT (Tether), USDC was always the most trusted stablecoin as its issuer Circle has severe audits and proof of funds. That all changed when it was known that they had USD 3.3B stuck in Silicon Valley Bank (1 of 6 banks used for its ~$40B reserves) last Friday. USDC depgged and hit a low of $0.878 over the weekend before regaining its peg on Monday after the backstop. As degens had to realize that trust in USDC ultimately relies on trusting the TradFi banking system and the government.

DeFi is built on USDC liquidity; it was considered the safest collateral to such an extent that Compound v2 hard-pegged it to $1. But during the weekend, Circle cannot honor redemptions. Why? Banks are closed. The only option was to market sell USDC on DEX/CEX, impacting the peg.

Let's recap how the peg is maintained for USDC:

When USDC < $1.0, arbitrageurs buy USDC and redeem with Circle for $1.0.

When USDC > $1.0, arbitrageurs sell USDC for a profit.

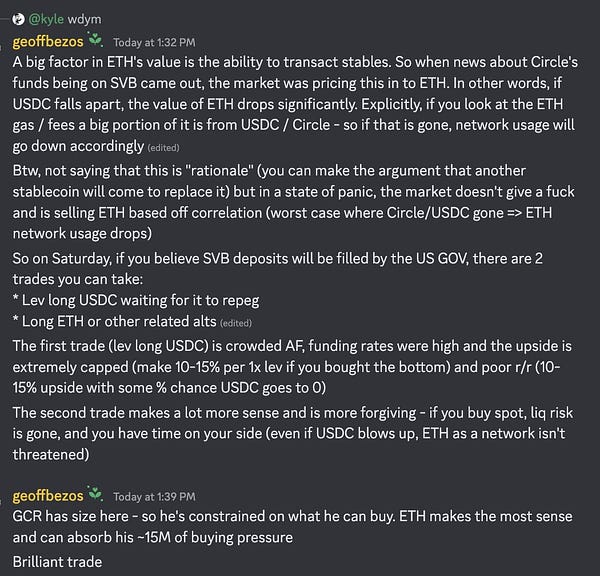

Not even announcements from Circle stating USDC will remain redeemable 1 for 1 with the U.S. Dollar & "will stand behind USDC and cover any shortfall using corporate resources, involving external capital if necessary" could stop the PTSD of the UST stablecoin implosion with Terra. Most traders took a "better save than to be sorry" approach. As always, if you panic, panic early; taking a 1% cut is nothing. I was a little late to the party but finally cut my exposure, swapped USDC at 0.975 for Tether, and rebought hours later at 0.93. USDC hit new lows shortly after, and I used a different approach. In hindsight, the best alpha would have been just longing ETH.

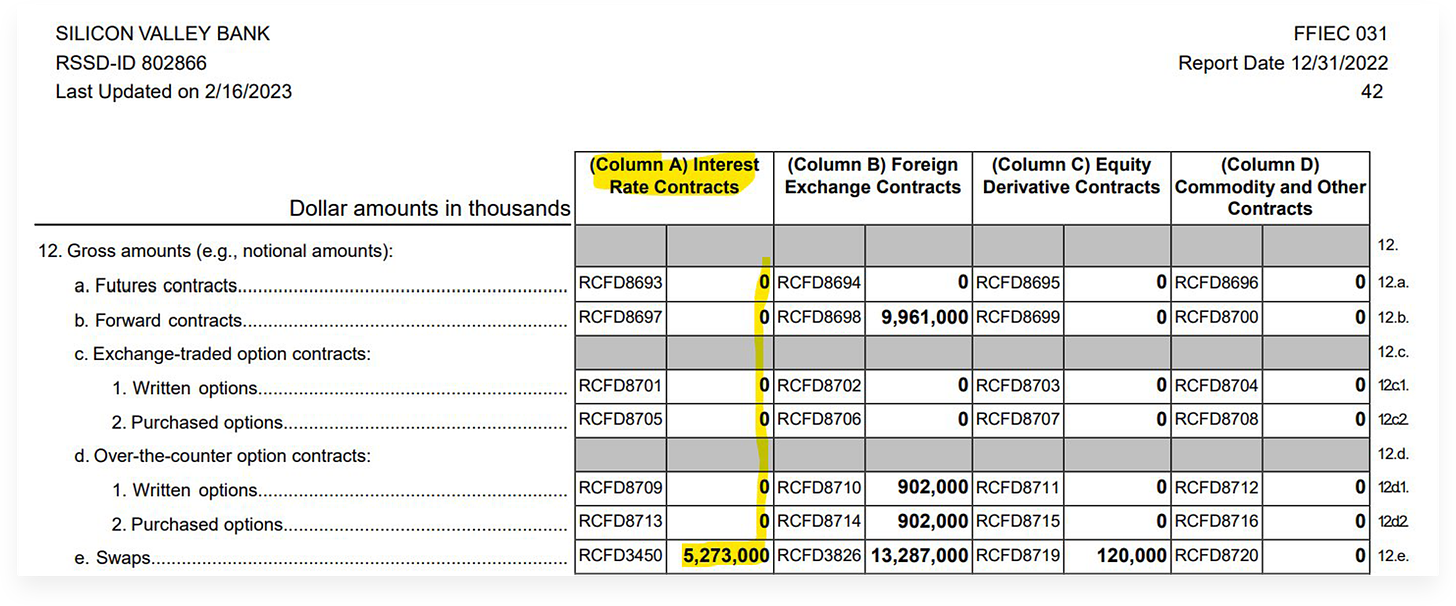

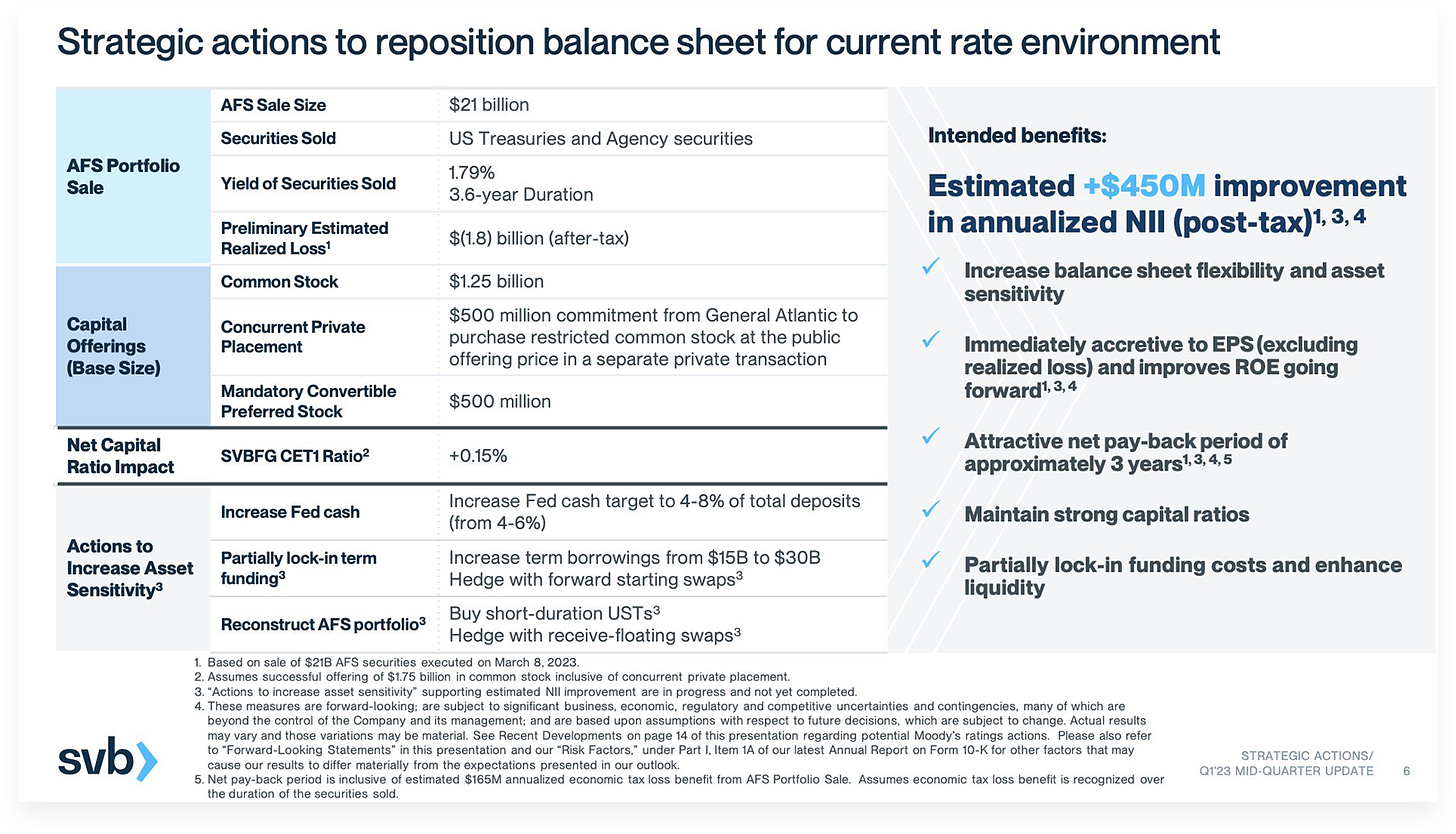

But why did SVB blow up in the first place? Deposits in SVB grew from $60 billion in 2019 to over $189B in 2022. They bought $80B in Mortgage Backed Securities (MBS) with an average yield of 1.5% as interest rates were at historic lows. When rates rise, fixed-income prices fall. And SVB held $120b in securities but didn't hedge their interest rate exposure.

SVB, indeed was picking up pennies in front of a steamroller. Its strategy to invest deposits in long-term fixed-rate bonds — without hedging — was to make an extra 0.4% yield. Additionally, when interest rates rise, SVB's cost of funds (i.e., interest-bearing deposits) increases while its interest income on loans might remain fixed (if it invested primarily in FIXED-RATE USTs!). This leads to a decline in profitability, i.e., lower "NIM" (net income margin). When SVB declared a $1.8B writedown on a $21B sale of almost its entire AFS (available-for-sale) fixed-income portfolio, it caused a bank run, and it's failing.

Meanwhile, Moody’s has cut its outlook for the entire US banking system from stable to negative, and Credit Suisse had to secure a credit line up to CHF 50B from Swiss National Bank. Truly bottom times, banks are collapsing left and right.

Interestingly we are seeing little to no outflows as stablecoin market cap is sitting at $130.4B. As for USDC, there are two paths moving forward.

Meme of the Day:

General:

Arbitrum’s long-awaited airdrop to go live next week and will hand 12.75% of its governance token’s supply to its community.

Coinflex rebranding to Open Exchange (OPNX), 3AC co-founder’s latest crypto venture.

Fidelity Crypto quietly went live, finally giving millions of users access to bitcoin and ether investments.

Coinbase introduces Wallet-as-a-Service products to simplify web3 onboarding.

Swiss bank Sygnum is seeing increased client inquiries, particularly from hedge funds, in light of Silvergate shutdown.

US DoJ is probing Jane Street, Jump, and Alameda over Terra stablecoin bailout group chats.

U.S. Federal Reserve is activating its long-awaited real-time payments system in July.

Binance is converting the remaining $1B industry recovery funds from BUSD to BTC, ETH, and BNB.

OpenAI’s newest version of Chat GPT-4 is taking the crypto world by storm.

Goldman Sachs filed a patent for blockchain tech to integrate with the settling mechanism.

DeFi & NFTs:

Lending protocol Euler has lost around $197m in DAI, WBTC, sETH, and USDC. in a flash-loan attack. The hackers seem to be the same ones that exploited some BSC projects a few weeks ago. Euler Finance’s offer to hackers: Keep $20M or face the law. Affected protocols: Angle, Balancer, Yearn, and Alchemix.

Aztec announced the closure of Aztec Connect (zk.money). Deposits will be disabled in a week, and users will continue being able to withdraw with no fees for one year.

Cosmos approved a proposal to launch v9-Lambda and released Replicated Security, allowing other chains in the Cosmos ecosystem to lean on its network security. It leverages the Security and provides value accrual to the ATOM ecosystem, as up to 25% of the app chain fees are distributed as rewards to Cosmos Hub stakers.

Gearbox V3 teaser: ReDEFIning leverage and lending.

Lido expects staked Ethereum withdrawals in May.

Uniswap is now live on BNB Chain.

dYdX passed the vote to reduce trading rewards by 45%.

Meta plans to stop working on NFTs.

Funding:

DeFiance Capital completed the first close of a $100M liquid token fund.

Alpha Transform Holdings announced $100M for two new funds.

Proven, working on zk proof of solvency, raised a $15.8M round led by Framework Ventures.

Kresus, building a “goof-proof web3 super-app”, raises $25M series A.

Violet launched Mauve DEX and raised $15M, backed by Coinbase Ventures & Brevan Howard.

Matchday, a soccer-centric Web3 gaming startup, raised $21M in seed funding.

Crypto payroll startup Toku raised $20M led by Blockchain Capital.

Web3 developer tools provider Cubist raised $7M in seed funding led by Polychain Capital.

Layer 1 blockchain Shardeum raising $5M in a strategic round at a $250M token valuation.

Crypto Twitter: