As markets are still in agony, prices remain somewhat modest as contagion spreads. Domino after domino is falling. It runs circles around centralized entities in the aftermath of FTX. BlockFi is exploring a bankruptcy filing, while Genesis halted withdraws for its lending division. Genesis had ~$175m in locked funds on FTX; however, it didn't impact their market-making activities. Then they received a $140m equity infusion from DCG (also running Greyscale). Currently has $2.8B in active loans, and effects are already tripling down to Gemini.

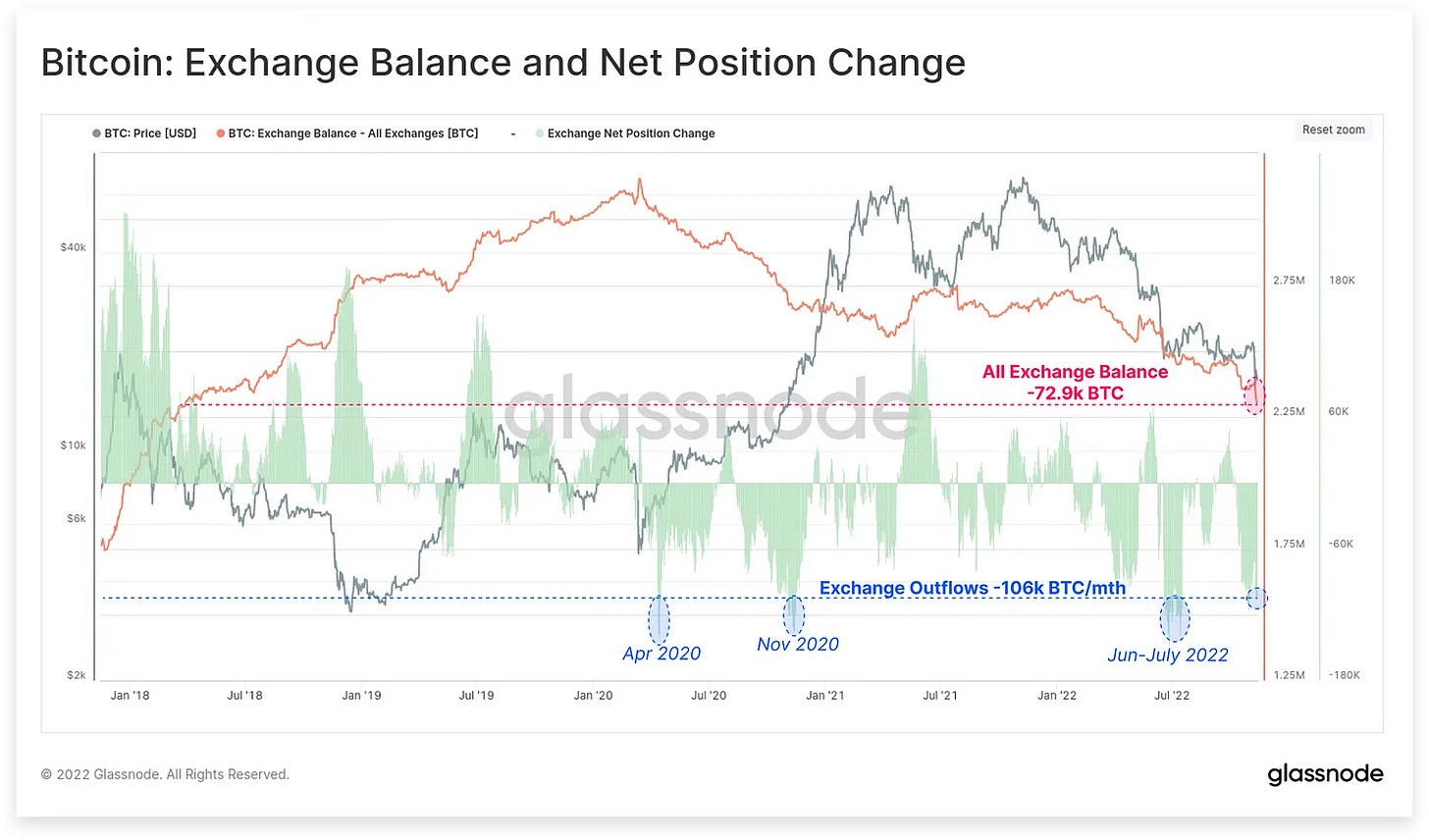

Ironically, the overall implosion is making a bullish case for DeFi. While on-chain activity is flourishing, DEXs generated over $32b in volume in the last seven days. Central exchanges have seen one of the most significant net declines in aggregate BTC balance in history, falling by 72.9k Bitcoin. As people are running off to self-custody.

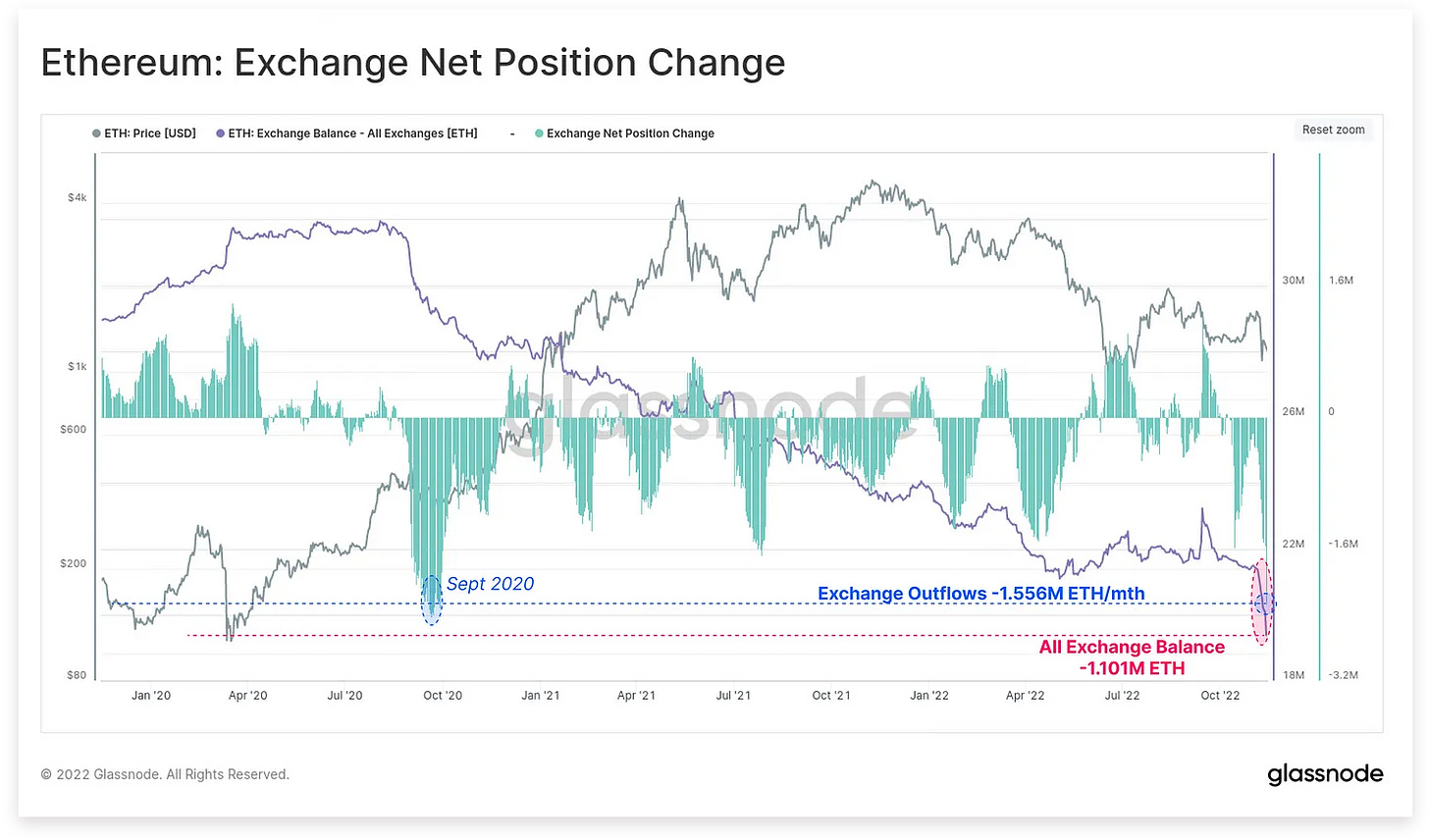

ETH saw 1.1m being withdrawn, the largest 30-day balance decline since September 2020 (peak DeFi summer), whereby centrally issued stablecoins of $1.04bn are flowing into exchanges.

At this rate, the market is running out of forced sellers. After the recent miners' capitulation, there are barely any CeFi platforms left. We are running out of most downside catalysts, so the contagion remains the elephant in the room. Will more collapses force one last leg down, creating no-brainer opportunities looking long-term?

Meanwhile, SBF is out in full force doing a PR whitewashing par excellence, labeling his fraud as some accounting error ($8bn hole in leverage, wtf). VOX (Foundation got a grant from FTX) and the NYTimes painted him like some misguided genius and failed to mention he is an actual fraud. It didn't take long until industry leaders called them out with facts. Stating that SBF is a blatant liar, a criminal who stole user funds and destroyed many lives. Script editors, take note! This story will enable multiple Netflix seasons.

GM! Sharing is caring. Be a chad and share this newsletter with your colleagues.

Short Nugget:

What’s the big deal with Genesis?

Last week Genesis stated “no material net credit exposure” to FTX. This week they suspended redemptions and new loans due to indirect exposure. The problem? They are the center of crypto.

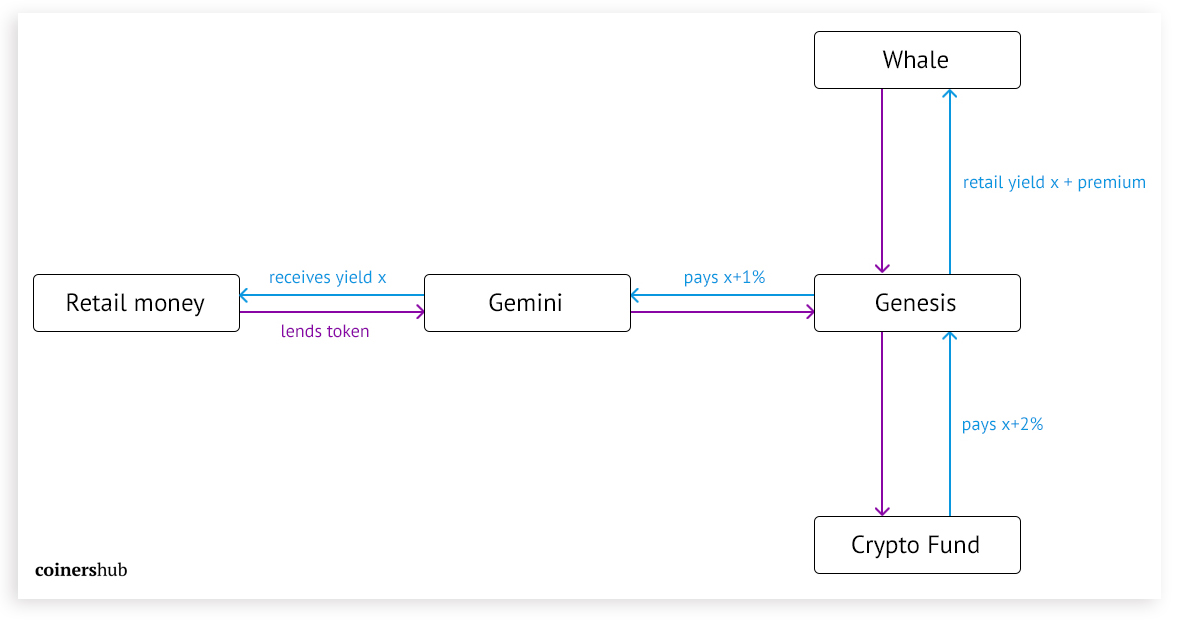

They custody funds and help institutions earn yield. You probably use Genesis if you are a CeFi platform. Which prompted Gemini also to stop any withdrawals.

Simplified the system works as the chart below as long as the counterparties stay solvent and can repay their debts. But if Genesis can’t get hold of its crypto, it can’t give it back to its CeFi platform, which fails then to provide the user with his deposited funds.

Beyond that, nearly every whale is working directly with Genesis. Now those institutions and family offices can’t get their crypto back. This liquidity crunch needs immediate fixing, and DCG will likely step in.

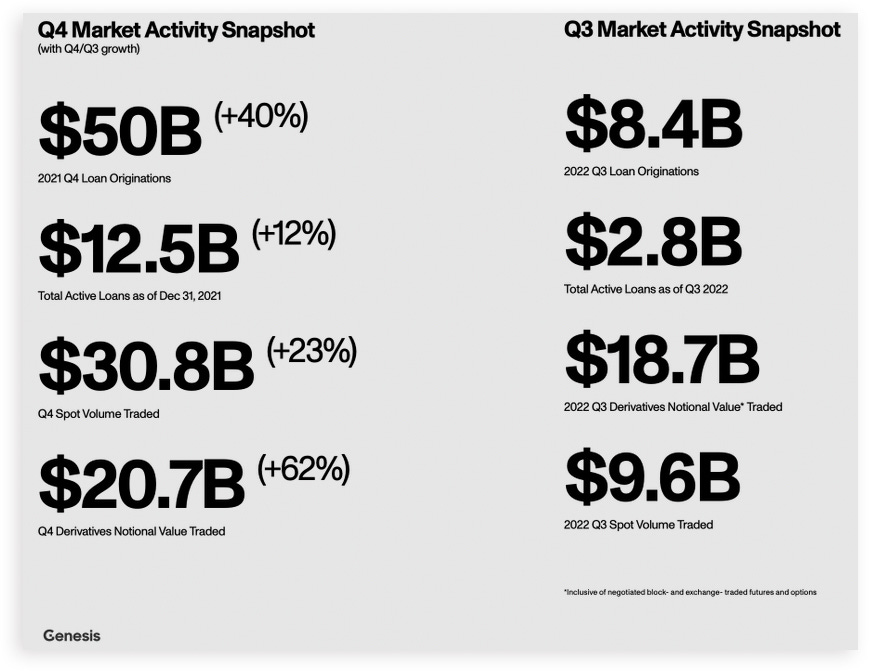

Genesis is the biggest lending desk in crypto, part of DCG, Bary Silber’s holding company, and numerous VC investments. Three Arrows Capital was their biggest creditor and borrowed $2.4bn. DCG assumed the $1.2bn claim, leaving Genesis with no outstanding liabilities tied to 3AC. The decline after other missteps was massive: the size went from $50bn in loans in Q4 2021 to the lows of $8.4bn in loan originations in Q3 2022. People are obviously having trust issues if the deleveraging process is enough. We can only hope for a duration mismatch and that they are sourcing new liquidity.

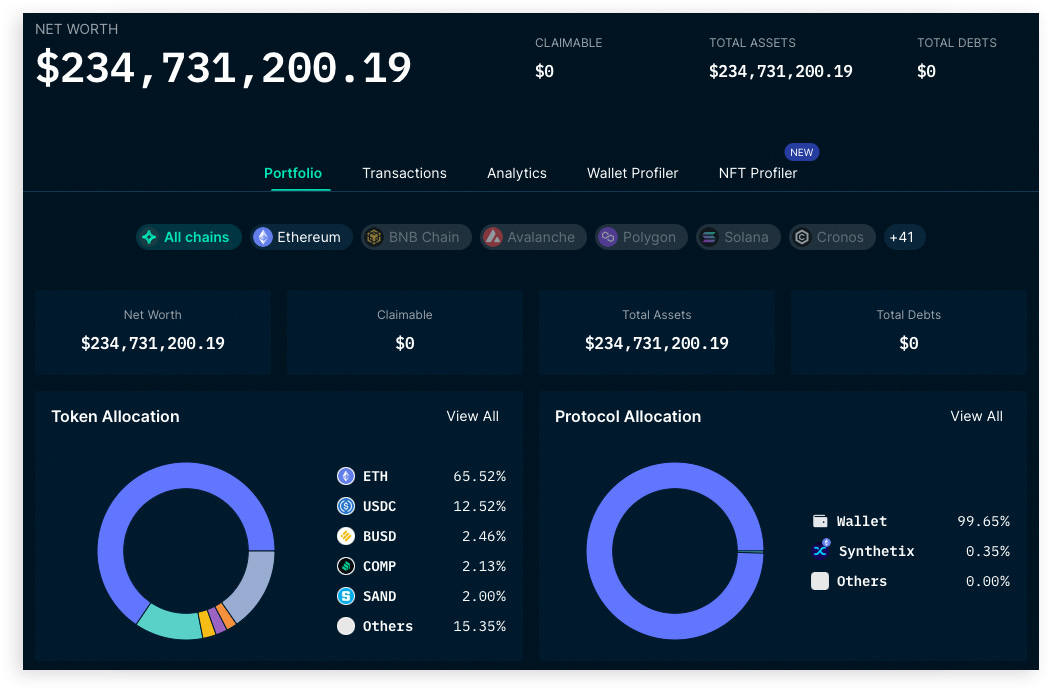

Nansen provided a dashboard overview of the top counterparties for two well-known Genesis Trading wallets. Combined, they currently hold $234m in various tokens. Both have Alameda as one of their top counterparties and FTT as one of their top tokens received/sent. More insights are provided by Martin Lee.

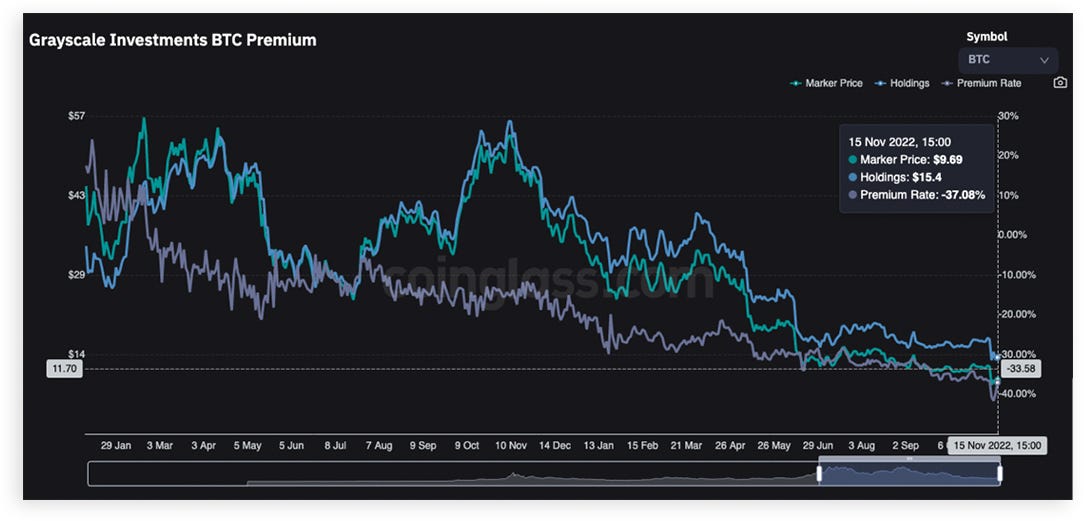

DCG also owns Grayscale. It bolsters 17 crypto ETFs and is one of the largest holders of Bitcoin (~$11b worth). GBTC allows investors to gain Bitcoin exposure through a private trust that trades directly on the stock market. It’s known for its arbitrage play. GBTC currently trades at a ~40% discount to the underlying BTC asset and will eventually even go lower.

Crypto News:

Chainlink Labs offers proof-of-reserve service for embattled exchanges.

Between 25% and 40% of crypto hedge funds had some level of direct exposure to FTX / FTT. Between 7-12% AUM lost on average.

Galois Capital, famous for predicting the Luna collapse and publicly shorting it, lost 100m in AUM on FTX.

Genesis, the lending arm of Genesis Trading, halts customer withdrawals.

Binance will launch a new industry recovery fund. Projects who are crunched in liquidity but otherwise strong can apply.

Temasek, Sequoia, and SoftBank take more than $600m in FTX write-downs.

Circle, the issuer of stablecoin USDC, adds support for Apple Pay.

Heavyweight Paradigm (recently raised $2.5bn) marks down FTX investment to zero at a $290m loss.

Crypto venture firm Sino Global Capital revealed that it has millions of dollars in assets held in custody on FTX.

Tom Brady, Gisele Bündchen, and other celebrities who promoted the beleaguered crypto exchange FTX were hit with a class action lawsuit.

As consumers rushed to self-custody solutions, hardware wallet manufacturers Ledger and Trezor reported a massive spike in sales last week.

Huobi revealed holdings of $3.5 billion in hot and cold wallets for transparency.

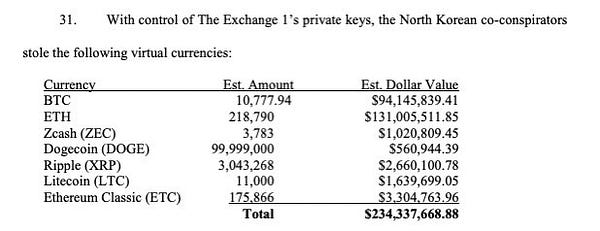

Crypto.com accidentally sent $400M in ETH to Gate exchange, which was returned. Strangely, given the harsh audits and protocols, withdrawals are increasing. Double strange: In April 2018, Gate got hacked by North Korea. Lost over $230m without disclosing.

Kraken, Coinbase, and Gate.io publish proof of reserves with liabilities.

Multicoin Capital's third VC fund has exposure of more than $25m to FTX.

DeFi landscape:

Matter Labs, the developer behind L2 solution zkSync, has raised another $200m. A total of $458M in mission-driven funding. Will go fully open-source and hint again at a possible token.

New users of Uniswap’s web app reached the 2022 high.

StarkNet Token deployed on ETH. Distribution is unknown yet. Tokens held by StarkWare shareholders, employees, and independent partner software developers have a 4-year lock.

Luna Foundation Guard released a technical audit report by JS Held. Showcasing how they did try to defend the UST peg. Key numbers: LFG: ~$2.8B (80,081 BTC and 49.8m in stablecoins) - TFL: spent $613M in additional capital.

Solana foundation & labs facts related to FTX bankruptcy. Solana Defi sees almost $700m in value wiped out due to FTX.

After a loss in trust in CEXs, we saw DEXs trading volumes flourishing. It hit $32bn over seven days. Over 106k BTC has been moved to self-custody.

Cosmos community rejects ATOM 2.0 proposal, which aims to revamp the Cosmos Hub. The community might relaunch and vote on multiple proposals instead. Turnout reached 73.41%. 47.51% in favor, 37.39% no with veto, 13.27% choosing to abstain.

NFT & Metaverse:

Team SoloMid (TSM) announced today that it has suspended its $210m 10-year naming rights deal with FTX.

Star Atlas, the Solana-based gaming metaverse blockbuster, said its cash runway was sliced in half after FTX collapsed.

Yuga Labs (BAYC, Cryptopunks, etc.) has acquired Beeple’s NFT platform “Wenew” and its flagship NFT collection, 10KTF.

Nike is taking further steps into Web3 with the release of .SWOOSH, based on Polygon.

Christina Ronaldo launches an NFT collection exclusively on Binance on November 18th.

SolChicks NFT project lost $20m of treasury funds due to the UST implosion in May 2022 and decided not to inform the community. During the de-pegging event of UST, they didn’t sell because the Ceo is “no daytrader.”

Crypto Twitter:

Meme of the Day: