Crypto Alpha Recap

30.01.2023: 25bps rate hike likely. DydX pushed back its token unlocks. FBI confirms North Korean hackers. Injective launches $150M ecosystem fund.

January comes to an end with another exciting, opportunity-filled week in crypto. We've been consolidating very nicely over the past week as the market gets ready for the FOMC meeting on Wednesday. The big question on everyone's mind is whether or not we are in a recession. The most recent Leading Economic Index from the Conference Board suggests a recession is imminent. Still, as history has shown, it takes a few months for the recession to materialize in the economy. Bitcoin and other risk-on assets like the S&P 500 kicked off 2023 with a bang, which is unlikely for a recession. This suggests that the current state of the economy may not be as bearish as some analysts predict, or it could be a sign that the market underestimates the possibility of a recession.

Overall a robust showing from the US data on the headlines, at least with GDP and durable goods beating consensus forecasts; however, the data could be better underneath the hood. GDP for Q4 (2.9%, estimate 2.6%) was boosted by consumer spending, but momentum, going into the year-end, was slowing on the back of higher interest rates in the US.

With inflation seemingly having peaked, for now at least, and recent economic activity showing signs of slowing, consensus is leaning towards a further slowing in pace from the Fed. Having produced four consecutive 75bp hikes they slowed to 50bps in December and we expect a further reduction to 25bps taking the upper band to 4.75%.

GM! Sharing is caring. Be a chad and share this newsletter with your colleagues.

Meme of the Day:

General:

Coinbase’s chief product officer will leave with $105M from stock sales. Massive payday for someone who didn’t deliver.

Bankrupt crypto lending firm BlockFi has $1.2B in assets tied up with bankrupt exchange FTX and Alameda Research.

A 116-page list of FTX creditors has been made public, illustrating the depths of FTX’s debts.

FBI confirms North Korean hackers were behind the $100M Harmony bridge exploit.

Data analytics firm Arkham Intelligence is adding support for Polygon in Q1.

DeFi:

Wormhole exploiter converts $150M in ETH to stETH via the DEX aggregator OpenOcean to take leveraged DeFi positions.

dYdX has pushed back its token unlocks for investors to Dec. 1 from Feb. 3 - it was set to release 150M tokens, around $282M.

Injective launches $150M ecosystem fund to accelerate interoperable infra and DeFi adoption.

MakerDAO’s community approved a proposal to deploy up to $100M in USDC from its reserve to Yearn Finance for a 2% annual yield.

Lido has submitted its design for withdrawals of ether on the protocol once the Ethereum Shanghai upgrade happens.

Transaction volumes on L2 network Optimism have dropped 70% after the end of the NFT incentive program.

Sushiswap is launching a perpetual futures exchange on the Sei Network to expand into non-Ethereum-based ecosystems.

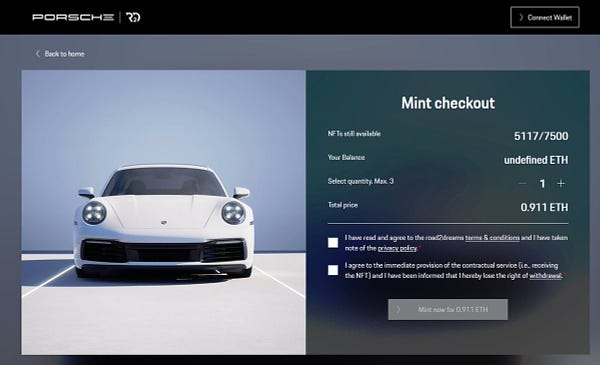

NFTs:

Doodles 2 is arriving at the end of the month and will launch on the Flow blockchain with new personalization options.

Web3 gaming studio Mythical Games is rolling out Mythical Marketplace 2.0, its new digital game asset marketplace, and is considering raising an additional $50M.

Kevin Rose, the founder of the NFT collection Moonbirds, had his wallet hacked, losing an estimated $1M in NFTs.

Pudgy Penguins Lil Pudgys will be allowed to cross-chain using LayerZero from Ethereum to Arbitrum, Polygon, and BNB Chain. Soulbound Tokens are issued to Lil Pudgys users through soulTransport, one for each chain.

Sidenotes:

MYSO Finance expanding to Arbitrum.

Sui Testnet Wave 2 is live.

Aave v3 is set to go live on the Ethereum network.

Cap launches V4 beta on Arbitrum.

Paraswap revamps the PSP token model to 2.0.

Funding:

Blockchain development platform QuickNode announced raised a $60M Series B round at an $800M valuation led by 10T and participated by Tiger Global and others.

Metaverse training software Gemba, used by Nike and Carlsberg, raises $18M in Series A round.

Web3 infrastructure firm Spatial Labs raised a $10M seed round led by Blockchain Capital. Jay-Z also participates, among others.

Sui-based Ethos wallet raises $4.2M led by Gumi Cryptos and Boldstart.

London-based Asset Reality has raised $4.91M in seed money to build a full-service solution for crypto asset recovery.

Crypto Twitter: