Crypto Alpha Recap

02.02.2023: dYdX users traded $466 billion in 2022. Canto TVL doubled. Addressable raised $7.5M. BonqDAO exploited. Uniswap select Wormhole as a bridge.

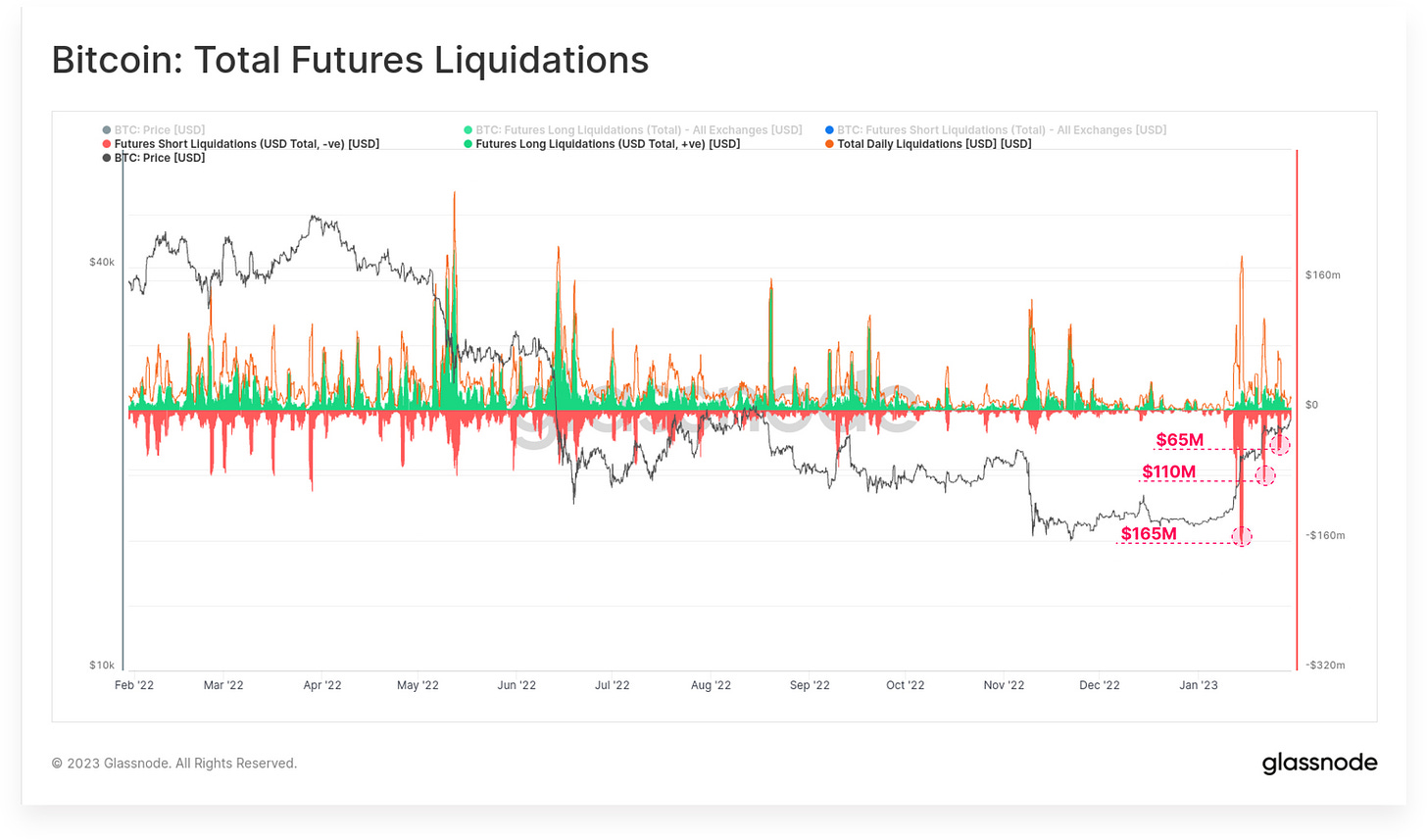

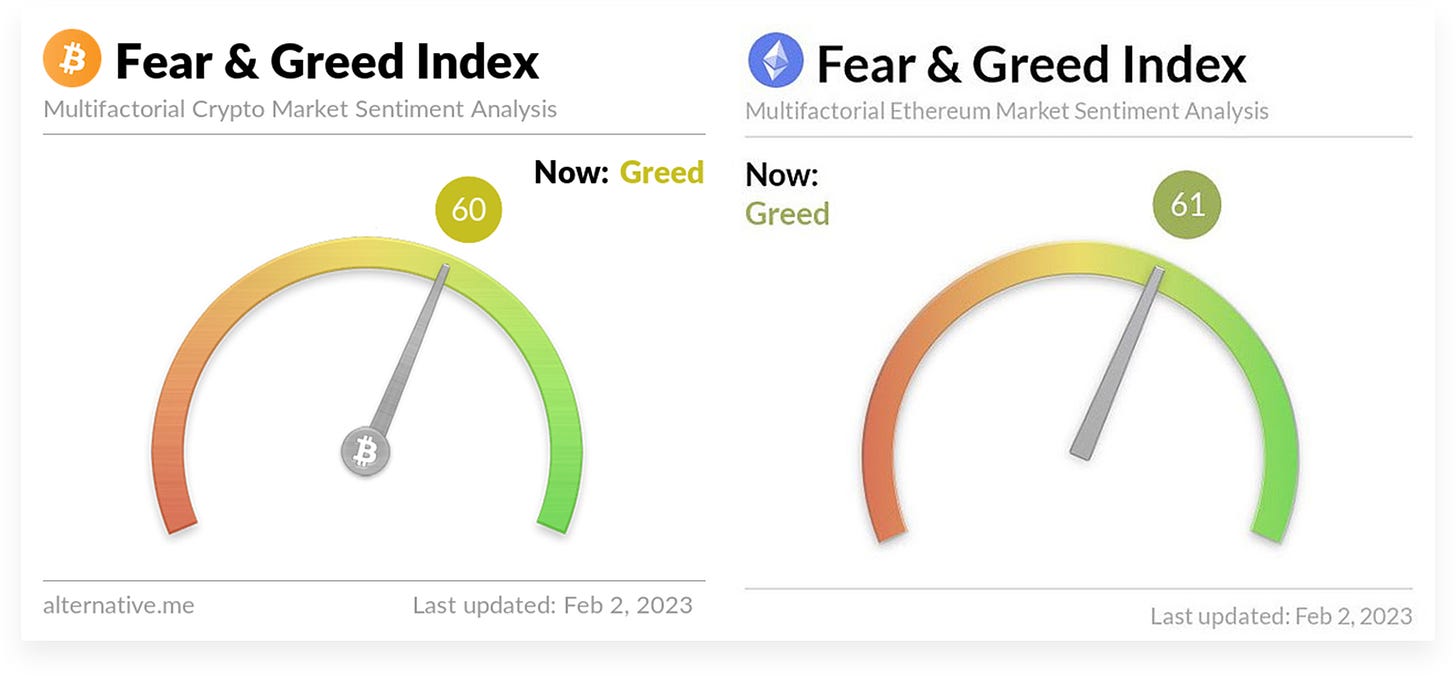

January stood an incredible month throughout the crypto ecosystem. As is often the case, such rallies are often fuelled by some degree of short squeezes within derivative markets, and this rally was no different.

The initial short squeeze in mid-Jan took many traders by surprise (85% of liquidations were shorts). $495M in short futures contracts were liquidated across three waves. This is an even larger magnitude relative to the longs liquidated during the FTX implosion (75% long dominance), showing how offside many traders were.

Macro: Jerome Powell nudged rates upward by 25bps as expected and was relatively dovish. The Fed also signaled that more hikes might be in the offing as it continues to wage its war against inflation. Falling claims show the labor market is still stronger than expected. ECB also signals more hikes ahead and delivered 50bps to 3%, and the Bank of England 50bps to 4%.

GM! Sharing is caring. Be a chad and share this newsletter with your colleagues.

Special Nugget:

I’ll be monitoring the following throughout February:

Cosmos Ecosystem:

ATOM is up 77% from the December lows carrying strong momentum. Q1 should continue as many bullish catalysts are happening. Circle is launching native USDC (chain called Noble), dYdX its chain, and Neutron is also around the corner. EVMOS fork CANTO is the strongest performer this year (+650%). New tokenomics, the liquid staking narrative (Quicksilver launch), exciting developments around Osmosis, and the much anticipated Gnoland airdrop will put Cosmos in the spotlight.

Token launches:

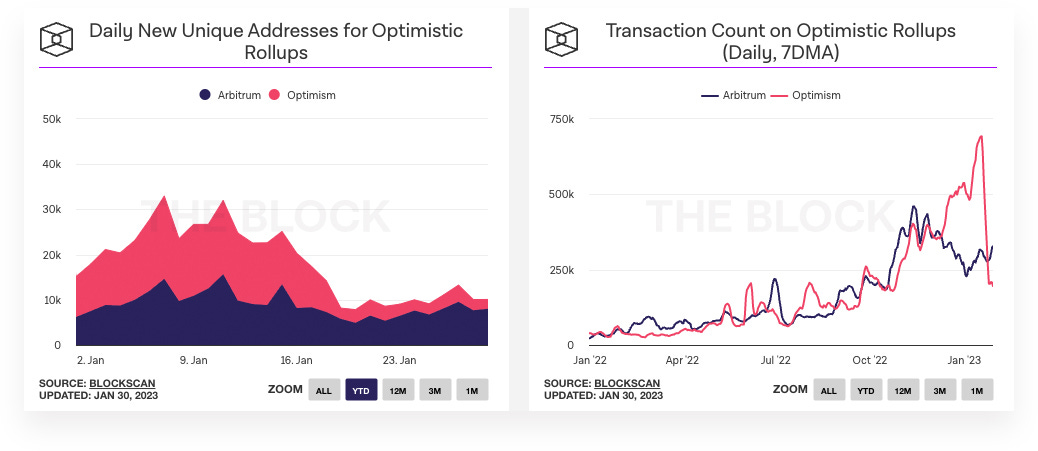

Projects continue to capitalize on market momentum with delayed unlocks, new products/partnerships, and tokenomics revamps. A favorable market segment could push long-touted tokens to be finally released. Connext Bridge is a candidate, the same as Zapper and Zerion. However, I don’t believe we will see an Arbitrum token soon. Since the Optimism odyssey is finished, there has been a sharp decline in transactions as Arbitrum is winning in all metrics, notably in TVL ($1.32B vs. $750M). So there is no urgency in playing that card for now.

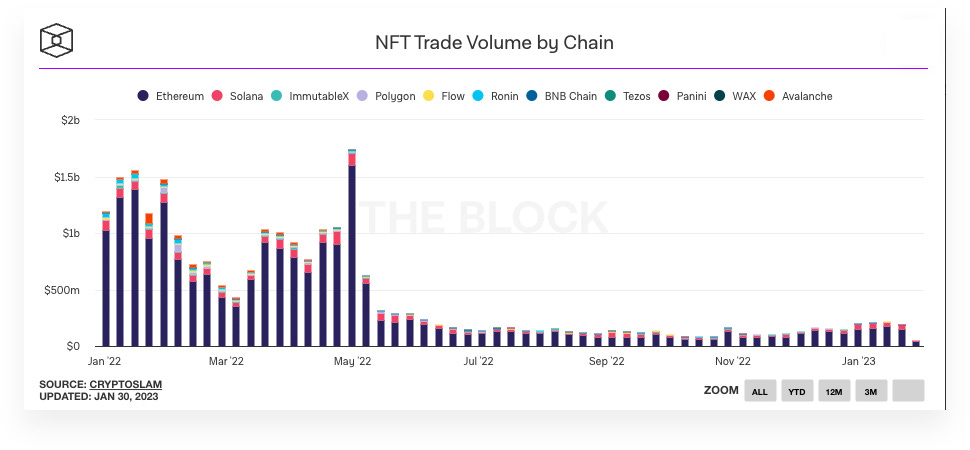

NFT surge:

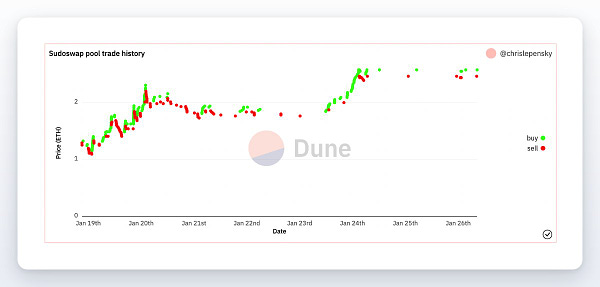

Volume remains relatively low, but with the upcoming token launches of SUDO & BLUR additional liquidity will hit the market through airdrops. It makes sense to monitor the downstream impacts on XMON, LOOKS, & X2Y2 as the NFT token narrative develops and how this stimulus will push collections.

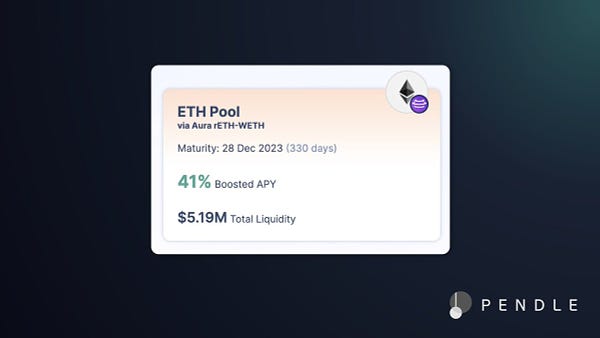

Ethereum:

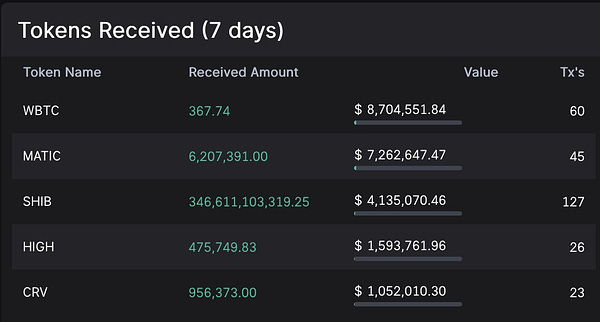

LSDs (RPL, LDO, FXS, SD) continued momentum & narrative ahead of staked ETH unlocks in March (13.5% staked) with the Shanghai upgrade. The L2 narrative also seems to push over to MATIC, as the zkEVM mainnet launch date is finalized and “soon.” The same term Stani used as we await the potential stablecoin launches of CRV & AAVE.

Meme of the Day:

General:

Mastercard and Binance are launching a prepaid card in Brazil.

Crypto investment firm Pantera’s Liquid Token Fund is rotating back into altcoins from bitcoin and ether for the first time since spring.

Do Kwon is staging a comeback after Terra’s $60 billion collapse and working on several new products, including bulking out his engineering department with new hires.

Crypto tax unicorn CoinTracker cuts 20% of its staff (19 employees), citing market headwinds and “over-hiring.”

The venture arm of big pharma corporation Pfizer has backed its first DAO in a $4.1M round. VitaDAO is a decentralized autonomous organization that funds research projects in the field of longevity science.

Bankrupt bitcoin miner Core Scientific has reached a new $70M loan agreement with B. Riley.

DeFi:

Fantom plans to introduce version 2 of its fUSD stablecoin to provide a more predictable and budget-friendly system for builders, partners, and users, developers.

dYdX users traded $466 billion in crypto derivatives during 2022.

Layer 1 blockchain Canto sees a surge in trading activity. The Cosmos-based blockchain Canto’s TVL doubled in January to $138M.

Secret Labs and Secret Foundation battle it out openly. Labs raised allegations around a lack of transparency from the foundation and an alleged mishandling of an OTC sale.

Uniswap DAO voted to select a single crypto bridge provider, Wormhole, for the proposed Uniswap v3 deployment on BNB Chain.

BonqDAO was exploited due to an oracle attack. Exploiter could borrow $100M of EUR against $1000 worth of collateral.

NFTs:

The Sorare NFT soccer trading card game has partnered with the Premier League on a multi-year licensing agreement.

Coinbase Wallet will now show transaction previews for transactions to help prevent NFT scams.

NFTZ, the world’s first exchange-traded fund for NFTs, is shutting down.

The number of Polygon NFTs traded on OpenSea surpassed Ethereum NFTs for the second consecutive month.

Sudo token is live: lockdrop and airdrop can now be accessed.

Sidenotes:

Lyra is live on Arbitrum, integrating with GMX.

Mars Protocol has deployed on Cosmos; the first outpost will be Osmosis.

Cardano's decentralized stablecoin Djed goes live on mainnet.

Optimism proposes the first protocol upgrade called Bedrock.

Funding:

New L1 Everscale blockchain received a $5M strategic investment from Venom Ventures Fund, the new Abu Dhabi-based $1B venture fund.

Crypto security startup Hypernative raises $9M seed round.

Sovereign Labs raises $7.4M to make it easier for developers to create new ZK-rollups. Haun Ventures lead the seed round. Other investors include 1kx and Robot Ventures.

Addressable raised $7.5M to make web3 marketing easier.

Squid raises $3.5M to build next-generation cross-chain swaps made on Axelar.

Canadian crypto mining firm Pow.re has closed a $9.2M Series A round (at a $150M valuation) and an $18M strategic investment.

Crypto Twitter: