Crypto Alpha Recap

23.12.2022. Binance shopping tour. BTC miner collapsing. SBF gets extradicted to the U.S. Caroline and Garry Wang pleaded guilty.

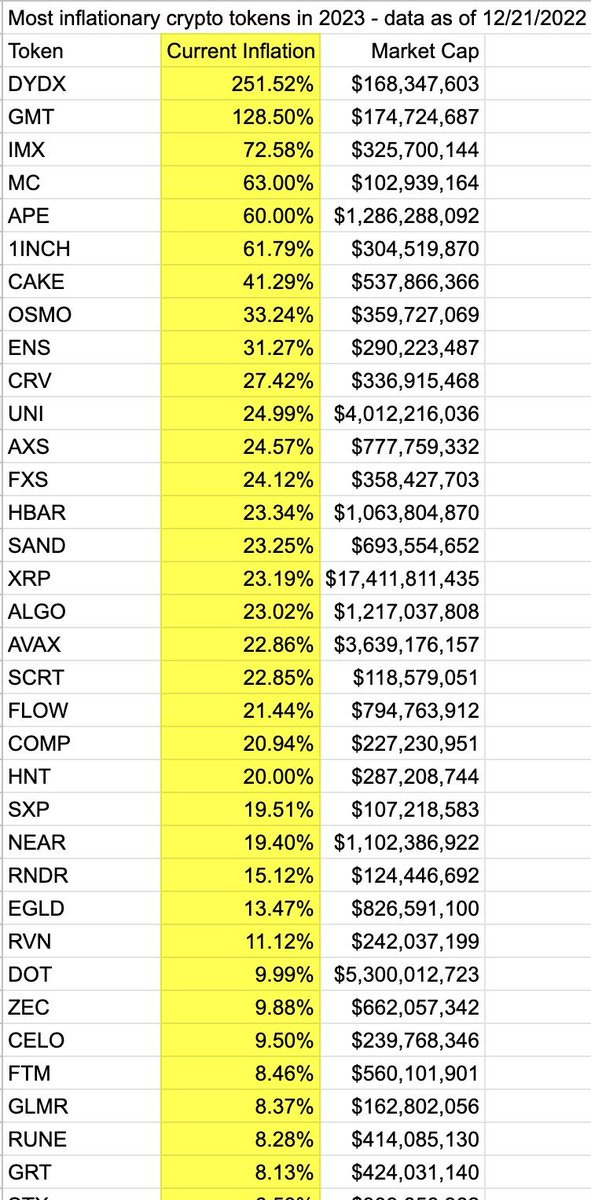

We are quickly approaching the last days of the year, and the last dominos begin to fall. What a year it has been. Glad it's over. While institutional players are on holiday, it's time to look ahead to the next narratives coming into 2023. The thing that turns even the best traders from objective money managers into subjective prisoners of the moment. Instead of making analytical, data-driven decisions, their trades become rash and impulsive. Predictions are pouring in, and you can access The Block's Digital Asset Outlook 2023 and the Crypto Theses for 2023 from Messari for free.

As I'm still speculating on decoupling crypto from traditional assets, playing the right narratives will be vital to surviving the bear market through 2023 (or, if you don't have the time, buy ETH). And more and more data is looking better by the day. The latest: MVRV: It's the ratio of Bitcoin's market value (MV) versus its realized value (RV). Currently, it sits around minus -0.31. This means, on average, the market's BTC cost basis is about $24,000 ($24K - 31% = today's price of $16,5K). In August, the MVRV difference was minus -0.41, and Bitcoin's price was roughly $24K. Which means the average cost basis then was about $42K. This ratio rising while price falls tell us that most, if not all, of those underwater longs from the $40K - $50K range have since capitulated. Supply has moved from weak-handed speculators to more disciplined buyers. All tourists have gone. Or as we say in Switzerland: 2023 is where we "separate the wheat from the chaff."

GM! Sharing is caring. Be a chad and share this newsletter with your colleagues.

Meme of the Day:

Credit where it’s due - this is truly a masterpiece.

General:

The Visa crypto team laid out their plans to allow auto payments from self-custodial wallets. Outlining a way for users to automatically send payments using the self-custodial wallet without signing each transaction using account abstraction. They also proposed that StarkNet might help bridge the gap between crypto and the real world.

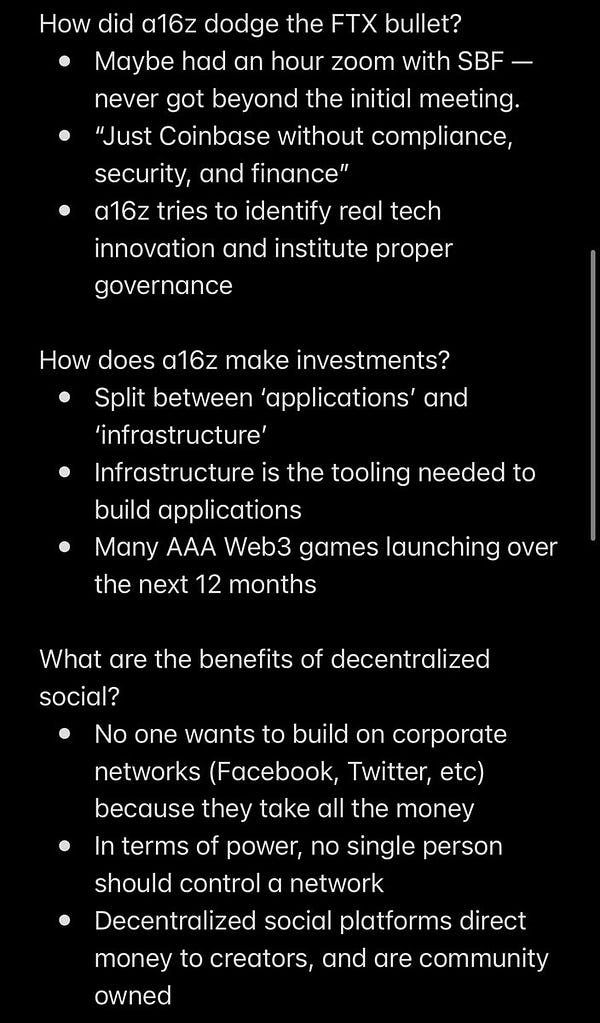

a16z still holds 95% of everything it's bought across its multi-billion dollar crypto funds and still has billions to deploy,

Coinbase and Binance enjoy market share gains after FTX's demise. Binance accounts for over 87% of the crypto-only exchange market share.

Binance.US had entered an agreement to acquire the assets of insolvent cryptocurrency brokerage Voyager Digital for $1BN.

Grayscale Investments is exploring options to return a portion of the capital of its flagship GBTC product with an offer for up to 20% of outstanding GBTC shares, which are currently trading at a 49% discount to net asset value if the SEC refuses to approve its spot bitcoin ETF.

The Group of Central Bank Governors and Head of Supervision (GHOS) of the Bank for International Settlements (BIS) has endorsed a global prudential standard for banks' exposure to crypto assets in 2025.

Binance has officially acquired the Indonesian exchange Tokocrypto, and about 58% of its employees have been laid off.

Polygon co-founder Sandeep Nailwal launched Beacon, a web3 startup accelerator that aims to create the next 100 web3 unicorns. Fifteen startups have already received funding to be announced in January.

FTX will try to claw back millions of dollars in donations to U.S. politicians made by SBF and his close associates to help pay back creditors following accusations that the contributions were funded with customers' money.

Several Bitcoin wallets worth 104 BTC ($1.7M), associated with the defunct Canadian crypto exchange QuadrigaCX have transferred funds after three years of dormancy.

Bankrupt crypto lender BlockFi has filed a motion to reopen withdrawals for users who have crypto locked in its wallet accounts.

Greenidge Generation entered into a non-binding debt restructuring deal with its lender NYDIG to pay down $74M in debt.

Publicly traded crypto miner Core Scientific files for Chapter 11 bankruptcy.

FTX has over $1B in cash. $720M in unconsolidated cash assets, $500M already held in U.S. institutions.

SBF signed extradition papers to return to the United States from the Bahamas. He was set to be released on $250M bond after appearing in Manhattan. Meanwhile, Alameda Research ex-CEO Caroline Ellison and Garry Wang (co-founder) pleaded guilty to involvement in frauds causing FTX's collapse.

Crypto exchange Kraken has publicly launched Kraken Pro, a suite of advanced trading tools and a new interface that unifies access to spot trading, margin trading, staking and portfolio management.

DeFi:

BitDAO mulls $100M token buyback for next year. It holds the second-largest treasury among DAOs and is worth $1.6BN.

Drift, a Solana-based perpetual swaps trading protocol that handled billions of dollars in volume during the 2021-2022 bull run before collapsing during the Terra crash, is going live with its revamped second version.

Uniswap partners with Moonpay, allowing going direct to DeFi using a credit/debit card or bank transfer at the best rates in web3.

Sushi DAO vote to direct all fees generated by SushiSwap to the protocol's treasury passed thanks to two large entities - GoldenChain, the digital investment arm of venture capital outfit Golden Tree, and a wallet closely tied to crypto trading firm Cumberland.

Ren Protocol's imminent shutdown likely, $15M still at risk.

Digital asset trading firm Wintermute booked $225M in revenue during the first nine months of 2022, compared to $1BN for all of 2021 but remains optimistic.

Ankr aBNBc Token exploit: a former team member inserted a malicious code package. The team is working with law enforcement to prosecute this former member.

Immunefi, a crypto-focused bug bounty platform, paid over $52M to white hat hackers in 2022, with crypto hacks topping more than $3BN.

NFTs:

Yuga Labs is bringing in Daniel Alegre, former president and COO of Activision Blizzard, as CEO, with current CEO Nicole Muniz moving into a role as partner and strategic advisor.

Mercedes Benz has filed trademark applications claiming plans for NFTs, Virtual clothing + goods, Financial services, and Cryptocurrency trading.

Art auction house Christie’s sold 87 NFTs for $5.9M in 2022, down 96% compared to 2021.

Trump move over: NBA legend Scottie Pippen’s NFT drop sells out in record 77 seconds.

Blur Airdrop 2 recalculated to fix the wash trading filters that affected legitimate traders.

Sidenotes:

Perpetual Protocol launches fee sharing, aka Lazy River 2.0 model.

Y2K Finance token coming soon.

Daniele (Frognation, “fuck the suits”) is retunring to Popsicle Finance.

THORChain's borrow program does not liquidate - coming Q1 2023.

NEAR is now compatible with Metamask.

Polygon’s zkEVM second testnet launched, the last step before mainnet goes live.

BNB Chain partnered with Fjord and Balancer to launch LBPs on its mainnet.

Funding:

Foundation Devices, a developer of Bitcoin-centric tools that include a hardware wallet, has raised $7M in a seed round led by Polychain Capital.

Fiat-to-crypto platform Utorg raised $5M in a seed round led by Dragonfly. TA Ventures and Hypra fund also participated.

Arrakis Finance, a decentralized market-making protocol, raised $4M in a seed funding round SAFT involving Uniswap Labs Ventures, Accel, Polygon Ventures, and Robot Ventures.

Axelar Ecosystem Startup Funding Program is a $60M initiative led by top-tier, crypto-native investment firms designed to nurture a pipeline of developers building Web3 products that rival anything on the centralized web.

Revel, an NFT or "social collectibles" platform, raised $7.8M in seed financing to become the Instagram and Robinhood of NFT platforms led by Dragonfly Capital.

Crypto Twitter: