Crypto Alpha Recap

10.02.2023: Restaking protocol Eigenlayer raises $50M. DCG reaches agreement with creditors. Lido v2 rollout. Revolut launches crypto staking. SEC cracking down on crypto.

After fantastic weeks crypto markets are under pressure as Gary Gensler strikes again. While he missed every fraud and accounting trick of failed centralized institutions (BlockFi, Voyager, Celsisus, FTX, etc.), the SEC is now going after the only players that never were culprits. Crypto exchange Kraken has settled with the SEC and agreed to shutter its staking service, paying a 30M in disgorgement and civil penalties. Essentially, the SEC is forcing US people out of exchanges into self-custody.

Today @SECGov charged Kraken for the unregistered offer & sale of securities thru its staking-as-a-service program. Whether it’s through staking-as-a-service, lending, or other means, crypto intermediaries must provide the proper disclosures & safeguards required by our laws.SEC chief Gary Gensler: “Today’s action should make clear to the marketplace that staking-as-a-service providers must register and provide full, fair, and truthful disclosure and investor protection.”

Market participants are nervous, as rumors had been circulating yesterday that the stablecoin issuer Paxos (BUSD, USDP) and others were facing a crypto banking crackdown. Paxos attempted to clear up rumors of trouble with the U.S. Office of the Comptroller of the Currency (OCC), insisting its application for a national trust bank charter remains in progress. All the while, Binance had to suspend USD bank transfers until a new banking partner was established in the upcoming weeks. Coinbase CEO Brian Armstrong said they would keep fighting for economic freedom as there was no way to register (a disingenuous offer).

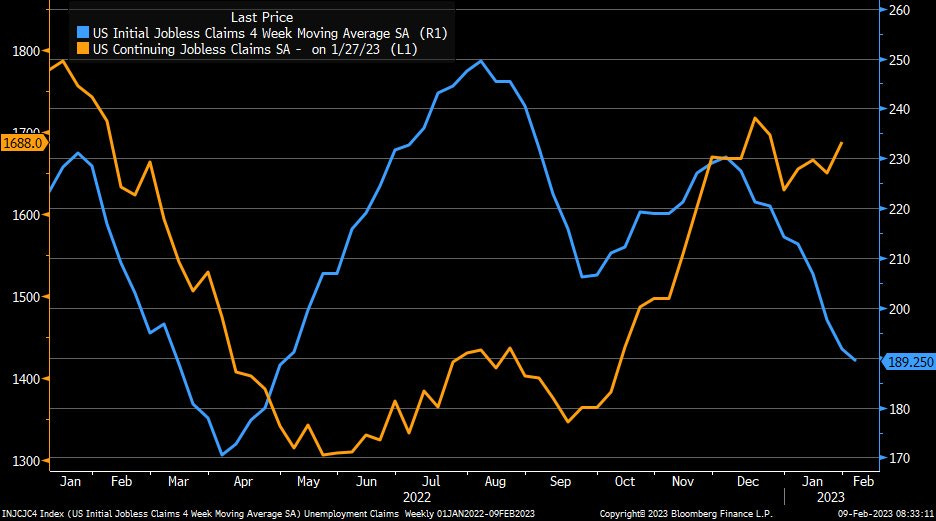

Macro: Relatively low jobless claims (up 13k to 196k) continue to point to tight labor market conditions within the U.S. economy, and Nasdaq had its best start since 1991.

Special Nugget:

Is the AI token rally sustainable?

Following all the recent hype around artificial intelligence chatbots (Google promoting Bard, Mircosoft relaunching Bing search with ChatGPT), crypto tokens related to AI and big data led to a second market rally over the past week.

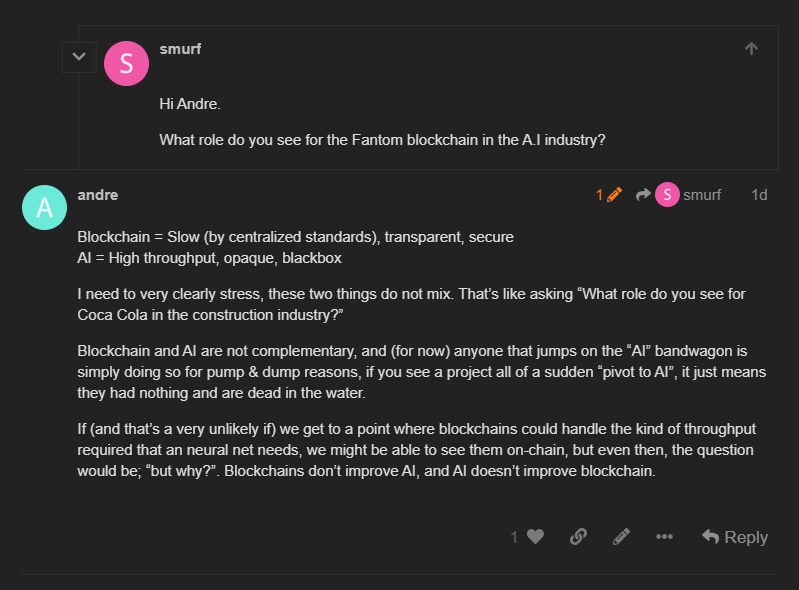

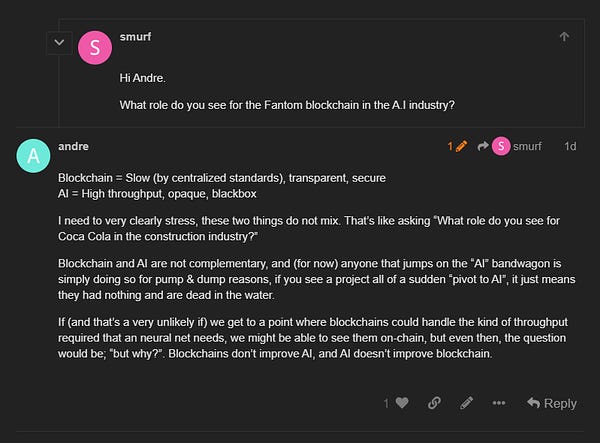

Blockchain and AI are not complementary, and (for now) anyone that jumps on the 'AI' bandwagon is simply doing so for pump and dump reasons," said Andre Cronje, Yearn founder and core contributor at Fantom. While the fundamentals do not match the rally - it didn't hinder traders from bidding across the risk curve and turning to crypto for a speculative outlet. Bid Data Protocol (BDP) led the assembly line, rallying 1400% weekly; AI-focused tokens like SingularityDAO (SDAO) followed with 170%. Similar projects like Fetch, Oraichain, Vectorspace or the Graph also saw noticeable gains rising between 70% and 95%. This isn't an indicator that should be taken lightly, for it points to late-longers chasing the pumps that they missed to begin with. But it also proves a healthier state of the market, allowing these pvp rallies in the first place. However, stablecoin inflows continue to remain flat, which often causes exhaustion and rotations in increasingly shorter timespans. And the following narrative in NFTs is just around the corner as traders are betting on an uptick in NFTs due to the upcoming Blur token next week.

Meme of the Day:

General:

DCG and Genesis subsidiaries reached an agreement with main creditors, owing more than $3.6B to its top creditors.

Crypto community donates $2.9M to an earthquake relief fund.

This year, crypto firms banned from Super Bowl television ads will have "zero representation."

Paradigm promoted Charlie Noyes and Dan Robinson to general partners, a first for the company.

Bitcoin miners Hut 8 and US Bitcoin merge to form a new US-based entity.

The UK's central bank, the Bank of England, has unveiled the model for a digital pound to create a new payment system and form of money.

Revolut launches crypto staking for Ethereum, Cardano, Polkadot, and Tezos.

SoftBank lost $5.9B in Q4. Previously, SoftBank, which has also backed crypto firms such as FTX, Sorare, and ConsenSys, posted a $10B loss in Q3.

DeFi:

A16z used all 15M UNI tokens to vote against a proposal to deploy the latest Uniswap iteration on BNB Chain.

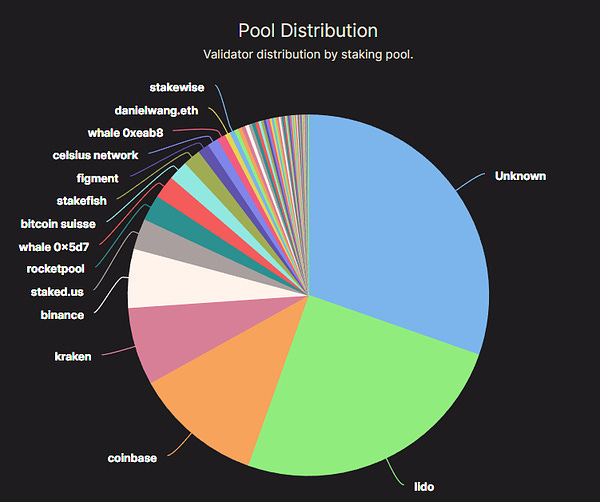

Lido Finance is rolling out several key upgrades in its latest V2. Aave will now distribute rewards from staking ETH on Lido on Ethereum, Arbitrum, and Optimism.

StarkWare plans to open-source the StarkNet Prover, a crucial component of its StarkNet Layer 2 solution. It will allow more individuals to review the code and increase transparency.

MakerDAO revenue fell 42% in 2022 amid the shrinking crypto lending market.

Ethereum Zhejiang testnet successfully processes first-ever ETH staking withdrawals.

Stargate voted successfully to re-issue a new STG and airdrop it to all STG holders. Reissue will happen on March 15th due to a potential security issue within Alameda.

ENS DAO voted to sell 10,000 ETH ($16.5M) to fund the project’s activities for the next 18 to 24 months.

NFTs:

Under-the-radar crypto project Delegate Cash protecting more than $400M worth of NFTs in just four months.

File hosting giant WeTransfer and blockchain platform Minima have created an NFT minting service.

Yuga Labs settles Bored Ape NFTs trademark lawsuit with Ryder Ripps collaborator.

JPEGz, the world's first total NFT market cap token is live on Arbitrum.

Metaverse project Sandbox and Saudi Arabia DGA signed an agreement to collaborate on metaverse projects.

Sidenotes:

OpenSea deploys new version of SeaPort, boosting bulk listings and fee savings.

Dopex launches on Polygon.

Acala EVM+ now live on mainnet.

Trader Joe's native joe token goes omni-chain with LayerZero.

Radiant v2 is going live around February 16.

DEX aggregator CoW Swap falls victim to $180K hack.

Flux Finance, bringing US Treasuries yield on-chain, is live.

Microsoft integrates ChatGPT into Bing search engine.

Funding:

A16z-backed Arpeggi Labs is looking to raise $11M from investors. The web3 music startup has already secured $9.1M from 21 investors.

Crypto lender SALT raises $64.4M in Series A.

EigenLayer, an Ethereum restaking protocol, is raising $50M in Series A funding. The round looks set to give the startup a $250M post-money equity valuation and a $500M token valuation. Previously, the startup raised $14.4M.

Blockchain intelligence firm Elementus raised a $10M round led by ParaFi Capital.

Crypto Twitter: