Crypto Alpha Recap

16.01.2023: Crypto short squeeze. MetaMask introduces Liquid Staking. Zhu & Kyle are raising money.

Respect the pump. Crypto markets regained the $1 trillion capitalization mark for the first time since November. US CPI data for December was released, and figures aligned with expectations. The report leaves us with the consensus that rates will shift higher in February by only 25bps. And just like that, we are pre-FTX levels.

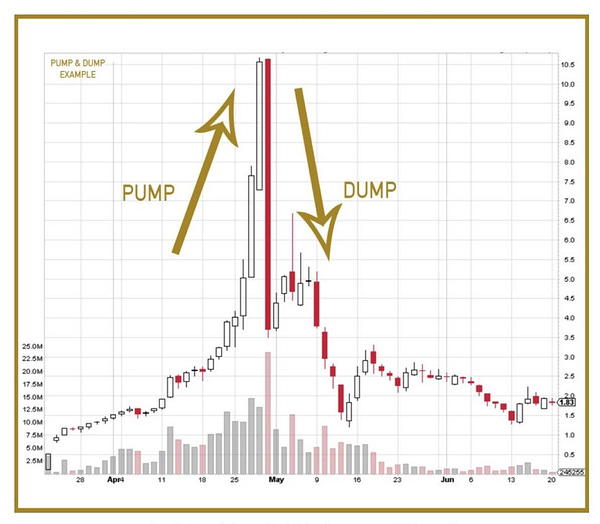

On Saturday, someone bought ~$4B worth of BTC futures in market orders triggering over $500M in short liquidations and squeezing altcoins left and right. It’s still very much PvP, as liquidity is low and doesn’t trickle down as broadly.

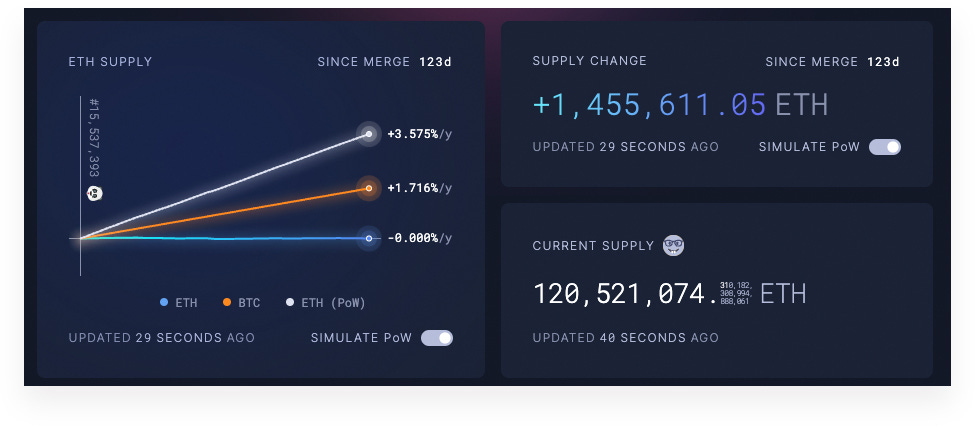

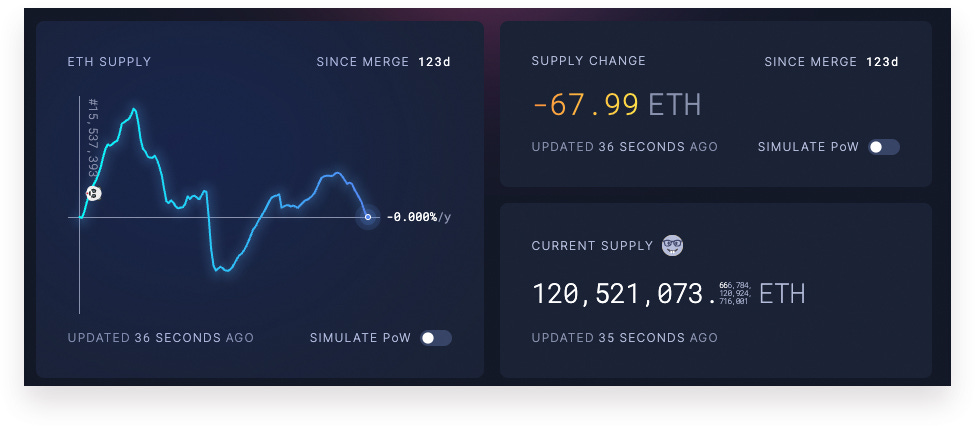

Gas fees continue to rise as we see an uptick in NFT volumes and general on-chain activity. One can only imagine what a supply shortage will look like in a bull market. Unlike Bitcoin, Ethereum doesn’t have a hard cap. Since it’s switched from proof-of-stake to proof-of-work, the issuance is net negative instead of a supply increase of 1.45M ETH. As long as the average gas price on the network becomes at least 16 gwei, the inflation is zero or even triggering a deflation.

Bitcoin is called sound money. It’s a term used to describe assets like Gold that are not prone to sudden appreciation or depreciation (laughs in crypto) in purchasing power over the long term. That’s why ETH is called ultra-sound money, an upgraded version to describe its potential to become a deflationary asset whose total supply will decrease over time.

GM! Sharing is caring. Be a chad and share this newsletter with your colleagues.

Meme of the Day:

General:

Crypto lender Nexo’s Bulgaria outpost was raided by local police, suspected of money laundering and tax violations.

Société Générale mints $7M in stablecoin loan from MakerDAO. The firm used home loan bonds worth $40M as collateral (debt ceiling of $30M)

Su Zhu and Kyle Davies, the founders of collapsed crypto hedge fund Three Arrows Capital (3AC), are hoping to raise $25M to start a new crypto exchange called GTX.

Troubled crypto lender Genesis owes its creditors over $3B, prompting its parent company, DCG, to sell some of its venture-capital portfolio ($500M).

North Korea’s Lazarus Group moved $63.5M (~41,000 ETH) from the Harmony bridge hack through Railgun before consolidating funds and depositing on three different exchanges.

The U.S. Department of Justice is investigating the two brothers behind Solana stablecoin exchange Saber Labs, Ian and Dylan Macalinao, for using a web of 11 pseudonymous identities to build an ecosystem of interlocking financial products around Saber and inflate TVL.

Crypto brokerage Blockchain.com is laying off 28% of its workforce, about 110 employees.

Justin Sun told Reuters that he’s considering buying up to $1B of Digital Currency Group’s assets.

DeFi:

Four months after Ethereum's Merge, 16M ETH has been staked. The figure constitutes 13.28% of the total ETH supply and represents nearly ~$24B at current prices.

Polygon eyes hard fork on Jan. 17 to reduce the impact of transaction fee spikes and chain reorganizations.

Algorithmic stablecoin market share falls from 12.2% to 1.6%.

Avalanche will support the stablecoin USP created by Platypus DeFi.

MetaMask liquid staking blasts off with Lido and Rocket Pool.

Self-proclaimed 'safest' DeFi lender, LendHub, loses $6M in a hack.

Sidenotes:

1inch partners with Beefy, under which the 1inch API will power ZAP V2, a tool enabling users to enter Beefy’s yield-earning products from any asset.

Visa listed Alchemy Pay as an official Service Provider.

Uniswap proposal to deploy Uniswap V3 on the StarkNet network.

Rocket Pool welcomes Coinbase Ventures in oDAO.

StarkWare released Papyrus as an open-source full-node client for StarkNet.

Radiant Capital launches v2.

Funding:

Digital asset market maker CyberX raised a $15M Series A round led by Foresight Ventures.

Sortium, a developer of Web3 entertainment technology, has raised $7.75M in a seed round.

Alkimiya raised $7.2M to “build decentralized capital markets for blockspace” in a round led by 1kx and Castle Island Ventures.

Createra, a creator-oriented metaverse project, announced $10M in Series A funding led by Andreessen Horowitz (a16z) to continue its pursuit of building the largest Gen Z-focused metaverse platform.

Crypto Twitter: