Crypto Alpha Recap

12.12.2022: China relaxes more. Busy week on the horizon. Blockchain venture investments on decline. Stablecoins volumes through the roof. NFTs continue to trend down.

Buckle up and prepare for volatility, as this week's eyes are on macro data. CPI tomorrow, FED rate decision Wednesday, retail sales, jobless claims, regional and national manufacturing, industrial production Thursday, and PMIs Friday. Bitcoin ($17k) and Ethereum ($1,2k) continue to range in a tight band as liquidity continues to dry up.

Experienced traders know - outlook matters way more than the actual data. Upcoming Recession? Priced in. CPI core increase + 0.3%? Priced in. Slowing pace with a 50bps raise? Priced in. What really matters are the words of Powell. The challenges will lie in the communication and precisely that; yes, the Fed is slowing the pace of rate hikes, but they still remain on a hiking path, and rates will remain higher for longer, so the outlook will matter.

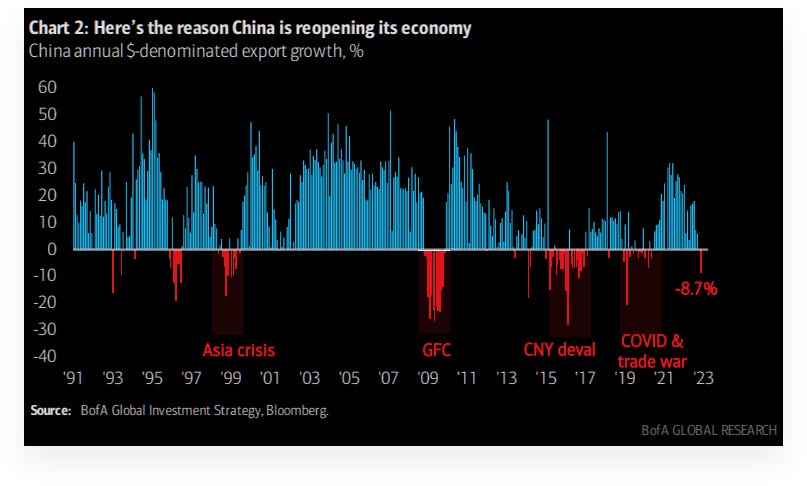

China: After months of harsh lockdown, frustrations finally erupted in China late last month as citizens across dozens of major cities took to the streets in protests over the country's refusal to back down on its strict zero-Covid policies. Both Chinese imports and exports crashed in November. The economy has grown at just 3% through the first three quarters, s a fraction of its long-term average growth of the past two decades. China's government is now in economic damage control mode and easing restrictions. A fully functioning Chinese economy is obviously positive for global demand, and it should be positive for global supply and can help address the supply side of the imbalance. As China has been an exporter of deflation for the past two-plus decades.

All while, G7 countries imposed a $60 price cap and limitations on the shipment, insurance, and financing of Russian crude to put a dent in the country's oil revenues. This had left Russia, producing slightly less oil than before it invaded Ukraine, scrambling for buyers and increasing the likelihood of moving through "shadow fleets."

We are in for an exciting week. Straighten your seatbelts.

GM! Sharing is caring. Be a chad and share this newsletter with your colleagues.

Special Nuggets:

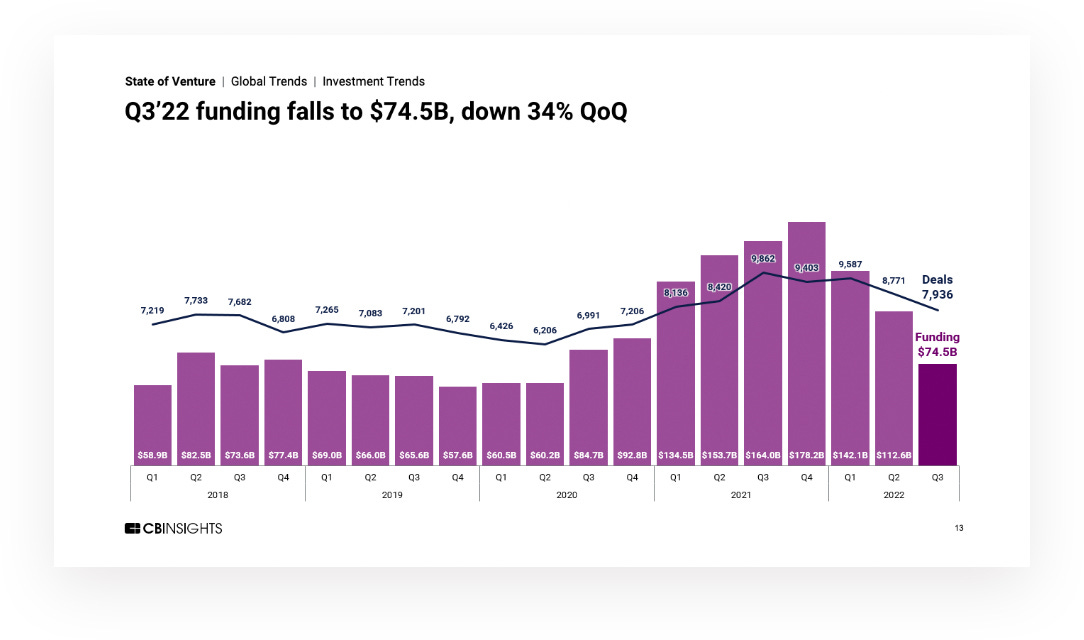

The status of blockchain venture funding:

Blockchain venture funding has been on a negative decline the past 2 quarters since marking a high of $10 billion in Q1. According to a recent report by CB Insights, funding came in at $4.6bn in Q3. Blockchain infrastructure & development companies saw a record number of deals at 74, increasing for the fourth quarter. While there were only 6 new blockchain unicorns, they still accounted for a quarter of total unicorn births across all industries.

This downward funding trend is not limited to Web3 since overall venture funding across all industries has also dropped significantly over the past few quarters.

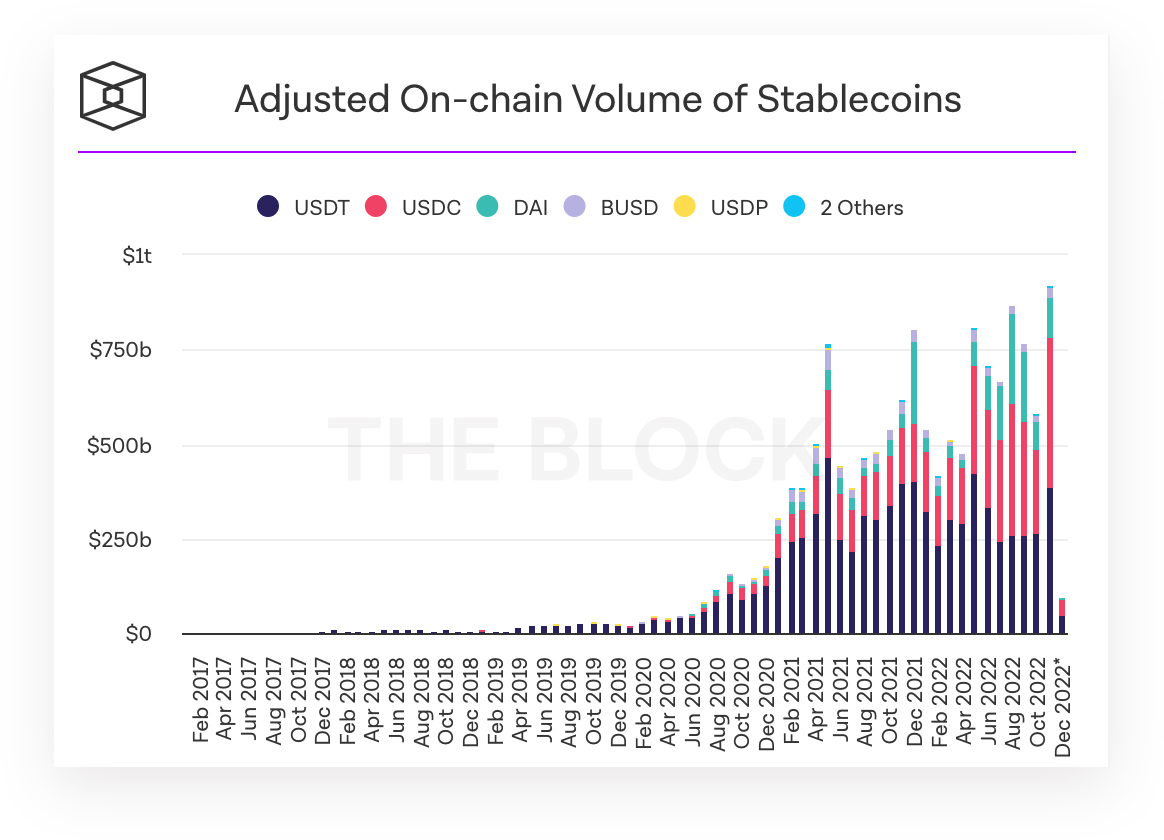

Stablecoin wars ahead:

Few like it, but stablecoins continue to be the crown jewel of this cycle. November had the largest on-chain volume of stablecoins ever recorded. The bulk of which was USDC. The latest player in this narrative is the Cosmos-based DEX Osmosis launching a new stablecoin protocol called stableswap. Osmosis's goal is simple: becoming the Curve of Cosmos.

It will allow developers to create pools of different stablecoins, similar to Curve's 3pool, to improve liquidity for stablecoins expanding to Cosmos. It's in anticipation of the native USDC launch of Circle in Q1 2023.

Curve announced their overcollateralized stablecoin in November, while Aave's solution is around the corner. The dark horse is Binance with its own BUSD, forcing it to be the de facto standard on its exchange as a dominant gateway into crypto. Coinbase also made a move offering free swaps from Tether's USDT to its USD Coin. Coinbase collaborated with Circle to launch the USDC stablecoin in 2018.

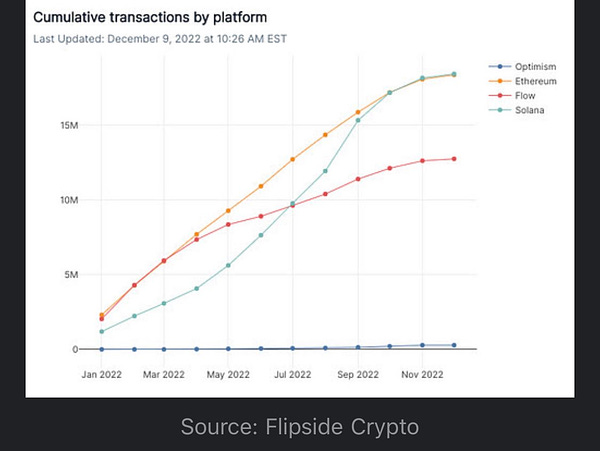

NFTs: down only

I’m still giga-bullish long-term on the overall possibilities of the technology. I’m confident it will play a critical role in mass adoption, getting retail again on board in the next cycle. But short-term? Down only as low volumes for NFTs continue as well as the demise of total traders. However, despite sales and volumes being down, monthly marketplace transactions have steadily stayed up throughout the past year.

Meanwhile, the debate around creator royalties is still ongoing on Solana. Royalties are only enforced at the marketplace level. This allowed marketplaces to undercut their competitors, and the arbitrage opportunity forced royalties down to zero.

As Warren Buffet said: "When the tide goes out, you see who is swimming naked." most projects are bleeding out without a solid revenue stream. Hyperspace stated that their hands are tied on royalties as an aggregator.

Metaplex is currently working on a new NFT token standard and was engaged in a Twitter war with Magic Eden. Metaplex has been getting pushback since they have sole ownership of the keys that can upgrade the token metadata program. It also takes priority over other features like Magic Eden's Open Creator Protocol. Royalties are essential for many creators who have been historically under-compensated for their work in the physical world. This debate will have enormous implications for Solana and the entire Web3 space.

Crypto News:

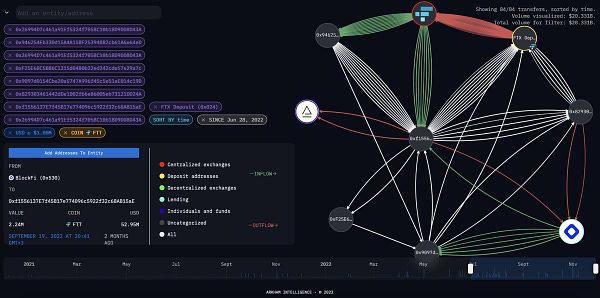

Nouns DAO will donate 100 ETH ($123,000) to ZachXBT to fund his investigative journalism. ZachXBT carries out good public services through tireless research that exposes crypto scams.

Do Kwon, who is wanted internationally in connection with the collapse of the Terra ecosystem, has moved to Serbia through Dubai.

The Block CEO Michael McCaffrey resigned after failing to disclose a series of loans from Alameda Research. He received 3 loans totaling $43m.

Plaid, a firm that connects banks and fintech firms, laid off about 260 employees as it grapples with the slowing economy.

Cross-chain bridge protocol Nomad is getting set to relaunch and partially reimburse those that lost funds in its $190m hack earlier this year. Users must go through KYC verification to let them bridge back assets to ETH.

Ren1.0 network is shutting down due to the events surrounding Alameda. As compatibility between Ren 1.0 and 2.0 cannot be guaranteed, holders of Ren assets should bridge back to native chains asap or risk losing them.

Coinbase CEO Brian Armstrong said the crypto exchange's revenue this year would likely be cut in half or more from 2021's sales number, blaming the state of the industry and shaken investor confidence.

Bybit releases Merkle Tree-verified proof of reserves.

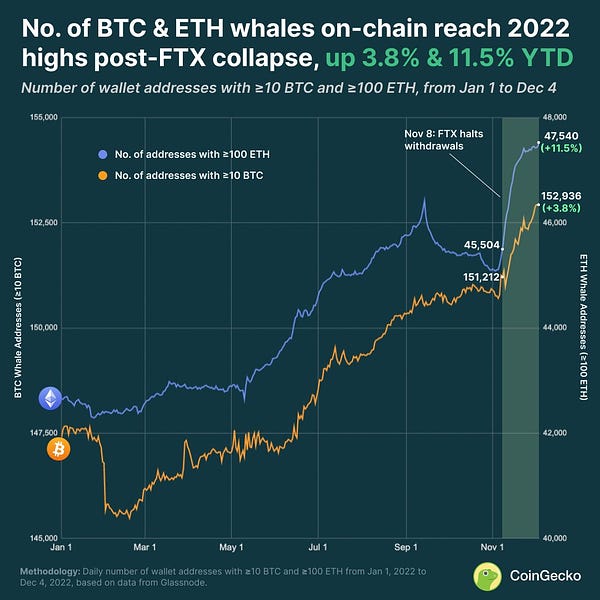

Credit investment firms are looking to buy claims from FTX's customers who could otherwise wait years to see any money.

DeFi landscape:

Staking on Euler has been deployed. You can earn EUL by lending ETH, USDC and USDT. APRs range from 9-45%.

According to the team, Gnosis Chain Merge completed the transition to proof of stake and made it the third-most decentralized network behind Bitcoin and Ethereum.

0xPlasma Labs proposal to deploy Uniswap v3 to BNB Chain, from which an additional $1bn of TVL and 1-2m new users can be obtained.

Lodestar Finance was exploited for about $6.5m. The attacker used the same method we saw on Mango Markets, leaving the protocol with a bad debt after pushing the price and taking out collateral against it.

SushiSwap lost $30m in the past 12 months on incentives for liquidity providers. Rework of tokenomics is imminent.

Uniswap fee switch governance voting begins as last time reported.

Bancor DAO, the decentralized community that oversees the Bancor DEX, mulls a proposal for a self-arbitrage bot to seek out opportunities in v3 pools. The DEX managed to run up a $26m deficit since June.

NFT & Metaverse:

ImmutableX and MoonPay announce NFT Checkout. The Moonpay primary NFT sale checkout feature enables users to mint and own an asset using a credit or debit card.

Polygon-based Starbucks NFTs are now available to beta testers, with a marketplace powered by Nifty Gateway coming in 2023.

Funding Highlights:

Digital collectibles startup Forum3 raises $10m in funding following its partnership with Starbucks to help power its web3 loyalty program.

Nillion, a web3 startup aiming to build a non-blockchain decentralized network, closed a $20m round led by Distributed Global. Other investors include AU21, Big Brain Holdings, Chapter One, GSR, HashKey, OP Crypto and SALT Fund.

Outdefine raises $2.5m in a seed round to build a decentralized hiring network on Solana. Backers include Jump Crypto, Big Brain Holdings and TCG Crypto.

Evertas, a cryptocurrency insurance firm, raised a $14m Series A round led by Polychain Capital. Also included are SinoGlobal Capital, CMT Digital Ventures, Foundation Capital, Morgan Creek, Bloccelerate, network0, Matrixport, and HashKey.

Crypto Twitter: