Crypto Alpha Recap

22.05.2023: Tether decreases bank deposits. Circle moves $8.7B to repo agreements to protect reserves from U.S. government default. Lido v2 is live. Ripple acquires crypto custody firm Metaco.

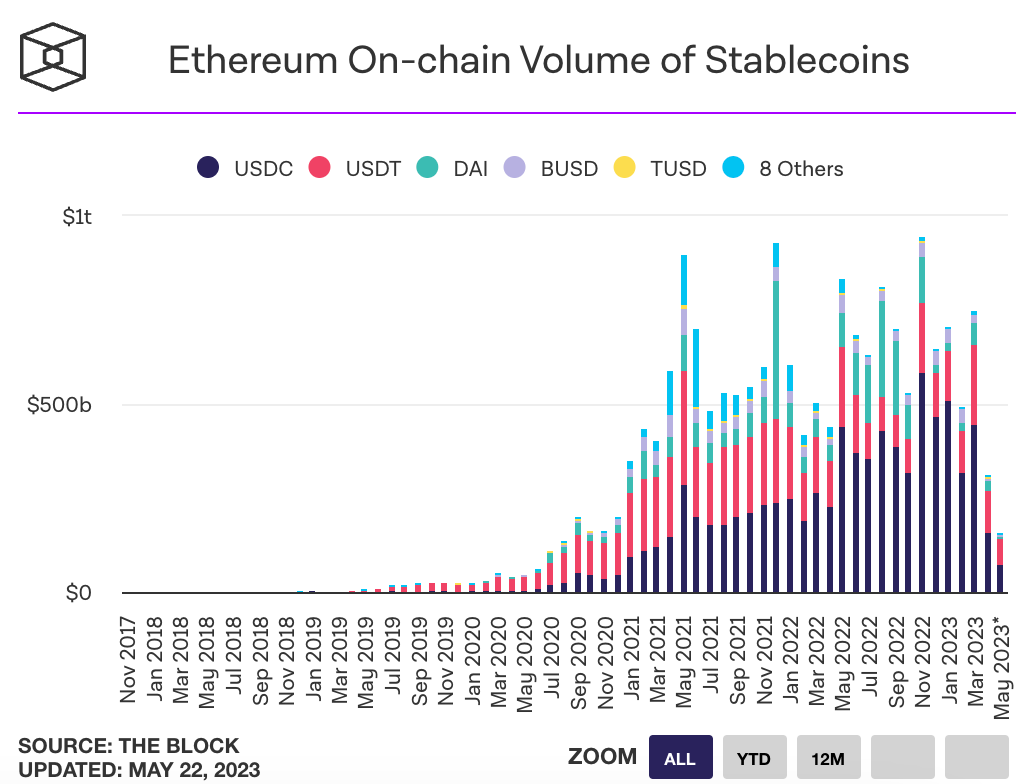

The monthly on-chain volume of stablecoins on Ethereum is on pace to be the lowest since December 2020, with only $159B in volume so far in May. Despite high mainnet fees during the recent meme coin mania, there seems to be less L2 activity in May than in April. Spot volume for BTC surged around the collapse of Silicon Valley Bank in March but has since tapered in recent weeks, averaging just around $4B per day in the last week compared to $20B in March. Meanwhile, the spot trading volume of ETH has also trended downward to $2B per day over the last week. However, despite these challenges, bid/ask liquidity has remained relatively stable, with 1% depth holding steady near $45–$50M even as major market makers exit the ecosystem.

Macro: New FOMC minutes are scheduled to be released Wednesday afternoon. Jerome Powell, on Friday, conceded that existing pressures within the banking sector might mitigate the necessity for more interest rate increases to curb inflation. Janet Yellen expressed concerns about the fiscal health of the United States, stating that the probability of the country fulfilling its financial obligations by June 15th seems fairly low.

Economists from Goldman Sachs have projected that by June 8th or 9th, the Treasury's cash balance will fall below the essential $30B threshold required to meet its obligations. Although the debt ceiling negotiations are heading in a positive direction, with McCarthy set to bring something this week.

Meme of the Day:

General:

Tether decreases bank deposits from $5.3B to $481M to reduce bank exposure. The issuer of the world's largest stablecoin will invest up to 15% of its profits in Bitcoin as it shifts its reserves toward crypto and away from U.S. government debt.

USDC issuer Circle moves $8.7B to repo agreements to protect reserves from U.S. government default.

BlockFi to liquidate crypto lending platform, over $1B on the line in litigation.

Ripple acquires crypto custody firm Metaco in $250M deal.

Visa taps Ethereum's Goerli testnet to experiment with account abstraction.

Leading crypto teams and investors launch $50M cross-chain fund powered by Wormhole.

Coinbase Cloud to run Chainlink node to advance smart contract connectivity.

DeFi:

Ribbon Finance introduces Aevo for on-chain options trading.

Lido v2 is live. This upgrade facilitates withdrawals and introduces staking routers. Stakers now have the flexibility to directly unstake their ETH via Lido. 450k ETH has been withdrawn, with Celsius representing 95% as they exited their entire position.

Overview of the next products Frax Finance will be shipping.

Osmosis announces a mesh security initiative. A new cross-chain security model that can combine staked assets from two or more blockchains and allow these chains to provide security to each other.

Loopring enables Block Trading, allowing users to execute large orders and access CEX liquidity directly from their self-custodial wallets.

LayerZero and Immunefi launch the largest crypto bug bounty program with up to $15M in rewards.

Compound III is live on Arbitrum.

NFTs:

Gala Games burns over $600M worth of GALA tokens; it has virtually depleted its treasury to alleviate concerns of a future token selloff.

NFT marketplace X2Y2 launches X2Y2 Fi (NFT loans) and the v3 upgrade (gasless loan offer cancellation, optimizes gas expenditure, auto refinance).

Ronin introduce Mavis NFT Market.

Axie Infinity game launches on Apple app store in key markets.

MiLady expands to Arbitrum.

Curve launches the UI for crvUSD. For now, sfrxETH is supported as collateral, with stETH coming next.

Sidenotes:

Optimism plans mainnet Bedrock upgrade for June 6.

Aevo launches OTC: The best place to trade altcoin options on-chain.

Compound v3 is now live on Arbitrum.

GMX V2 testnet is live.

SEI mainnet is close.

Near Protocol to use Wormhole bridge for cross-chain transfers.

Sperax and Camelot partner.

Quickswap integrates limit orders.

Funding:

Web3 startup Story Protocol has announced a $29.3 million funding round led by Andreessen Horowitz’s crypto fund A16z Crypto.

HashKey is targeting a $100-200M raise at a $1B valuation.

Auradine raises $81M in series A financing for next-generation web infrastructure.

Web3 developer platform Airstack has raised over $7M.

Peter Thiel backs Bitcoin startup River in $35M round.