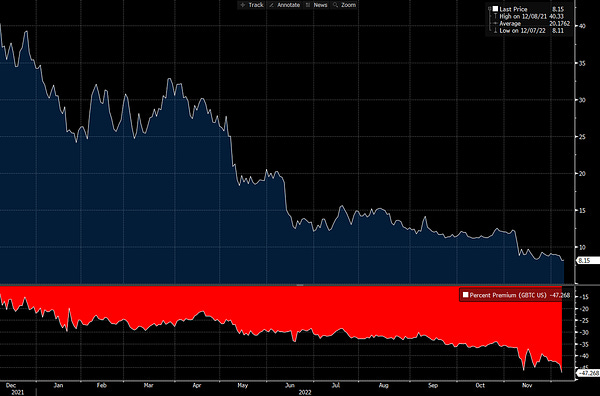

In the peak of a quiet week, Grayscale is back in the headlines. This time, Fir Tree Capital Management is suing Grayscale to erase the current GBTC discount by lowering fees and resuming redemptions. The trust has roughly 850,000 retail investors who have been "harmed by Grayscale's shareholder-unfriendly actions." They claim that Grayscale refuses to redeem shares because doing so would cut into profits. Grayscale is the cash cow of DCG and collected $615.4m in fees last year.

It makes you question a lot when you see CeFi / VC players were as dumb as retail, just with way more oversized bags. We now know that "non-directional exposure" was a mirage. All those easy arb trades had long since been arbed away, forcing trading firms to branch out into directional trades like the Grayscale "arb" or VC "investing," which was basically buying locked-up tokens at a discount. Money was pouring into crypto from CeFi and DeFi lenders, and they only could lend it to traders. And the traders didn't have anything sensible to do with it. We've all been rooting for DeFi to win investment money away from TradFi, but for DeFi to succeed, we don't need more money. We need better things to do with it.

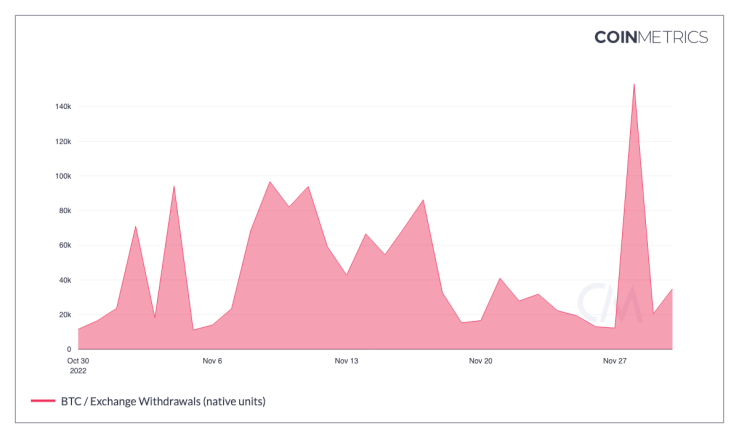

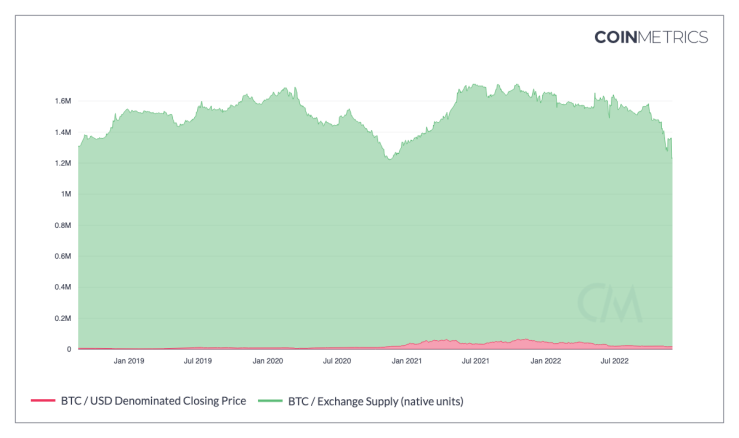

In reaction to the FTX fraud, most remaining Bitcoin holders have decided to move their assets into self-custody. Since the start of November, over 220,000 BTC (~$3.7bn) has been transferred from exchanges into cold storage.

As a result, exchanges only currently hold about 1.2m BTC. That’s the lowest amount since November 2020.

Special Nugget:

FTX aftermath:

The FTX contagion isn't going away any time soon. Genesis has been working with an array of experts, parent company Digital Currency Group and clients on a "path forward" that avoids bankruptcy. Genesis said in a client letter that working on a plan to address issues in its lending unit would take weeks rather than days to complete.

Meanwhile, the invitation to SBF (former CEO of FTX) could soon turn less friendly. The House Financial Services Committee is mulling a subpoena. How this guy is still walking free remains a mystery. Pressure is increasing, though, since 3 U.S. Senators sent a letter to Silvergate Bank, the California-based bank, to learn more about their involvement with FTX. This is an interesting case since Silvergate is an FDIC-insured bank almost entirely focused on crypto (>90% AUM). It's known for its Silvergate Exchange Network (SEN) and is the connective tissue between the fiat and crypto economy. They connect all major crypto institutions, allow for U.S. dollars + Euros exchanges, and operate 24/7. Silvergate helped facilitate over $10bn worth of transfers from FTX accounts to Alameda via SEN. Silvergate has put out a statement saying they were "the victims" in this case. The stock is down -84% YTD, and deposits are down to $11.9 billion.

Silvergate sought to reassure investors and customers that the bank’s assets are safe and that they comply with due diligence and anti-money laundering laws after a class-action lawsuit filed last week alleging Silvergate was complicit in the movement of customer assets between two of its clients, FTX and Alameda Research.

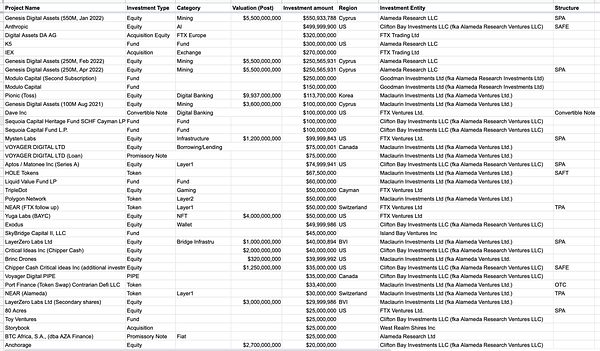

Furthermore, the Financial Times kindly mapped out every single one of Alameda Research's venture bets, and there were quite a few surprises. The trading shop associated with FTX made about $5.4 billion in investments, with Genesis Digital Assets and Anthropic rounding off the top two spots.

Here you will find the full sheet. While much of it reads like a who's who of crypto companies, tokens, and funds, it also includes fertility clinic Ivy Natal, military drone company Brinc, and 80Acre Farms, a vertical farming company.

Crypto News:

Binance CEO CZ calls Sam Bankman-Fried “one of the greatest fraudsters in history” and a “master manipulator.”

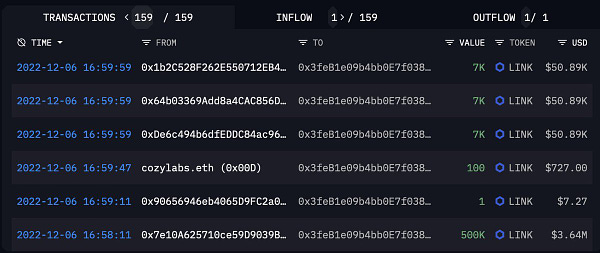

Digital asset platform Amber Group is reassuring that it is “business as usual” at the firm following reports that the company laid off hundreds of employees. However, on-chain data indicates that they are on the verge of bankruptcy.

Gate established a $100M industry liquidity support fund for all market makers, high-frequency trading institutions, high-quality listing projects, and other institutional clients or HNW individuals.

Goldman Sachs reportedly plans to spend “tens of millions of dollars” to buy or invest in crypto firms after FTX’s demise and sees exciting opportunities.

A leaked draft of the European Commission’s new taxation directive seeks to close the “regulatory gap” for crypto users. Crypto taxes could bring in $2.5bn for the EU.

Grayscale Investments is being sued by hedge fund Fir Tree Capital Management. The firm wants to push the company to address the significant discount it trades at by lowering fees and resuming redemptions.

Amid recent backlash, ConsenSys (MetaMask) clarified that it plans to only store and retain user IP addresses and wallet data for up to 7 days.

Mazars concluded that Binance’s bitcoin reserves are fully collateralized, following a proof-of-reserves and proof-of-liabilities verification with a collateralization ratio of 101%. Binance generates 90% of its revenue with transaction fees.

Ledger drops a new hardware wallet called “Stax.” It’s the same size as a credit card and is embedded with magnets, so multiple devices can easily be stacked (Stax, you get it?).

DeFi landscape:

Osmosis, the largest DEX in Cosmos, has launched a new stablecoin trading exchange known as a stableswap.

Polygon raised $450m from Marquee investors in a private token sale. The first batch of vesting & distribution for 2022 unlocks happened in late November 2022.

Perennial Labs, a DeFi-native derivatives protocol, is live on ETH mainnet. It raised a $12m seed round from Polychain, Variant and Archetype.

Aave purchased Sonar, a social gaming application with web3 support, to integrate its decentralized identity platform, Lens Protocol.

1inch tokens worth over $100m (15% of total supply) were unlocked in December. The remaining tokens are locked in a four-year vesting schedule till December 2024.

Hashflow partners with Wormhole for cheaper cross-chain crypto swaps.

Nexus Mutual expects a $3m loss from exposure to Orthogonal Trading's $36m default on Maple Finance. Sherlock's staking pool also took a ~ $4m loss due to a non-paying borrower in a Maple Finance pool.

SushiSwap proposes to direct 100% of xSUSHI revenue to the treasury wallet as the project was running out of funds (1.5y runaway).

NFT & Metaverse:

Blur Airdrop 2 is officially live. 14 days to claim by placing a bid.

Warner Music Group and Polygon have partnered with LGND.io on a new web3 music project. The new collaboration marks Warner Music Group’s latest step into web3, following its tie-up with marketplace giant OpenSea.

ImmutableX-powered NFTs from web3 games such as Gods Unchained, Guild of Guardians, Illuvium, Embersword and Planet Quest are now available on Gemini-owned NFT marketplace Nifty Gateway.

Funding Highlights:

Uniswap-based DeFi protocol Panoptic raised $4.5m to build a decentralized protocol for perpetual options. Investors include Uniswap Labs Ventures, Coinbase Ventures, and Jane Street.

Bitwave, a crypto-focused tax and accounting platform raised $15m in a Series A funding round led by Hack VC and Blockchain Capital.

Camelot, a new DEX on Arbitrum, raised $3.8m through a public sale.

Crypto Twitter:

Meme of the Day:

ChatGPT is everywhere now.