Crypto Alpha Recap

20.02.2023: Abu Dhabi starts $2BN web 3 fund. Flashbots introduces MEV-Share. Siemens issues the first digital bond. Credit Suisse invests in digital asset infrastructure.

This was a wild week. More SEC regulatory fud and stablecoin worries as Garry appears to be on the road to pushing the industry back underground. It didn’t hinder Bitcoin from clocking $25k for a short time, it’s the highest level since June. We still have room to grow if the macro doesn’t cuck us. Key resistance is at $25k, with $31k as the next level if we break to the upside. It’s no bull market or bear market; it’s just “the market,” as I’m on the side of the echo bubbler.

Coinbase earnings are nearly upon us, and the crypto exchange will drop its full-year 2022 earnings when markets close on Feb. 21. CoinShares and Block also report earnings this week.

Macro: Last week's CPI report has investors rethinking their bluff call on the Fed's rate path. US CPI remains sticky, adding to the slower, higher, longer Fed mantra. The focus has also shifted to services inflation, where prices are rising much faster than they are for goods (7.2% vs. 1.4% YoY, respectively). Powell says the word "disinflation" 15 times during the FOMC meeting. This sent risk assets into party-on mode as many are looking through to a pause in the rapid rate-hiking cycle.

The big question is to what degree the strength in the economy interrupts the current downward trend in inflation. In other words, will we learn that the Fed's claim that the disinflationary process started was premature? Futures are betting the Fed funds rate will end 2023 at +5%. We may still be on track to achieve the goldilocks scenario where inflation comes down without the economy going into recession.

I'm traveling through Asia for the next three weeks and will take a break from the newsletter. Don't get liquidated in the meantime, frens.

GM! Sharing is caring. Be a chad and share this newsletter with your colleagues.

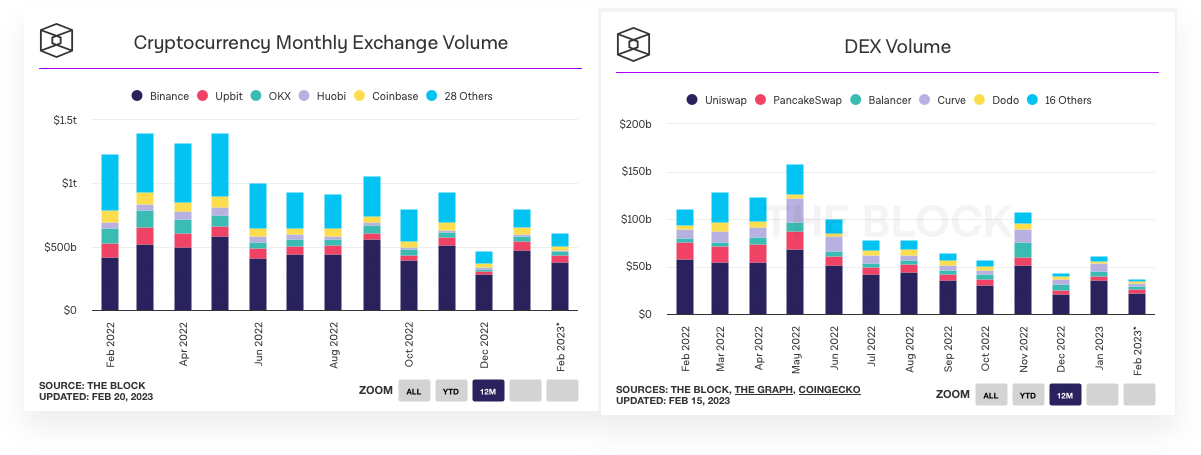

Volume on crypto exchanges is $608B for the month vs. $797.23B total in January. Overall still unimpressive; retail seems not back yet as DEX volume is $37.2B in February vs. $61.29B in January. Stablecoin exchange reserves are $24.349B, down from last week’s $26.193B - undoubtedly fueled by the BUSD and SEC regulatory FUD.

Interestingly the total stablecoin market cap stayed the same at $136.2B. DeFi TVL is at $50.78B, up from last week's $47.07B, slowly moving up with the rest of the market.

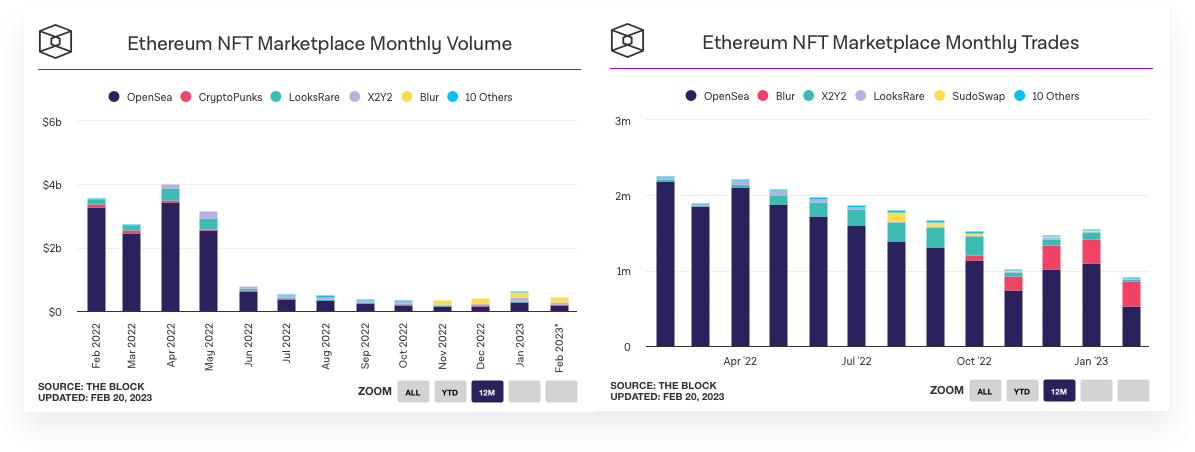

NFT volume: $446M so far for February vs. $616.99M total in January. Again, not impressive, although BLUR had a tremendous start and is going into an open dispute with market leader Opensea. Blur, like its predecessors, has taken the community by storm and got everyone buzzing. Remember when Looks Rare came out of nowhere and disrupted the market? The battle lines were again drawn in the NFT creator royalty debate.

OpenSea is dropping fees to 0% for some time while also moving to a 0.5% “creator earnings model, with the option for sellers to pay more.”). Citing a shift in the NFT ecosystem and coming shortly after Blur made its case for creators to list on its platform rather than OpenSea. As it stands, creators can’t earn royalties on Blur and OpenSea simultaneously. Due to the configuration of marketplace policies, they can only earn full royalties on OpenSea or Blur — but not both together.

Blur has drawn the second-highest volume this month, incentivized (hi @washtrading) with its dedicated token. And they raised funds at a billion-dollar valuation. Who will top this war between marketplaces, traders, and creators?

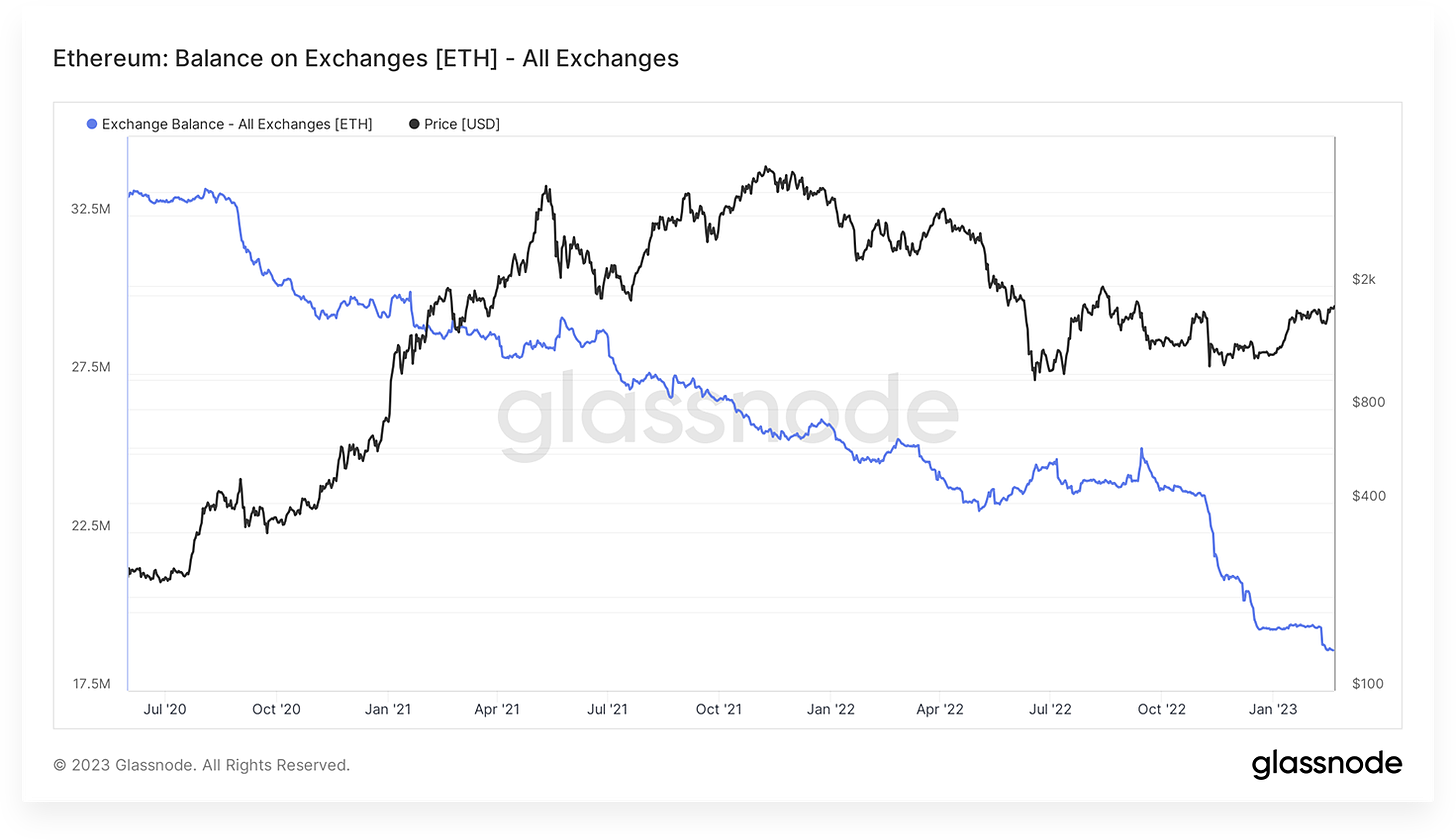

Meanwhile, the total amount of ETH held on exchanges continues to trend down only. For ETH to become deflationary, gas fees must average 16.6 Gwei or higher. Since EIP-1559 was implemented, gas fees have averaged 51.9 Gwei, turning ETH deflationary. Indeed, ETH supply is down -0.014% since the Merge in September 2022.

If gas prices stay at this level, this is what burn and issuance would look like over a year. Ethereum would burn almost three times the amount of ETH issued, and the total supply would drop by 1%.

Taking the actual yield (expected yield - new issuance) from the current staking APR (4.24%) to an adjusted staking APR of 4.52%. Since issuance is currently negative, it acts as a tailwind instead of a headwind.

Meme of the Day:

General:

Hub71, Abu Dhabi's tech ecosystem, has started a $2B initiative to back the region's Web3 and blockchain technology startups.

Top web3 gaming guild Yield Guild Games (YGG) is entering the venture capital space, raising $75M for its first fund.

On Jun. 1, 2023, Hong Kong will officially make a crypto purchase & sell trading fully legal for all its citizens.

Galois Capital, a crypto hedge fund with half its assets trapped on the collapsed crypto exchange FTX, is reportedly shutting down and returning its remaining money to investors.

Bankrupt crypto lender Celsius proposes a sale plan to NovaWulf. The proposed sale would see smaller creditors get around 70% of their money back.

A group of well-known investment firms has acquired stakes in troubled crypto-friendly bank Silvergate. Susquehanna Advisors Group reported a 7.5% stake in Silvergate, worth over $35M, Citadel Securities owns a 5.5% stake. BlackRock, an existing investor in the bank, increased its stake to 7.2% from 5.9% on Jan. 31.

Siemens issues the first digital bond ($60M) on blockchain by Germany's Electronic Securities Act.

Evan Cheng, the CEO, and co-founder of Mysten Labs is raising money for a venture capital fund in the region of $100M. The fund will invest broadly across the sector, not just in projects built on the Sui blockchain.

Crypto market maker GSR makes further layoffs as the bear market bites, affecting 5% to 10% of staff.

Stanford Research Director and former Dean revealed to be SBF's bond signers.

DeFi:

Polygon plans to launch zkEVM, a zero-knowledge Layer 2 scaling solution, on mainnet beta on Mar. 27.

The Ethereum layer-2 scaling race has just gotten tighter. ZK roll-up protocol zkSync renames its 2.0 to Era and allows registered projects to deploy on the zkEVM mainnet.

The Graph can access The Graph Network on Arbitrum.

Lido DAO proposals to sell or stake $30M worth of ETH.

Cosmos-based L1 Kava launches version 12. The upgrade enables any Cosmos chain DAO to have more control and flexibility over their emissions

Flashbots introduces MEV-Share protocol to share profits with Ethereum users.

Avalanche-based stableswap Platypus lost ~$8.M to the attacker that took advantage of a flaw in the protocol’ USP stablecoin solvency check mechanism. The Platypus team later recovered $2.4M with the help of security firm BlockSec and will reimburse LP, who lost funds in this attack.

NFTs:

Blur debuts long-awaited token, set to raise at a billion-dollar valuation.

DOS Labs, a gaming studio with over 400k daily active players and a large network of Web3 game developers, launched its Avalanche Subnet.

Cosmos ecosystem to launch interchain NFTs via $270K incentivized testnet.

Azuki NFT collection introduced Jay & Jelly - BEANZ.

Magic Eden laid off 22 people as companies across the industry cut staff amid challenging times. They also partnered with MoonPay to help users buy digital collectibles with credit cards, Apple Pay, and more.

Sidenotes:

Pendulum mainnet has launched.

Bribes are coming to Uni V3 manager.

RNDR Distributions and Unlocks update and clarification.

CANTO to update inflation parameters.

OHM lending markets are now live on Silo and Euler.

Helium is to migrate to Solana by March 27 fully.

Funding:

Former Jump Trading developers raise $19M from Dragonfly Capital, Naval Ravikant, Cobie, Hasu, and others to build Monad blockchain.

Swiss digital asset infrastructure company Taurus raised $65M in a Series B round led by Credit Suisse.

Alongside, a crypto index-focused platform closed an $11M seed round led by a16z.

Amazon, Google, and Kering back NFT animation studio Superplastic with $20M for making “synthetic celebrities.”

Nefta raised $5M in seed funding at a $32.5M valuation. That’s a 225% jump in its valuation from last June.

Crypto Twitter: