Crypto Alpha Recap

12.01.2023: FTX recovers $5BN. Binance US is buying Voyager. DCG situation escalating. CPI prime time. Microsoft intends to increase its stake in ChatGPT.

2022 was harsh from the outset. A mix of leverage and fraud has left the market lacking flows and narrative. Whether macro events like Fed hikes, the invasion of Ukraine, or crypto-specific catastrophes like FTX and the total destruction of CeFi players, we've been put through the wringer. Last year was a case study of centralized business models in crypto failing. And most boils down to human intervention, which is something that smart contracts in DeFi solve. Either massive misjudgments or straight-up fraud. Ironically, making a solid case again for DeFi. A conclusion you wouldn't come to if you look at some of those token prices.

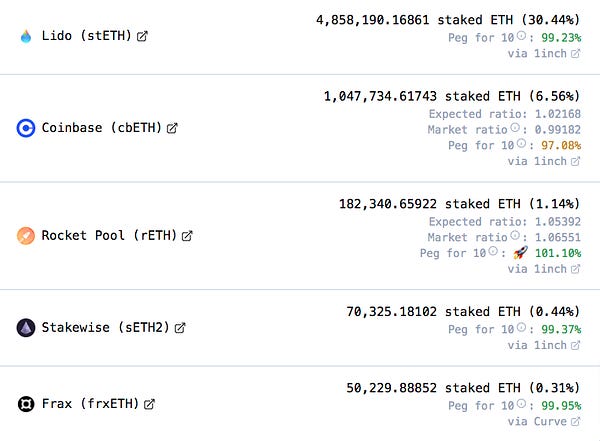

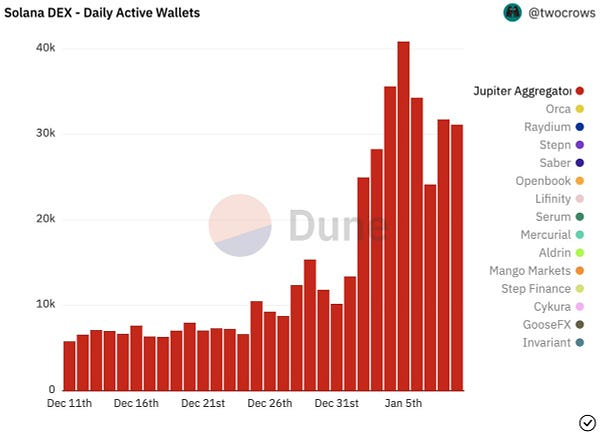

This year started surprisingly well despite the ongoing DCG/Genesis situation. Plenty of predictions have poured in for 2023, but it's hard to make too much sense of a market where things move more in a month than traditional assets in a year. Spotting and riding narratives in this PVP market will remain essential, as we saw with the recent emergence of Liquid Staking Derivatives, the AI trend (seriously?), or the surge in NFTs.

Macro: It's US CPI prime time. Further moderation in the Headline YoY for December is expected from 7.1% to 6.5% and one for Core from 6% to 5.7%. Chinese CPI for December came in as expected, with a slight tick-up in the headline YoY measure to 1.8%. Biden is scheduled to speak later in the day post-CPI on the subject of "inflation," so we've seen this movie before mainly on NFP prints, but he is confident that today's print will help his narrative. Headline-wise, a 6.4/6.6% would print, and above 6.7% would reverse sharply.

GM! Sharing is caring. Be a chad and share this newsletter with your colleagues.

Special Nugget:

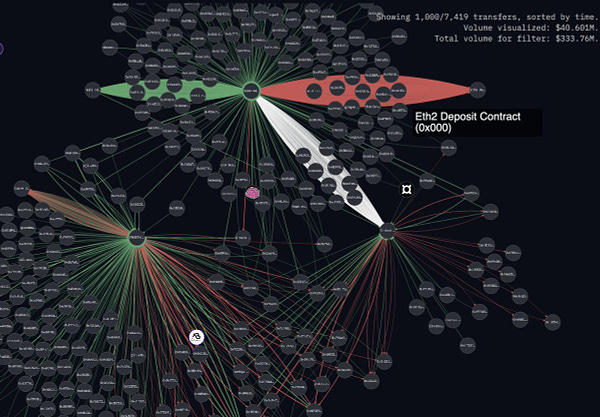

The state of DeFi:

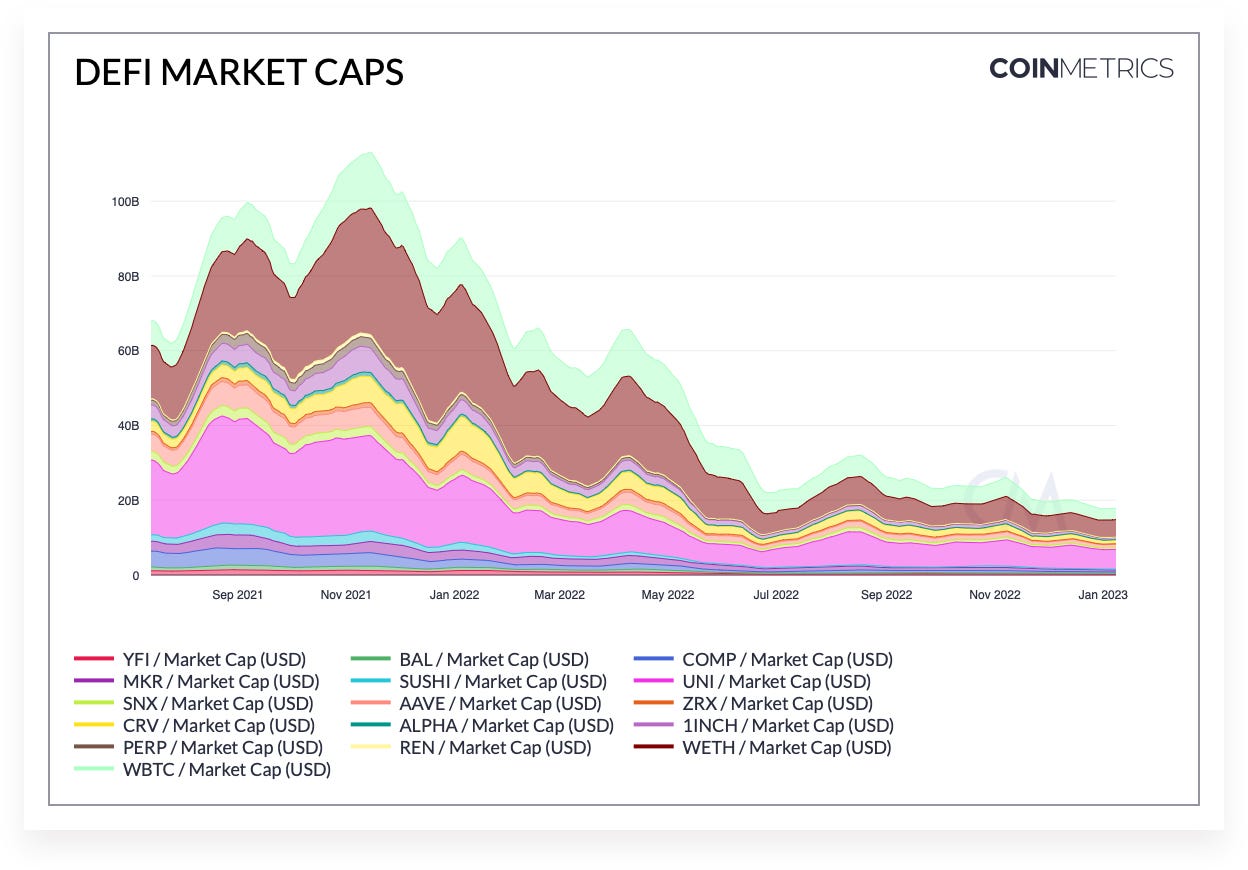

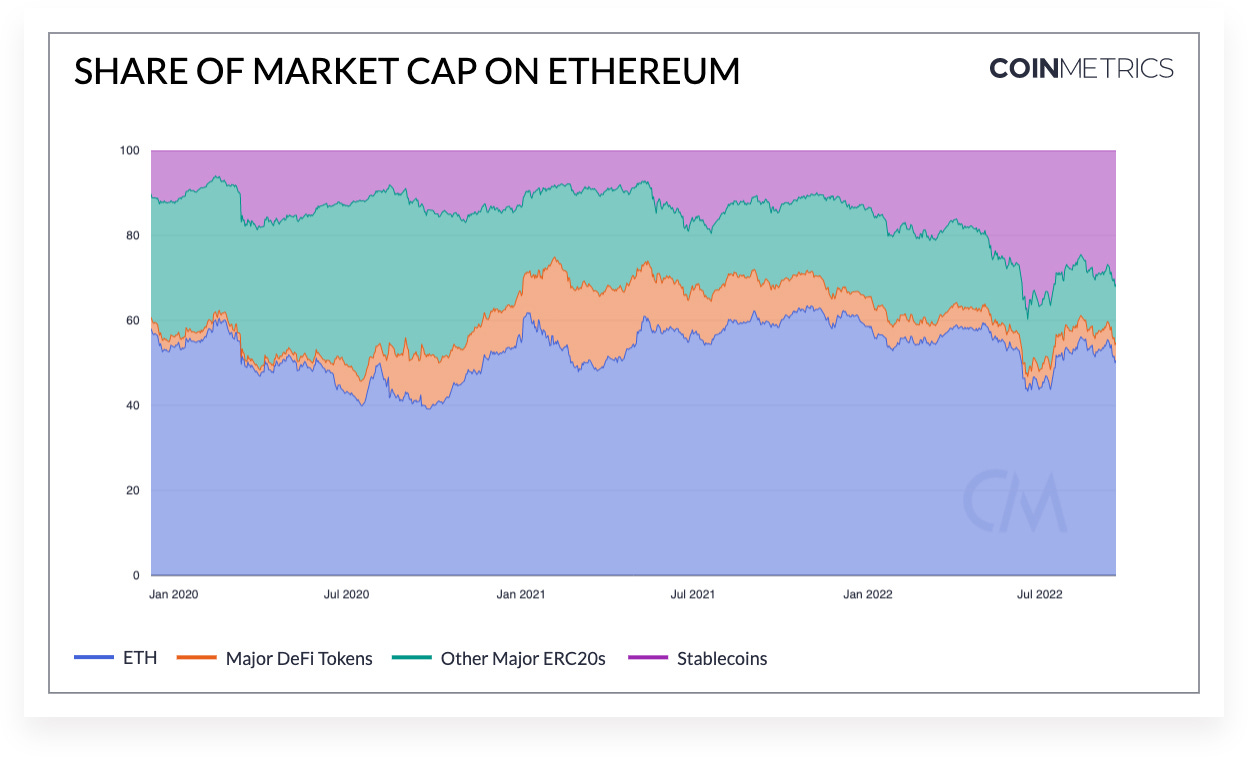

The aggregate market cap for DeFi tokens has been down only over the past few months. Despite the recent decline, the DeFi ecosystem has grown tremendously over the past few years. In January 2020, the overall DeFi ecosystem was worth under $2BN.

Today, it is worth around $18BN, although still below its peak valuation of around $100BN. While the aggregate market cap may fluctuate, the underlying innovation and infrastructure development spurred by these lofty valuations will likely create constant value among some (but not all) projects.

One of the most critical issues to consider when judging the relative performance of DeFi tokens, particularly when making inferences about future performance, is the relative amount of tokens held by treasuries, developers, or early investors. Or short, how ridiculous are the tokenomics? With the acute awareness of centralized agents' recent failures, expectations are high for DeFi to excel in 2023. But it's essential to detach DeFi tokens from the underlying adoption of the protocols.

DCG Update:

The ongoing DCG/Gemini/Genesis/Winklevoss debacle is like an onion with multiple layers - each one brings more tears. After the deadline for the first one had passed, Winklevoss wrote another open letter to Barry Silbert. Demanding the removal of DCG CEO Barry, alleging that Genesis and its parent company defrauded Gemini and users of its Earn program. Notably, the letter laid out a list of accusations as to what Winklevoss believed :

Genesis lost $1.2BN when Three Arrows Capital collapsed. "Recklessly" lent to 3AC, helping to balloon the AUM of Grayscale Bitcoin Trust and thus the fees earned by its sponsor.

Barry pretended to fill that hole by saying DCG gave funds to Genesis.

Instead, DCG's bailout was an IOU so that Genesis could list it as a "current asset" valued at $1.1BN

Gemini, the Winklevoss's exchange, is shutting down Earn as a result. Genesis could owe Gemini as much as $900M. It prompted a response from Barry, rebuking point by point. Lots of words, but still no money; we are one step before the last domino falls.

Meme of the Day:

General:

Federal prosecutors in New York and the SEC investigate Digital Currency Group (DCG) for internal transfers at its lending subsidiary Genesis.

Mt. Gox's repayments timeline has been pushed back by two months; payments will start in March and continue until the September 30 deadline.

FTX has recovered more than $5B in different assets, not including another $425M in crypto held by the Securities Commission of the Bahamas. The U.S. Department of Justice also seized FTX cofounders' Robinhood shares worth over $450M.

Judge allows Binance US bid to buy bankrupt crypto lender Voyager's assets to advance. The sale will allow customers to recoup 51% of their deposits.

Huobi Korea is set to sever corporate ties with crypto exchange Huobi Global and run its own business.

Around 117 parties are interested in buying four FTX businesses: LedgerX, Embed, FTX Japan, and FTX Europe, according to court documents.

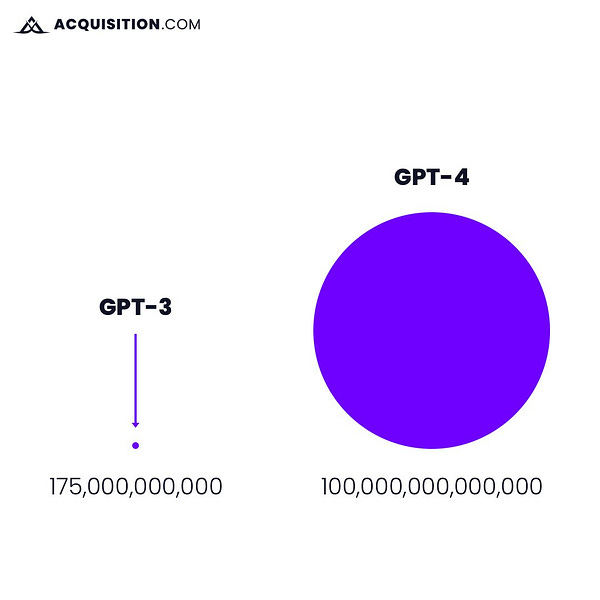

Microsoft is in talks to acquire a 49% stake worth $10B in ChatGPT owner OpenAI.

Binance outlines ambitions to grow headcount by up to 30% in 2023. The exchange group grew from 3,000 to 8,000 in 2022.

Coinbase lays off another 950 employees, reducing operating expenses by about 25% Q/Q.

Binance annual revenue grew 10x over the past 2 years, while OKX's grew 4x. Huobi global's quarterly revenue fell -98% since the second quarter of 2021.

DeFi & NFTs:

Curve 3pool’s liquidity currently stands at roughly $600M, down approximately 90% from $5.5B recorded at the start of January 2022.

Ondo Finance, a DeFi firm offering decentralized investment opportunities, has launched tokenized versions of U.S. treasuries and bonds.

Arbitrum and Optimism transactions now exceed Ethereum.

Cosmos-based e-Money is unwinding its euro-backed stablecoin EEUR.

Yearn Finance will allow users to create their own vaults to accrue yield and deposit proceeds to earn even more token rewards.

Mastercard launches web3-focused artist incubator with Polygon.

Sidenotes:

Premia merges with Knox Vaults.

ConsenSys launches private beta testnet for zkEVM scaling technology.

Opensea supports Arbitrum Nova.

ETH Shanghai testnet is planned for the end of February.

Trader Joe's expands to the BNB chain.

Lens Protocol lets creators issue token-gated content.

StarkNet releases the first public version of Cairo 1.0.

BitDAO's Layer 2 network (Mantle) has launched a public testnet.

MYSO v1 protocol is officially live on ETH mainnet.

Dopex partners with Lido to launch the stETH Single Staking Option Vault.

Funding:

The Easy Company has raised $14.2M in a seed round and launched its “social” crypto wallet to help onboard more mainstream audiences.

C14, a New York-based web3 payments firm, raised $2.5M in seed funding led by General Catalyst.

Abu-Dhabi-based Venom Foundation and Iceberg Capital are partnering to invest $1 billion in a host of web3 applications.

Cosmos-based DeFi Protocol Quasar has raised $5.4M in a funding round led by Shima Capital at a $70M valuation. Other investors in the round included Polychain Capital, Blockchain Capital, HASH Capital, CIB, and Osmosis co-founder Sunny Aggarwal, among others.

Jumbo, a DEX built on the NEAR Protocol, raised $3.5M, led by Pantera and Huobi Incubator.

Crypto Twitter: