This week, there is little movement as the market is still in pain after FTX. Bitcoin remains at $16k, while ETH is above $1.1k. DCG situation is developing rapidly, but for once, the news isn’t as bad as expected.

Timing market cycles is famously complex. The key is to pay attention when price action no longer lines up with sentiment. We are likely closer to the end than the beginning. Although people are still emotional. It will hit bottom when apathy is absolute and people don't care anymore.

Makro: The market is taking the dovish side after yesterday's Fed minutes. Stocks were rallying, and the USD and US yields were backing off. The narrative remains in place; a slowing of the pace of hikes is coming, the terminal rate will be higher than previously thought, and it will stay in place for longer. Meanwhile, the OECD slashed growth estimates for next year, with growth expected now to be 2.2% globally instead of 3.1%. Seems a tad optimistic still. The EU-Russian oil cap negotiations drag on with estimates for the cap between $60/70 pb.

China's covid woes continue to build, with new record highs on the mainland. Restrictions are starting to be reintroduced into the major hubs. Shanghai has tightened rules for people entering the city today. Meanwhile, Beijing has closed down public spaces, and the city has also requested a negative covid test result within 48 hours for those entering workplaces and shopping malls.

GM! Sharing is caring. Be a chad and share this newsletter with your colleagues.

Special Nugget:

DCG UPDATE:

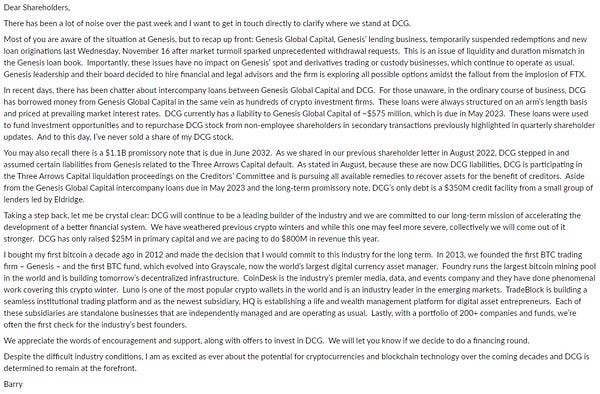

Contagion-wise, unsurprisingly, the Genesis story is not at its beginning but closer to its end as they have appointed a restructuring advisor with investment bank Moelis & Company. DCG, Genesis's parent company, has broken cover and admitted having intercompany loans, although most debt is long-term.

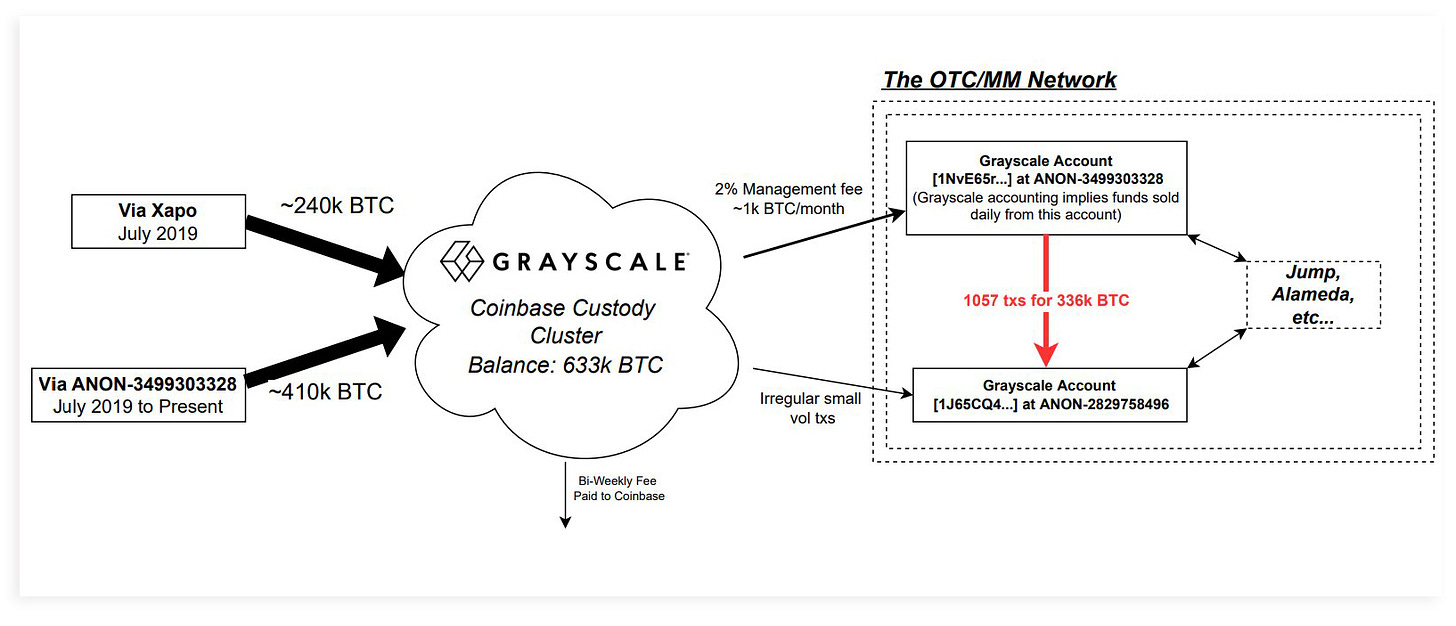

First, the good news. On-chain forensics confirms the approximate 633k Bitcoin balance held by GBTC at Coinsbase custody. Based on the results, we can conclude that Greyscale's self-reporting is credible, although they have chosen to forgo using transparency. On guess is that Grayscale doesn't want to disclose their most frequent counterparties, therefore utilizing the security concern comment as an excuse.

Barry Silbert, founder and CEO of DCG, released the following message on Tuesday. Reassuring there is no imminent threat and: “Collectively, we will come out of it stronger.”

Key takeaways:

DCG owes Genesis $575m due May 2023

Loan funds were used towards investments and repurchasing DCG stock from non-employees.

Also owes Genesis $1.1bn on a promissory note due June 2032. After they stepped in to assume liabilities from Genesis due to the implosion of Three Arrows Capital.

DCG, in aggregate, owes $2.025bn. $1.675bn to Genesis and $350m to external creditors.

DCG has only raised $25m in primary capital, pacing to do $800m in revenue this year. But needs to mention the cost basis and profitability.

Overall this feels sketchy. But the fact is, DCG’s Grayscale business is precious. Since GBTC charges a 2% annual fee for doing nothing. A fire sale is off the table. Also, most debt is long-term; only the $575m (due in May) needs to be addressed quickly. Without having any insights into DCGs balance sheet, the situation still seems somewhat under control. Good for the market. It remains to be seen if DCG can raise money again or is forced to sell some assets to plug the hole.

Crypto News:

Bitcoin miners are selling at the most aggressive rate in almost seven years, with a 400% increase in selling pressure over the last three weeks.

Core Scientific, the largest US publicly-traded Bitcoin mining company in terms of computing power, lost $1.7bn in the first 9 months of the year. Likely to file for bankruptcy if it can't find more funding to repay its $1bn debt.

Man Group, the most prominent publicly traded hedge fund firm, is reportedly close to starting a crypto hedge fund.

Tornado Cash developer Alexey Pertsev will remain in jail until late February.

The Pantera Bitcoin Fund bought $137m worth of BTC. 141 accredited investors participated with a minimum investment of $50k each.

Avalanche releases a second SDK for building Avalanche VM, the Rust SDK, allowing developers to quickly launch their own blockchain on a subnet.

FTX Group, has a combined cash balance of $1.24bn, according to a new court filing. Far below the $3.1bn FTX owes its top 50 creditors.

JPMorgan officially registers a cryptocurrency wallet trademark.

Iris Energy unplugged miners used as collateral for over $100 million in debt after receiving a default notice from its lender.

Japan's central bank will begin a CBDC experiment in early 2023. Several banks will stress test a digital yen for more than two years.

DeFi landscape:

Curve releases a whitepaper and official code for its stablecoin. The overcollateralized stablecoin will rely on an algorithm called Lending-Liquidating AMM (LLAMMA).

Uniswap is launching a new bug bounty. Depending on the bug's severity, rewards can reach up to $3m for white hackers.

Celo partners with Ethereum software firm ConsenSys. The partnership will allow integration with ConsenSys' Infura infrastructure.

Tether conducted a chain swap and moved $1bn USDT from Solana to Ethereum. Overall, supply will not change.

Djed, the Cardano-based decentralized stablecoin, will be integrated into 40 apps in the Cardano ecosystem.

Velodrome will be distributing 4m OP tokens over the next 6 months. The incentive program is called "Tour de Optimism."

Chainlink presents its "Link economics 2.0". Staking starts on 6th Dezember.

Bridging protocol Synapse adds support for the Canto blockchain.

NFT & Metaverse:

Magic Eden expands NFT support to Polygon as its 3rd chain and is going fully multichain.

Grand Theft Auto (Rockstar) has followed Minecraft in banning NFTs from its third-party online servers.

The Sandbox is kicking off its three-part land sale on Thursday in collaboration with popular brands like Tony Hawk, Snoop Dog, and Playboy, among others.

Porsche is getting into NFTs, launching a Twitter account for the “ journey to merge the physical and digital.”

French luxury fashion brand Givenchy has become the latest company to offer phygital NFTs — a physical good backed by a digital token.

Scotch whisky maker Johnnie Walker has continued its Web3 push by allowing NFT holders to vote on the design of a bottle for a limited-edition drop.

Reebok is joining Nike in Metaverse and has filed 2 application trademarks.

Funding Highlights:

Binance Labs invested strategically in hardware wallet maker NGRAVE and will lead its upcoming Series A round.

Foresight Ventures, a crypto fund with $400m in AUM), is launching a $10m incubator program called Foresight X.

Web3 and VR gaming studio, Thirdverse, raised $15m in its latest funding round. MZ Web3 Fund led the round with participation from Dash Ventures, OKX Ventures and YGG.

Onomy Protocol, converging DeFi & Forex, closed a $10m round.

NFT utility platform Tropee raises $5mled by Tioga Capital.

Crypto Twitter: