Crypto Alpha Recap

21.03.23: The $2B Arbitrum injection. Polygon is partnering with IMX. Central banks enhance the provision of U.S. dollar liquidity. Coinbase to begin operations overseas.

Bitcoin shows great strength coming into a charged week and continues outperforming alts. However, its dominance is reaching a significant resistance level, suggesting that a shift in capital flows is around the corner. The market is waiting on the FOMC - the last catalyst - and depending on the outcome, the market will transition into full risk on. One of the only sectors immune to BTC’s liquidity black hole was Arbitrum, as Offchain Labs announced the launch of Arbitrum’s native token, ARB. While a token was always the plan, Coinbase building on OP’s stack and recent regulatory pressure may have advanced the timeline as Arbitrum’s token.

UBS has agreed (aka forced by the government) to buy Credit Suisse in a $3.2B all-share deal. About $17.3B in additional tier-1 bonds will be completely written down. As a result, the riskiest bonds around the world are falling.

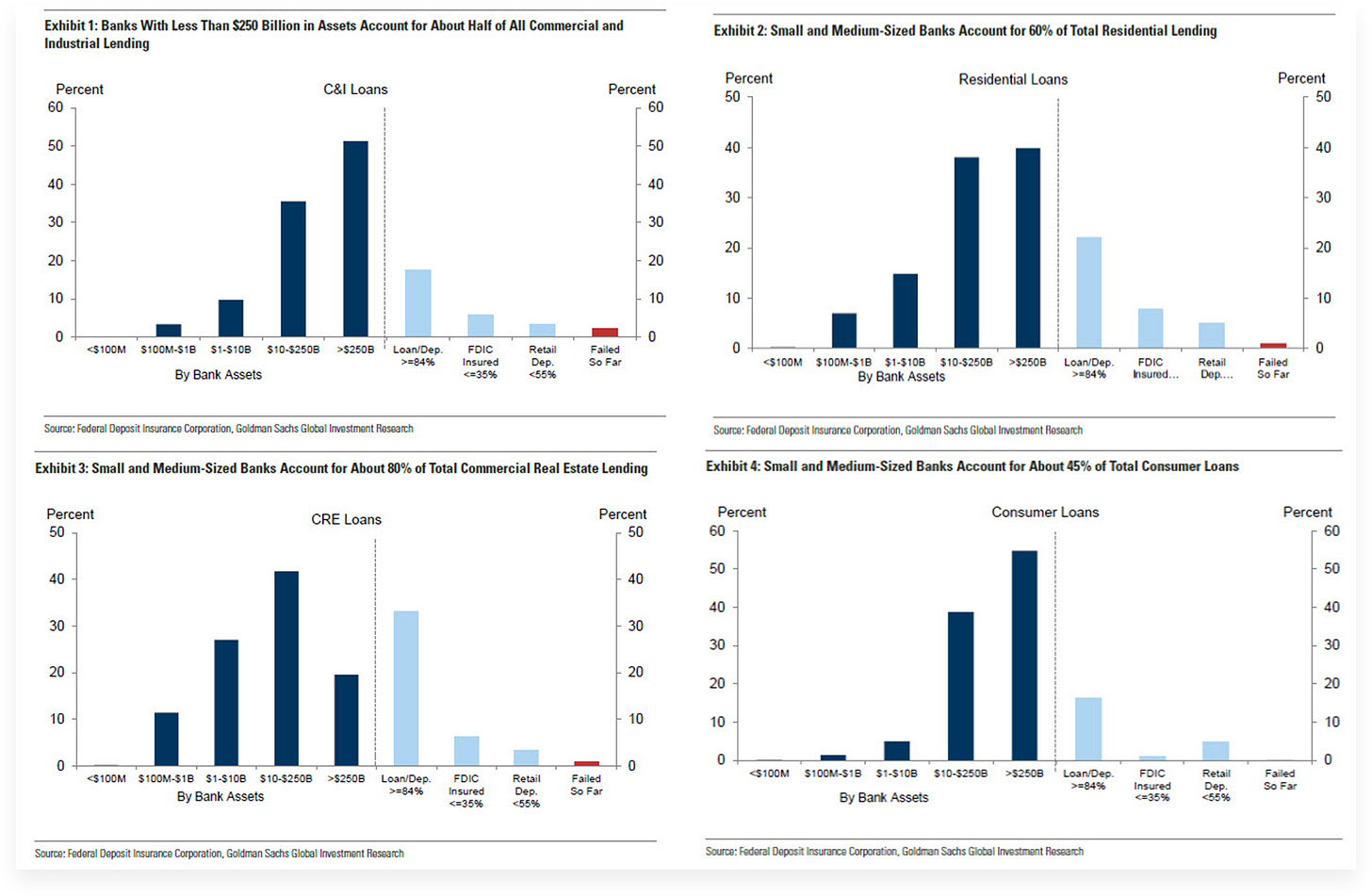

Macro: The Fed faces one of its toughest calls in years: whether to raise rates again to fight stubbornly high inflation or take a timeout amid the most intense banking crisis since 2008. Small/medium banks account for 50% of US commercial and industrial lending, 60% of residential real estate lending, 80% of commercial real estate lending, and 45% of consumer lending.

With a 50bps hike now off the table after the collapse of multiple banks, markets are leaning towards a quarter-point raise (61%), but the prospects of a pause remain a real possibility (39%).

Special Nugget:

Arbitrum - the 1-2 billion on-chain injection:

It’s finally happening; the premium L2 solution Arbitrum drops its token. It feels like everyone I know got somewhat of an allocation, as the median airdrop size is 1250 ARB. Yet, only 625,143 addresses (probably around 100k unique users) are eligible - we are still early. Nansen developed the airdrop distribution model backed by on-chain data analyses using NansenQuery. It was perhaps the best-known open secret as I gained myself 12K tokens anticipating a potential drop.

Arbitrum is an ETH Layer 2 scaling solution (sits atop the base layer of a blockchain to speed things up) that supports smart contracts without the limitations of scalability and privacy. Users enjoy low transaction fees and less congestion on Arbitrum. Offchain Labs, the team behind the optimistic rollup, raised $120M ($1.2B valuation) in August 2021 after the official launch of Arbitrum One mainnet.

The token launch is on Thursday, March 23, and you can monitor real-time data on the airdrop through Westie’s great dashboard. Meanwhile, there are already OTC deals happening between $1.10 - $1.30 at the time of writing. Arbitrum is transitioning to a DAO model, of which ARB will be the governance token. This enables decentralized proposals & protocol upgrades. I see governance as a meme (except if you receive airdrops), making you hold your bag while others dump it on you; in any case, here is a great thread about its governance model.

There are plenty of price predictions and models, mostly comparing it to Optimism. Although TVL (another flawed metric since we know money follows yield and only sticks as long incentives are running) or FDV comparisons aren’t fair since Arbitrum has a higher TVL without ever running liquidity mining incentives. The market consensus is that Arbitrum is of much higher quality than Optimism, and the price will undoubtedly reflect this in the long term.

I will take some chips from the table in the short term if we really should see the $1.5 - $2 range. What matters for the price is what you can do (yield farming, collateral, single side LP on Uni V3, etc.) to put your new tokens to work, but at launch, the price is mostly determined by marginal buyers/sellers. We have witnessed this distribution model (launch > pump > dump > long distribution/accumulation> new ATH) with plenty of other launches, and I doubt this time will be different. Anyway, the airdrop will act as a stimulus for the Arbitrum ecosystem, and yields will increase due to ARB incentives. And it will also have positive flow-on effects for the broader crypto market, as people can access additional liquidity. If you are into more sophisticated LP strategies, Coin Data School has a premium guide on how to play the airdrop with LP positions.

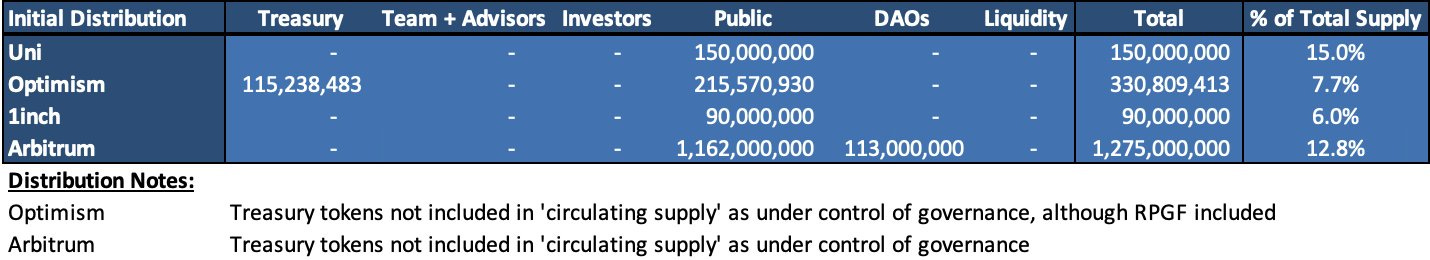

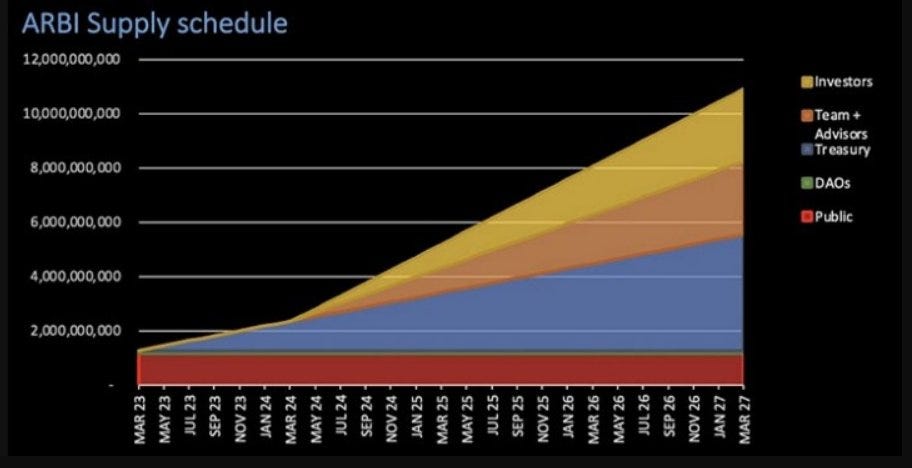

Initial supply is at 10B, with all investor/team tokens subject to a 4-year lockup with unlocks happening in one year and monthly unlocks for the remaining three years.

DAO Treasury: 4.278B (42.78%)

Airdrop: 1.162B (11.62%)

DAOs in Arbitrum ecosystem: 0.113B (1.13%)

Investors: 1.753B (17.53%)

Team + Advisors: 2.694B (26.94%)

Initial supply is on the higher side, similar to UNI, while emission rates are at 0 for the first year (OP with 81%). Also, the vesting looks relatively flat.

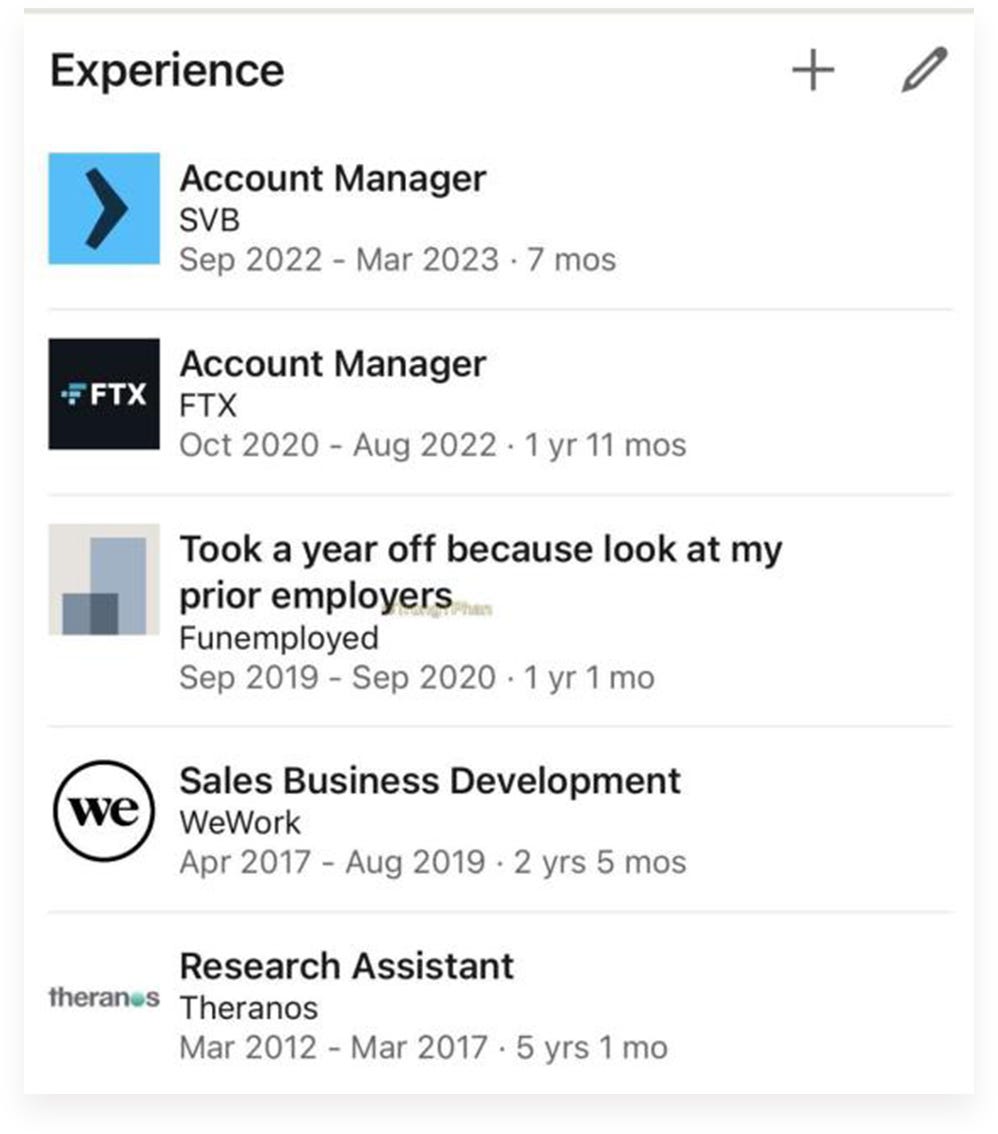

Meme of the Day:

General:

Coordinated central bank action to enhance the provision of U.S. dollar liquidity.

Silicon Valley Bank's former parent company, SVB Financial Group (SIVB), filed for Chapter 11 bankruptcy protection.

FTX will auction its derivatives exchange LedgerX to bidders on April 4.

Coinbase is in talks with trading clients to begin operations overseas as US regulatory environment worsens.

Microsoft is adding a crypto wallet to Edge browser.

Polygon co-founder Anurag Arjun has left the company to concentrate on Avail, his Layer 1 blockchain start-up.

DeFi:

Drama over at DefiLlama as team forks the website and is now called Llama. The aggregator reached $5B in volume since launching in January.

Osmosis Foundation, the leading interchain DEX, converted more than 10% of the cash in the treasury into Bitcoin.

Radiant v2 is finally live with a interesting farm game theory.

Euler hacker ($197M) sent an on-chain message, looking to return funds.

Uniswap V3 is also coming to AVAX.

NFTs:

Polygon is partnering with IMX. Immutable will launch a zkEVM MATIC staked chain.

Salesforce has partnered with Polygon for an NFT-based loyalty program.

Crypto Twitter: