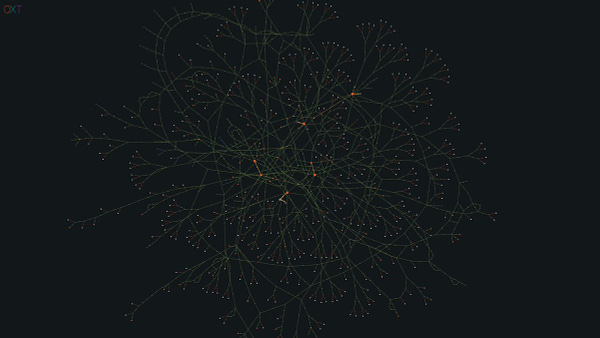

Everyone’s asking why aren’t we lower yet. Following the demise of FTX, the risk of contagion is high (Genesis, Multicoin), and bearish momentum took hold of crypto. The fallout of SBF’s fraud has left many market makers, hedge funds, and other large traders without access to their operating capital. The market is quickly escalating into a full-blown, no-holds-barred, peer-versus-peer trading environment.

While DeFi enthusiasts correctly see FTX as a failure of centralization, most others will, unfortunately, see it as a failure of crypto. Although the core value-proposition “finance without trust” was validated, no new money of any size will flow in. So if you ask who is left to buy, you can revert it to whom is left to buy? Not many. The same goes for jpegs. Pre FTX crash and burn, the market was already having trouble finding enough liquidity to sustain the onslaught of constant new releases. Most NFTs just slowly grind to consistent new lows. If you are going to trade this market, you must be a ninja. Get in and get out fast in the short term.

As for the question, who is left to sell? We got one, a biggie. Last time I mentioned the implications of Genesis for DCG and Greyscale. Things got from bad to worse over the weekend.

USA Week Ahead:

Wednesday 1:30p ET: Powell Speaks at Brooking Institute

Wednesday 2:00p ET: FOMC minutes are released

Markets will be closed Thursday and open Friday but closing early, expect thin markets and potentially extended price ranges should anything material happen with Wednesday’s Fed talk. Overall, equity markets are pretty calm; regarding crypto, we could see a massive volatility spike around DCG. We are in for a showdown this week. One way or another, we will see severe reactions depending on this outcome.

GM! Sharing is caring. Be a chad and share this newsletter with your colleagues.

Special Nuggets:

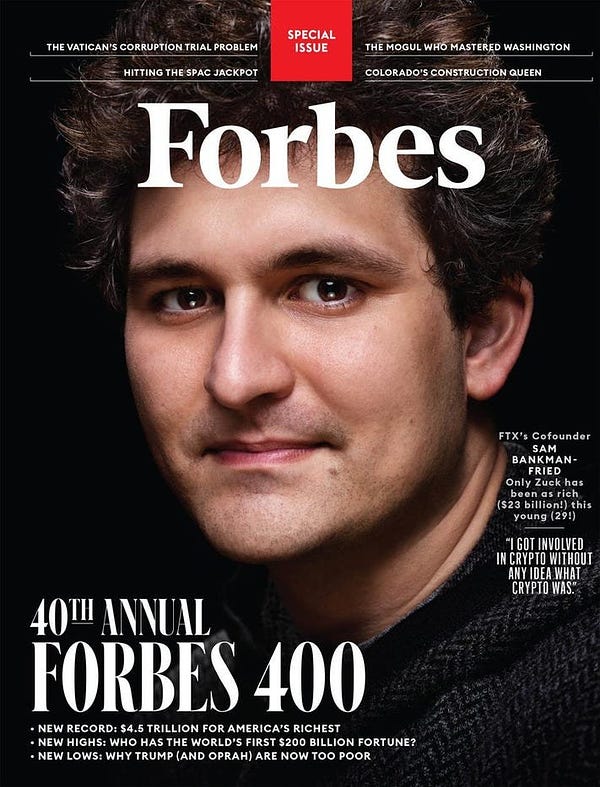

DCG is in trouble:

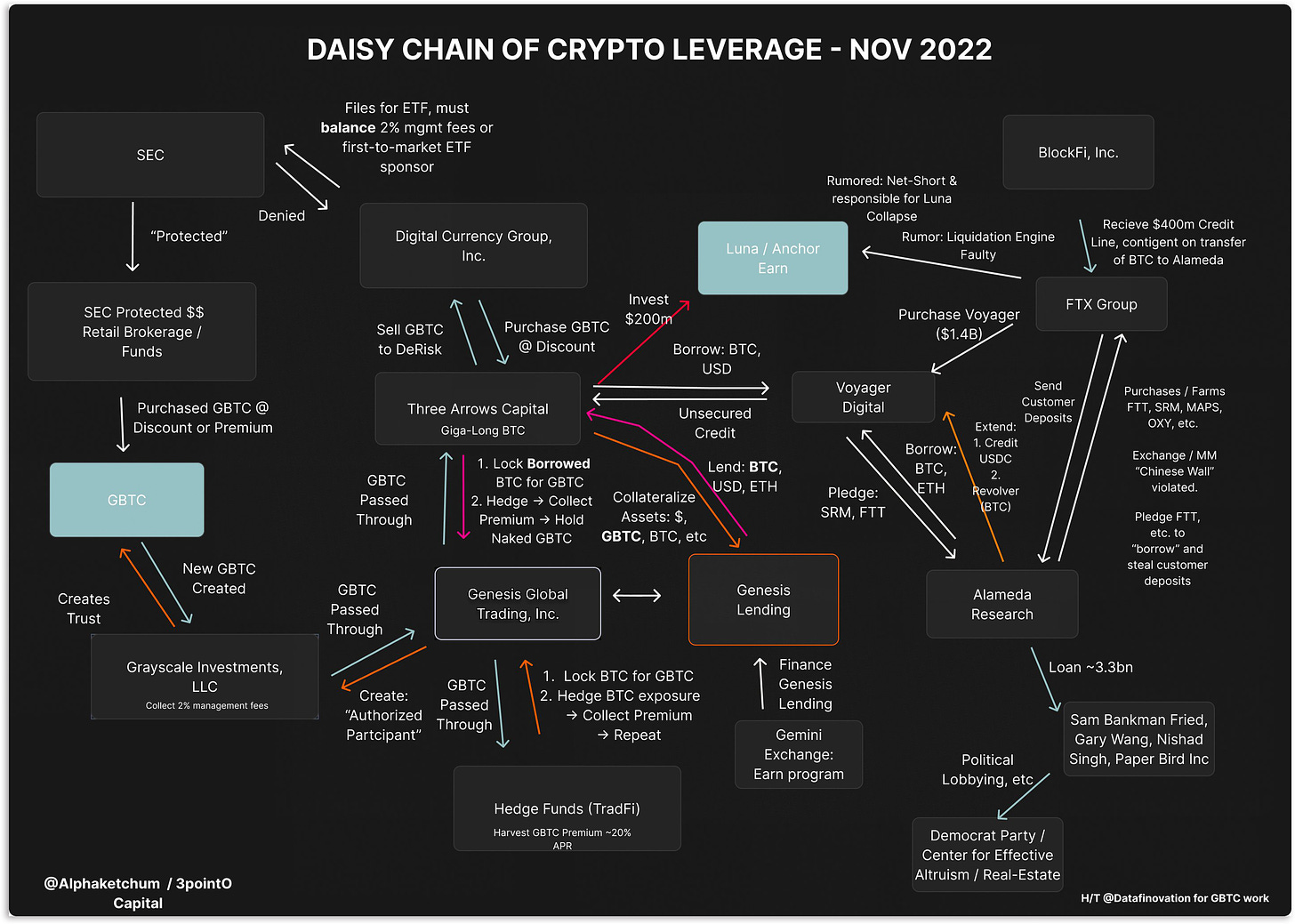

Genesis had $2.8bn of “active loans” at the end of the third quarter of 2022. Its parent company, Digital Currency Group, already infused $140m cash after Genesis stated it had about $175m in locked funds in FTX. Shortly after, Genesis halted its lending unit on Thursday. It didn’t help that Greyscale was withholding on-chain proofs of reserves on Friday due to security concerns. The move by Grayscale comes as pressure mounts on crypto businesses to introduce proof of reserves in the wake of FTX’s liquidity issues and subsequent bankruptcy. As a result, the GBTC discount nears 50% as market participants seem anxious.

There are no proven sources yet, but rumors are DCG is also in trouble. Owing $1.1bn to Genesis via a previously undisclosed promissory note that had been hidden from potential investors. Again, this has yet to be confirmed; allegedly, DCG is looking to raise $1bn asap to inject capital into the subsidiary to restore confidence.

Genesis was a gem in the DCG portfolio and a pioneering prime broker in the crypto category. It is critical in enabling large institutions to access & manage risk. Genesis has lost more earnings (due to 3AC and FTX counterparty blow-ups) than Genesis has ever generated since its inception. 3AC was allegedly over $1bn in losses alone. The whole picture is done by 3point0 Capital.

GBTC has been dumped by institutions all year because of the failure of 3AC (100% sell) and BlockFi (100% sell), and DCG picked it up. That way, they did try to mitigate the impact of the selling pressure and prop up the fund's NAV like a stock buyback. It became the largest holder of its subsidiary's bitcoin trust. Market participants are concerned that the failure of Genesis could confirm that DCG needs to start selling off significant chunks of crypto assets to backstop Genesis. The worst-case scenario is to dissolve the trust if there is a solvency issue. That's why all eyes are on Greyscale ($10.5bn in BTC assets) due to the sheer amount of Bitcoin.

As a measure, DCG has already raised $600m in a new credit facility, following up on a recent $700m secondary equity transaction 2 weeks earlier. It was led by a pair of Softbank funds and valued the company at $10bn. Currently, there is no further info, and we can pray DCG will resolve this mess. The financing is complicated, and anyone working on the deal can't talk. The relationship among those entities creates structural restrictions with GBTC and ETHE and who is allowed to do what and why. Credit facilities that size means non-crypto native financing, and that takes time. The outcome of this will provoke a massive reaction in the market. That's guaranteed.

Day 1 FTX bankruptcy pleadings:

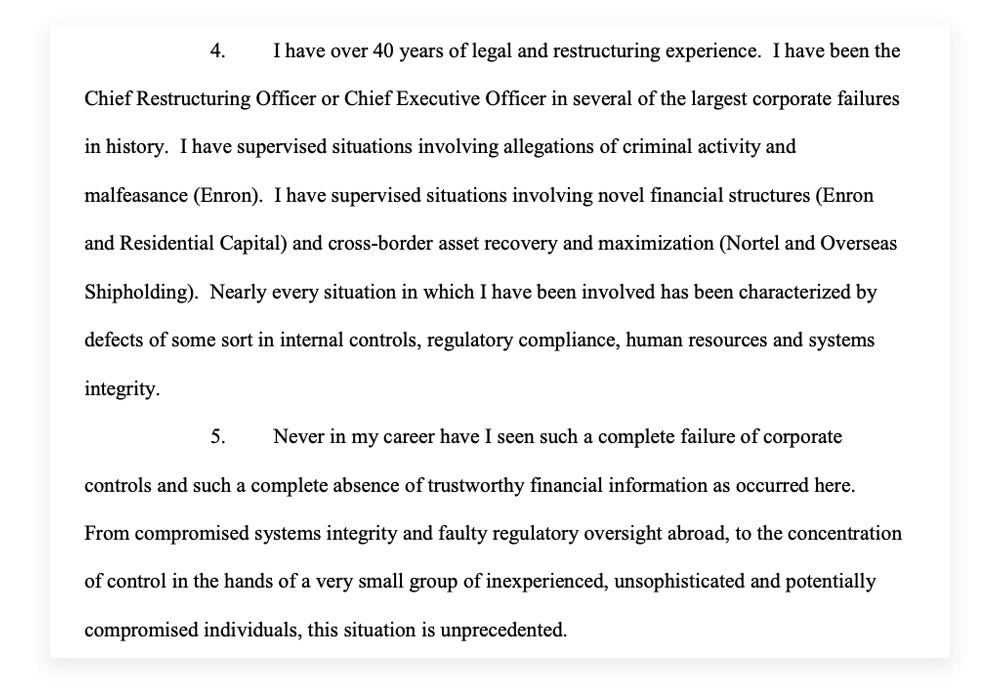

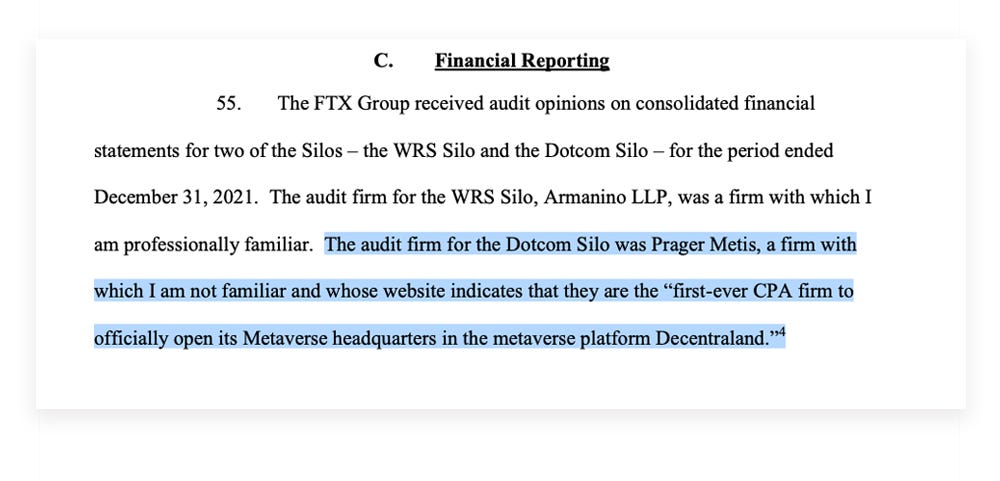

The 30-page bankruptcy filing was released. When you've got this on page 2, you know it's going to be an absolute banger:

Some highlights:

FTX had no cash management or employee record system. Managers accepted employees’ expenses with emojis.

The Bahamian government directed SBF to send FTX assets to government wallets and admitted it afterward.

SBF gave billion-dollar loans to himself and his inner circle (SBF $1bn, Nishad Singh $540m, Ryan Salame $55m) and was used for donations and houses.

FTX didn’t have an accountant or keep proper records of customer deposits. They also used software to conceal the misuse of customer funds.

FTX built a “secret exemption” so that Alameda could avoid the auto-liquidation protocol on the app. Alameda was in god mode.

Lacked independent governance, never had a board meeting, and used an unsecured group email with root access to private keys and data.

John J Ray, the new CEO, seems to have some humor, though!

By the way, black Friday is just around the corner. Watch out for must-have tools hitting the discount code. The first we spotted was TradingView. They offer a 40-60% discount depending on the package.

Crypto News:

FTX owes its 50 biggest creditors more than $3bn. The top 10 accounts for 1.45bn. One customer lost a staggering $266m.

The world’s largest publicly-traded hedge fund, Man Group, wants to jump into crypto. The London-based company manages over $138 billion in assets and could look to launch the fund by the end of the year.

Getting funds out of FTX could take years or even decades.

Grayscale will not show proof of reserves due to “security concerns.”

Neobank Revolut will launch a lightweight version of its app in the coming months with features such as ianstantaneous cross-border transfers targeting lower-income countries such as Latin America, Southeast Asia, and the Middle East.

Binance.US is preparing to bid for bankrupt lender Voyager Digital - previously made a $50M bid for Voyager but lost it to FTX.US. Other bidders included crypto investment manager Wave Financial and trading platform CrossTower.

Multicoin Capital lost more than half of its flagship fund’s capital in about two weeks. Excludes illiquid, side-pocketed investments. 9.7% of fund assets, including derivatives, that were custodied by FTX.

DeFi & NFT landscape:

Emurgo, the official commercial arm and a founding entity of the Cardano blockchain, plans to launch USDA, a U.S.-pegged stablecoin, in early 2023.

The FTX hacker is getting rid of the stolen ETH as quickly as possible and converting 25,000 ETH (~$30m) into wrapped Bitcoin. 370m is still out there, and 200k+ ETH is left in the wallet.

Adidas unveils its first NFT wearable collection, Virtual Gear, which includes 8 silhouettes within 16 variations.

Funding Highlights:

Yakoa got $4.8m to build a cross-chain NFT fraud detection tool.

ADDX raised $20m in an upsized Pre-Series B funding round. Joining their board is new shareholder KB Securities, a subsidiary of Korea’s largest banking group KBFG.

Virtualness, a mobile-first platform designed to help creators and brands navigate the complex world of Web3, secured over $8m in seed funding. The fundraising was led by Blockchange Ventures, and joined by Polygon Ventures, F7 Ventures, Micron Ventures, Oceans Ventures.

Web3 Music Platform Element Black raised $6m from Central Research Capital, JKL Group, Aralern Capital, and other institutions.

Crypto Twitter: