Crypto Alpha Recap

24.03.23: Nasdaq to launch crypto custody service in Q2. Circle expands in Europe. SEC having a go at everyone. Do Kwon arrested. ZkSync Era: First zkEVM goes live.

A wild week to say at least. The SEC is trying hard to scare the industry into regulatory compliance as SushiSwap served a subpoena. Coinbase received a SEC Wells notice, while Justin Sun (he paid influencers like Lindsay Lohan to shill his garbage) and his companies are charged with fraud and other security law violations. And believe it or not, they got Do Kwon. The Terralabs (Luna) founder has been arrested in Montenegro.

Arbitrum’s initial claim process was a clusterfuck, but the overall market consensus of its premium was confirmed: It’s currently trading above Optimism at around $1.40. With over 80% claimed, zero emissions, and team/investor tokens vested, it looks like an attractive longterm bet.

Macro: FED increased interest rates by 25bps for the ninth consecutive hike, pushing the federal funds rate to its highest since September 2007. Traders now see a roughly 50% chance officials won’t raise rates again. By the end of the year, they anticipate the federal funds rate will drop below 4.2% after hitting a peak of just under 5% in May. By the bond market’s interpretation, both a recession and rate cuts are certain this year.

Another day, another troubled name: credit default swaps for Deutsche Bank are surging. Janet Yellen said regulators would “certainly” take additional actions to insure deposits if required.

Special Nugget:

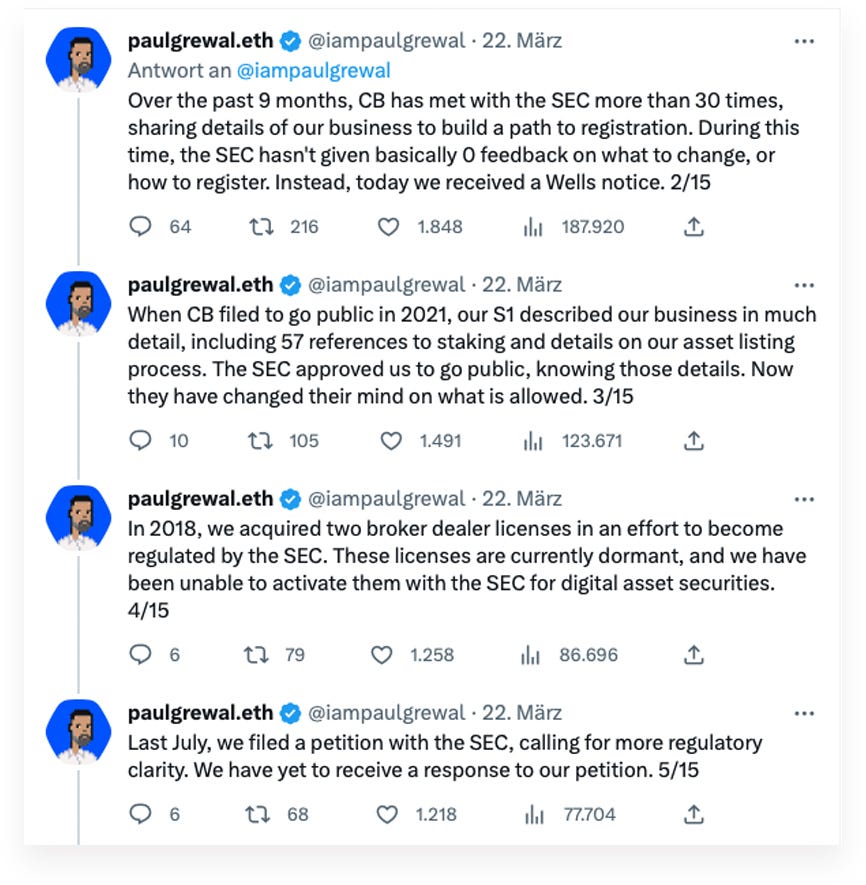

The SEC is sending a message. They are ramping up enforcement. Coinbase received a Wells Notice from the SEC alleging that the company's staking products (Coinbase Earn, Coinbase Prime, and Coinbase Wallet) constitute unregistered securities. And they answered as CEO Brian Armstrong quickly came out of the tranches.

It is difficult to overstate how remarkable it is that this is the response of a public company to a Wells notice. Chief Legal Officer Paul Grewal highlighted how the SEC is ticking.

Since 2018, the industry has criticized the SEC for regulating the crypto space through enforcement actions. The regulator has assumed that almost every token and ICO currently listed by exchanges is an unregistered security. It's coming to a showdown, and Coinbase won't crumble, unlike Kraken, and has the resources to fight.

While countries like the U.K. and EU create regulatory frameworks and financial rails to accommodate crypto, the U.S. will see the industry moving offshore.

Meme of the Day:

General:

Stablecoin issuer Circle has applied for a French crypto asset license as part of a broader growth strategy for Europe.

The Nasdaq seeks to offer custody services to institutions dipping their toes into cryptocurrency. The exchange is set to enter the crowded market of institutional bitcoin custody in Q2.

Hong Kong is eager to become a crypto hub—and digital asset companies are sizing up the opportunities.

Llama drama is resolved; the team has agreed on the token decision (there won’t be a token nor an airdrop), and all links are now redirecting to the original domain and products.

Real estate broker Engel & Völkers now accepts Bitcoin and USDT in Switzerland.

Euler Finance to enter talks with exploiter over the return of funds.

Swiss banks were inundated with requests by crypto firms after the collapse of crypto-friendly banks.

DeFi & NFTs:

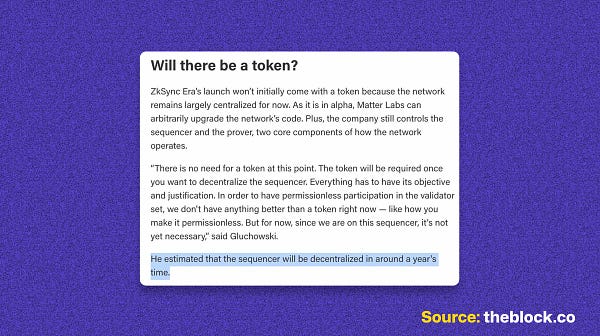

ZkSync Era: First zkEVM goes live in a major development for Ethereum.

L1 blockchain Zilliqa will bring EVM compatibility to the network on April 25.

Neutron aims to become the first Cosmos Hub consumer chain. The prop states to pay 25% tx fees + 25% MEV revenue to ATOM delegators + validators.

SUI team announced the upcoming launch of the SUI mainnet in Q2.

GMX proposes deployment on Coinbase's Base blockchain.

Noble, a purpose-built asset issuance platform on Cosmos, is coming out of stealth mode. Mainnet launch is on March 27.

Multichain NFT marketplace Magic Eden expands to Bitcoin, enabling users to trade Bitcoin NFTs without paying royalties.

Sony to introduce NFTs into PlayStation games.

TreasureDAO is set to receive 8M Arbitrum tokens, holding the joint-top spot alongside GMX.

Sidenotes:

Velodrome V2 “Night Ride” Beta is live.

LooksRare aggregator is live.

Plutus DAO introduced $plsARB, an Arbitrum derivative token, that allows holders to earn dual yield in both PLS and ARB.

Fuel Network’s "Beta-3" testnet is live.

SushiSwap had received a subpoena from the SEC.

Funding:

Pixelcraft Studios, the creators behind the popular metaverse game Aavegotchi, said Monday it raised $30M in a multiyear token sale.

Layer 1 blockchain network Radix reached a valuation of $400M in a new funding round.

Iceland-based CCP Games raised $40M led by a16z to build a new blockchain-based game set in the Eve Universe.

WinZO launches a $50M fourth fund to invest in the global gaming ecosystem.

Market Maker DWF Labs invest $20M in Synthetix.

Social platform OP3N raised $28M in a Series A funding round led by Animoca Brands.

BH Digital has raised $9M for its Nova Digital Opportunities fund. Nova Digital is overseen by portfolio manager Kevin Hu, who recently joined BH Digital from Dragonfly Capital.

Crypto Twitter: