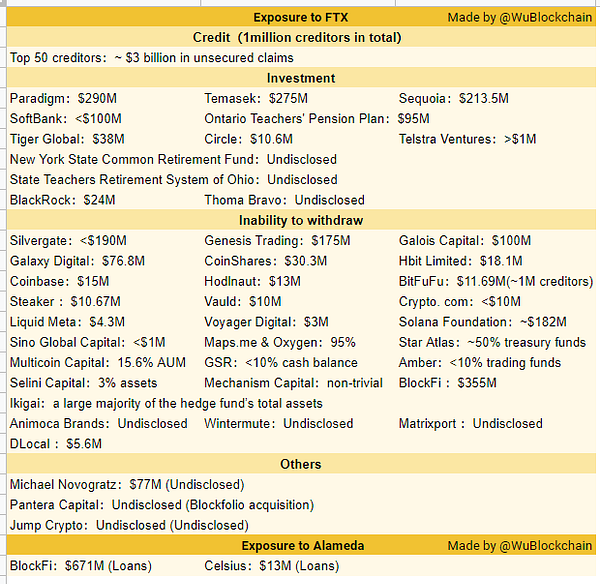

Outside of the delusional insanity of SBF, it was a quiet welcomed week in crypto. Crypto Twitter was taken over by AI, which was used to create tokenomics models or predict crypto's end. ETH & BTC have been in a five percent range as volatility and liquidity continue to dry up. This market structure will likely remain in place until lenders can re-establish themselves in the aftermath of DCG/Genesis, FTX, and BlockFi.

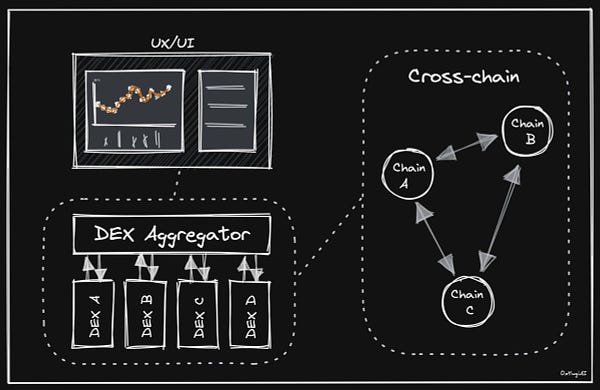

Unsurprisingly, DEX volumes for November doubled over the previous month with $110 billion. The third highest month of DEX volumes for 2022. If you take low asset prices into account, it's likely the best month this year.

Few would have predicted that stablecoins and NFT marketplaces would be the crown jewel of the cycle, but here we are. There are now a dozen plus NFT marketplaces, and CRV will soon join MKR, followed by AAVE GHO, in issuing native stablecoins while the DEX narrative is going strong, seeing increased volume and users of GMX, DYDX, JOE, UNI, GNS.

Macro: CPI data & FOMC 13th/14th, 50 or 75 bps hike, 50 with a likelihood of over 70%. Firmer tone across the board with China “reopening” stories continuing to build. Yes, the additional strict measures are being lifted in the major cities and manufacturing hubs, but the country remains in an overall zero-policy state for now. The U.S. labor market continues to be very strong. This seems in conflict with the many layoffs in the tech sector.

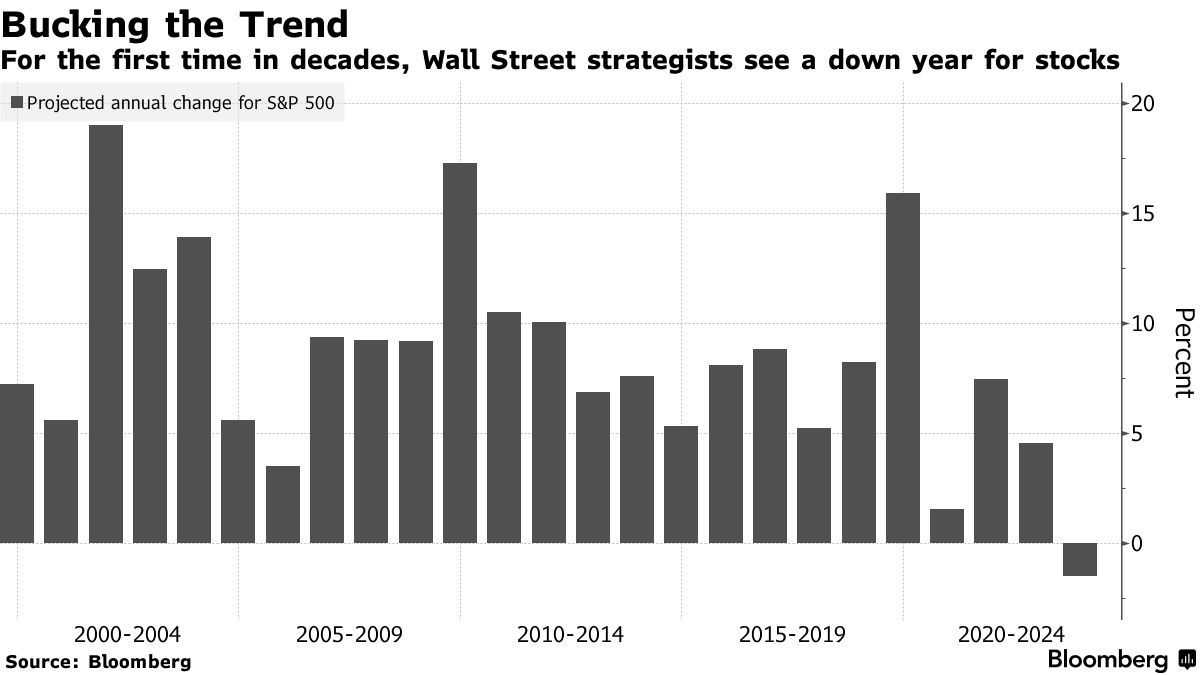

Interesting side notes: for the first time since 1999, the average forecast of the S&P 500 is negative. Typically the average forecast is around 10% in line with historical averages. So most strategists forecast the U.S. economy to go into recession in 2023. At the same time, many also expect an unambiguous drop in inflation, which would give the Federal Reserve the clearance to ease up on its hawkish monetary policy stance.

Crypto News:

Telegram has sold more than $50m in usernames via Fragment, a platform that secures name ownership on the blockchain.

Bitmex depositors may now self-verify their liabilities in the crypto exchange’s total liability balance sheet.

Stripe introduces a customizable and embeddable fiat-to-crypto onramp. It's important to note that Stripe is not the first to offer one of these widgets. Products like Moonpay and Ramp integrate with self-custodial wallets, allowing users to buy crypto directly with fiat.

Former FTX US president Brett Harrison is trying to raise money for a new crypto startup. Looking for $6m at a $60m valuation.

Bybit announced plans to reduce the workforce as part of an ongoing business reorganization.

Genesis owes its creditors at least $1.8bn, CoinDesk reported. That figure includes $900m owed to customers of Gemini’s Earn.

Glassnode releases new “Proof-of-Reserves”, which involves the verifiable disclosure of both reserves held (on-chain), and matched liabilities (both on, and off-chain).

Nexo will be phasing out its products and services in the United States due to a lack of regulatory clarity.

Regulated crypto bank SEBA Bank and digital asset financial services group HashKey have formed a strategic partnership focused on accelerating the institutional adoption of digital assets in Switzerland and Hong Kong.

DeFi landscape:

Indexing service The Graph will soon add support for the Polygon blockchain. It will allow Polygon developers to find the data they need to improve the efficiency of their dApps.

As a result of material misrepresentations regarding their financial position, Maple has severed all ties with the parent entity Orthogonal Trading. 8 defaulted loans totaling $36m, roughly 30% of active loans across the protocol.

Compound is set to vote to increase the supply cap for WETH supply to $194m in Ether on the v3 protocol. Apple claims that the gas fees required to send NFTs need to be paid through their In-App Purchase system so that they can collect 30% of the gas fee.

Ankr, a web3 infrastructure project on BNB Chain, has suffered a major exploit with an attacker minting and dumping millions worth of its wrapped BNB token, aBNBc. In total, the hacker made off with approximately $5m in profits.

Avalanche DEX Trader Joe is deploying on Arbitrum.

Uniswap is experimenting with a real-fee switch on.

1INCH large token unlocks is coming up on December 30. 14.813% of the total supply.

NFT & Metaverse:

Apple blocked Coinbase wallet's last app release until they disabled the feature of sending NFTs.

Blur’s second airdrop is arriving today. 10x bigger than Airdrop 1.

The first Web3 project Porsche has planned is a 7,500-piece NFT collection based on the classic Porsche 911. The NFTs are scheduled to be released in January 2023.

Coca-Cola teamed up with Crypto.com to release a collection of 10,000 FIFA World Cup NFTs.

Reddit introducing NFTS to a mainstrain audience is a success. More than 4.4 million have been minted since Reddit launched the collection earlier this year.

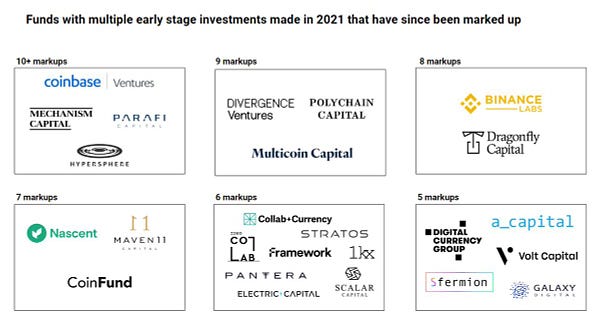

Funding Highlights:

Web3 developer platform Fleek has raised $25m in a Series A funding round led by Polychain Capital. Other investors in the round included Protocol Labs, Arweave, Coinbase Ventures, Digital Currency Group, North Island Ventures, Distributed Global, The LAO and Argonautic Ventures.

Daesung Private Equity, a Korean venture capital firm, has announced the launch of a metaverse fund of 110 billion won ($83.5m)

Cybersecurity startup Cyvers raised $8m in a seed round led by Elron Ventures.

Crypto hardware wallet maker Ngrave is aiming to raise $15m in Series A funding, according to a pitch deck obtained by The Block.

Crypto Twitter: