Crypto Alpha Recap

07.04.2023: LayerZero Labs raised 120M. MEV developments. Uniswap V3 forks live. Saylor buys more Bitcoin. zkSync Era surpassed $150M in TVL. Trader Joe will launch Liquidity Book V2.1.

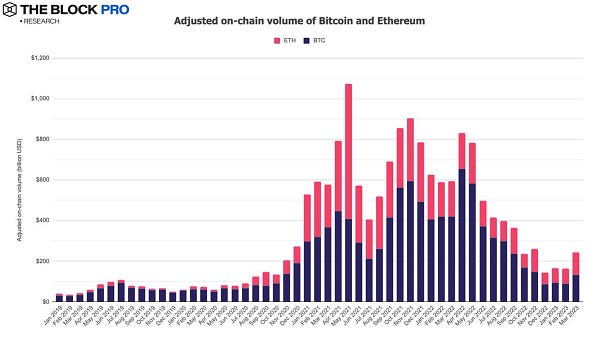

A relatively quiet week as ETH is holding up better than Bitcoin going into the upcoming Shanghai upgrade (which will enable staked ETH withdrawals); expect volatility.

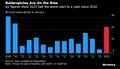

Macro: Signs of labor market cooling reduce the likelihood of aggressive hikes as US non-farm payroll employment rose 236k in March, below the expectation of 239k. The unemployment rate dropped from 3.6% to 3.5%, below the anticipated 3.6%. Average hourly earnings rose 0.3% mom, matched expectations. Time for a pivot? Corporate bankruptcies are further on the rise. They’re at their highest since the last financial crisis.

Meme of the Day:

General:

OPNX Exchange, the new venture by the bankrupt 3AC founders, has gone live and lets users trade claims of bankrupt crypto companies. Ironic, though, since Zhu Su was one of the main actors at the beginning of the contagion with his irresponsible GBTC trade and TerraLabs investment.

It’s no secret that Microstrategy is a stock for getting Bitcoin exposure. Microstrategy buys 1045 more Bitcoin. Total holdings are at $4.17B. Fidelity, Bank of America, Black Rock, and Vanguard increased their share positions.

Tokenized gold assets surpassed $1B in combined market capitalization as gold’s price neared its all-time high.

Binance market share drops 16%.

Bitcoin crosses 800M transactions in 2023 Q1.

Bakkt has completed its $155M acquisition of the integrated trading platform Apex Crypto.

The NFT market surged in February, topping $2B in total trading volume.

DeFi:

zkSync Era surpassed $150M in TVL two weeks after it launched.

Trader Joe will launch Liquidity Book V2.1 soon, featuring significantly higher capital efficiency, automated liquidity management, optimized gas fees, and limit orders.

Manifold is building a liquid staking platform with its omnichain token, called mevETH (additional yield through MEV opportunities). Manifold also acquired Cream Finance’s validator set, securing 25K in ETH.

A group of MEV bots lost over $25M in a sophisticated attack on ETH.

Aave eyes expansion to BNB Chain, Starknet and Polygon zkEVM.

More than 30 Ethereum projects have collaborated to launch MEV Blocker RPC, a tool designed to protect users from various MEV attacks.

PancakeSwap V3 launches on BNB/ETH following Uniswap license expiry.

The new generation of DEXs will be order book based. Base and MatterLabs looking to host a new generation of decentralized exchanges powered by the limit order books familiar to traditional exchanges.

NFTs:

Opensea launch a no-fee ‘Pro’ marketplace with NFT rewards in its battle against upstart rival Blur.

LooksRare V2 is now live, offering lower fees, cheaper gas, one-signature bulk listing, support for more NFTs, and seller payout in ETH.

Magic Eden is now live on ETH.

Arsenal FC has launched an NFT ticketing system for their football matches. Fans can purchase and trade NFT tickets that prove ownership for physical match tickets.

Sidenotes:

Euler funds were successfully recovered in full.

Dune launch Dune SQL.

Aevo is officially live on mainnet, an optimistic roll-up that runs on the OP Stack.

Coinbase Ventures joins liquid staking protocol Rocket Pool’s Oracle DAO.

Arbitrum put forth new proposals following the original pushback.

Funding:

LayerZero Labs has raised a $120M Series B round at a valuation of $3B, tripling its valuation from the $135M round in March 2022.

Re7 Capital and Republic Crypto launched a $100M fund for investing in liquid tokens on April 1.

Delphi Labs, the incubation arm of crypto research firm Delphi Digital, has raised $13.5M led by P2P, the creator of liquid staking provider Lido, with participation from noted investment firm Jump Crypto.

SwissBorg, the Swiss crypto startup, closed a Series A community funding round with $23M and 16,600 investors.

Polyhedra Network, a startup that provides web3 infrastructure backed by zero-knowledge (ZK) proofs, has raised $15M in a pre-Series A funding round led by Polychain Capital.

M^ZERO, a decentralized infrastructure layer for digital asset value transfer, has emerged from stealth mode with a bullish $22.5M seed round.

Blockchain data indexing platform Satsuma raised $5M in a seed round.

DeFi hub Nibiru Chain has closed an $8.5M seed funding round at a $100M valuation.

Modular blockchain Astria has raised $5.5M in seed funding to develop its shared sequencer network from 1kx, Delphi Ventures, and Figment Capital.

Crypto Twitter: