We are moving fast again. With the uncertainty around DCG somewhat resolved and the final default of BlockFi, the market is running out of forced sellers. Only hardcore people seem to remain, but nobody said a trench war would be fun.

Crypto exchange volumes have fallen to $659bn in November from $841bn in January of this year, according to The Block's data. Questioning the validity of crypto after the $10bn fraud of FTX and proclaiming its demise is becoming the status quo. The declaration of crypto's death as a consequence is nothing new. Bitcoin has already died 466 times. And while BTC correlation to stocks has never been higher than in 2022, I'm starting to believe we gonna see a decoupling coming Q1.

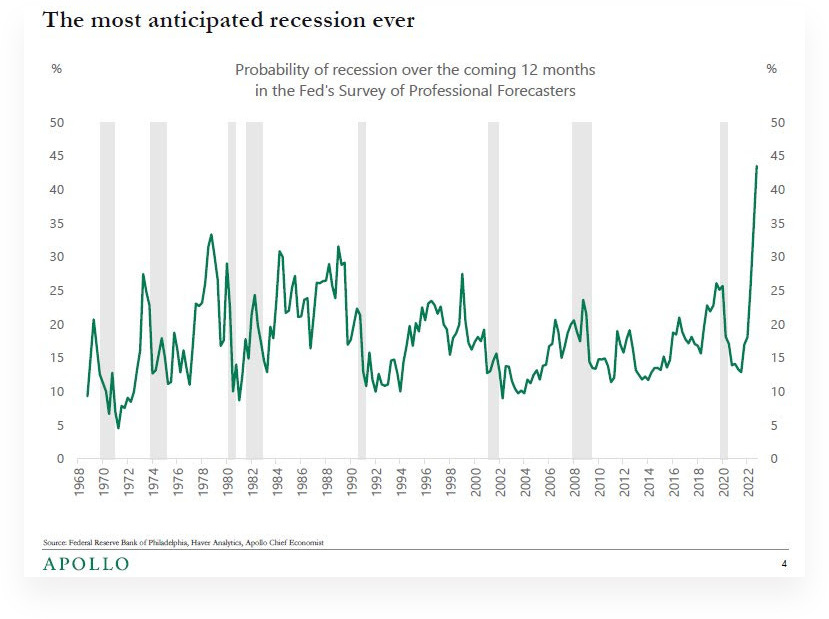

If you look at the macro, it's still ugly. The economy cooled off in recent weeks. It is challenging to say if the cooling is purely healthy or represents the start of a recession. The magnitude of the cooling will largely depend on FED's policy. Powell's speech yesterday wasn't much new. Still needs a restrictive approach and substantially more evidence of inflation falling. However, the 50bps is back up in the high 70s percentage-wise as the most likely outcome for the Dec FOMC.

Powell didn’t say anything new. However, the 2-year yield dropped slightly from 4.5% to 4.3%. Markets now expect:

Dec 2022 50 basis point hike to 4.25% to 4.5%

Feb 2023 50 basis point hike to 4.75% to 5.0%

The Fed is planning to slow the pace of increases, but it was clear that their focus is on how high to raise rates and how long to keep them there. There is eventually more pain to come. Technology companies have been bulletproof growth machines for the better part of the last decade with a “beat and raise” pretty much par for the course over earnings periods. Value for many of these companies has crowded around intangible assets. Things like goodwill and brand power mean paying up for future growth that seems to falter now. As for crypto, we are in one big accumulation zone. If you are pain resistant, it’s time to position and lay the foundation for the next cycle over the coming months.

GM! Sharing is caring. Be a chad and share this newsletter with your colleagues.

Special Nugget:

Another CeFi player is down:

The writing was on the wall. BlockFi is finally bust and filed for chapter 11, conducting major layoffs and claiming more than 100,000 creditors. The declaration shows that BlockFi had to sell the bottom to boost its cash position. It liquidated crypto for $257m. The fall from grace is rather spectacular after they raised $350m at a $3bn valuation in March of 2021.

The firm was already experiencing financial troubles this summer when it received an injection of $250m from none other than FTX. Given their relationship with FTX, it shouldn't have come as a surprise that BlockFi was forced to suspend withdrawals on November 10th in the fallout from FTX.

BlockFi has $355m in assets frozen on FTX and a $671m defaulted loan to Alameda. Collapsing to get bailed out to collapse again thanks to the company who bailed you out: Priceless. BlockFi will sue Sam Bankman-Fried over his Robinhood shares ($575m stake). The lawsuit came just hours after BlockFi filed for bankruptcy protection, having suffered “a severe liquidity crunch” triggered by the failure of FTX.

Another fun fact: they even own Gary $30m. Guess they never paid their fine after all.

Crypto News:

Binance led a $1bn Industry Recovery Initiative (IRI) to fund web3 developments. Third-party firms and ventures include Jump Crypto, Aptos Labs, Polygon Ventures, Animoca Brands, GSR, Kronos, and Brooker Group.

Kraken is reducing its global workforce by approximately 1,100 people (30%).

Fidelity officially opens retail crypto trading accounts.

Bybit is launching a $100m institution support fund for market makers and HFT institutions.

Huobi will form a "strategic partnership" with Poloniex a week after denying rumors that the two firms were planning to merge.

BitDAO ($1.7bn treasury) launches modular Ethereum Layer 2 network Mantle.

Amazon has ordered a miniseries (8 episodes) based on the collapse of crypto exchange FTX from the directors behind Marvel's "Avengers" franchise.

Fantom blockchain is cash-flow positive, earning more than $10m in annual revenue, excluding capital gains. Treasury holds >$100m in stablecoins, >$100m in crypto assets, and $50m in non-crypto assets.

Binance has entered Japan by acquiring the locally licensed exchange Sakura Exchange BitCoin (SEBC).

Mastercard filed another crypto/web3 trademark application covering: crypto transaction monitoring software, providing cryptocurrency info, risk assessment services.

DeFi landscape:

Proximity Labs announced a 10m fund for a decentralized order book solution on NEAR.

Chainlink is launching staking v0.1 on Dec. 6th. Stakers will be locking their funds til the planned launch of v0.2 (in 9-12 months), when the funds can be unlocked or migrated.

Polygon bridge holds $27m of unclaimed funds (users have swapped tokens back from Polygon to Ethereum — but only completed half of the withdrawal process.)

Aave pauses lending markets for 17 Ethereum-based tokens. After a massive short position on Aave’s CRV market resulted in a bad debt of $1.6m.

Solana-based DEX Serum stated it was now “defunct” due to FTX implosion and replaced by a community fork called OpenBook.

1inch introducing a new feature to prevent sandwich attacks. If 1inch detects that a transaction may be attacked in this way, it will send it directly to a validator.

The MakerDAO community rejected a proposal to use up to $500m of the stablecoin USDC to invest in bonds with crypto investment firm CoinShares.

Solana-based crypto wallet Phantom is expanding to Ethereum and Polygon and will now compete with the market leader, MetaMask.

Compound introduces caps on ten collateral assets to guard against the risk posed by tokens with low liquidity (WBTC, BAT, UNI, COMP, LINK, SUSHI, ZRX, AAVE, YFI, MKR).

NFT & Metaverse:

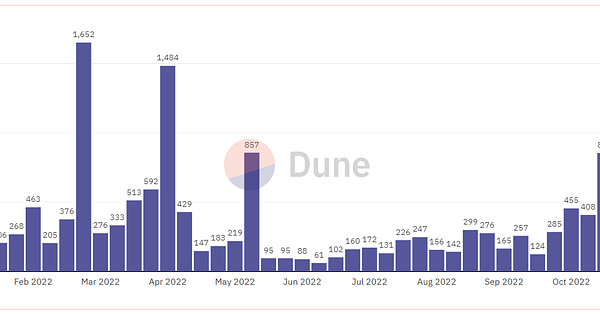

NFT creators collectively earned $1.1bn in royalities this year on Opensea.

Uniswap Labs (the biggest DEX) is officially launching NFTs. Enabling trading across major marketplaces as an aggregator (15% cheaper in gas fees). Starting with a $5m airdrop to past users of Genie.

nftperp.xyz Beta Mainnet is officially live. Starting pairs are BAYC/ETH & PUNKS/ETH.

Prada presents the new Timecapsule NFT Collection. Each drop is linked to both a limited edition physical product and a gifted NFT.

Web3 gaming DAO, Game7, has launched a $100m grant program to enable game developers to build the tools needed to make Web3 gaming better and more accessible.

OpenSea is integrating the BNB chain.

Funding Highlights:

Kiln, an Ethereum Staking-as-a-Service startup, raised $17.6m in a Series A funding round from Consensys, GSR Ventures, and Kraken's venture capital arm.

Web3 game publisher Fenix Games raised $150 million in funding to acquire, invest and distribute blockchain games.

Animoca Brands is planning a fund of up to $2bn to invest in metaverse companies.

Pearpop, a marketplace for social collaborations, raised $18m for its Series A, bringing its valuation to $300m. Includes funding from Ashton Kutcher, Guy Oseary’s Sound Ventures, and Alexis Ohanian’s Seven Seven Six. Blockchange Ventures, Avalanche’s Blizzard Fund and C2 Ventures.

Ripple leads $72m Series B round into crypto market maker Keyrock.

XanPool—a cross-border payments infrastructure provider—is accelerating expansion plans across Europe, the Middle East, North Africa, and Latin America after raising $41m.

Lyra, a protocol for options liquidity built on Ethereum, raises $3m strategic round led by Framework Ventures & GSR.

Crypto lending firm Matrixport is looking to raise $100m at a $1.5bn valuation. Matrixport has $5bn in trading volume every month and $10bn in AUM and custody.

Roboto Games, a new game studio aiming to bridge the Web2 experience and accessible Web3 in-game elements, has raised $15m in a Series A funding.

Crypto Twitter:

Cool Memes: