Crypto Alpha Recap

15.05.2023: Jane Street & Jump pull back crypto trading. Cosmos blockchain Neutron goes live on mainnet. Binance leaves Canada. crvUSD redeployment done.

The recent CPI numbers came in lower than anticipated, bolstering the broader markets. The reported number was 4.9%, slightly below the expected 5.0% and significantly lower than the 9.1% recorded just a year ago. In April, the CPI, excluding food and energy, showed a slight easing to 5.5% year-on-year from 5.6% in March, aligning with expectations. The rental market continues to experience a slowdown, and core service prices, excluding housing, are also decelerating. The tightening labor market and the Federal Funds Rate above inflation indicate the potential for higher Treasury yields and inflation expectations.

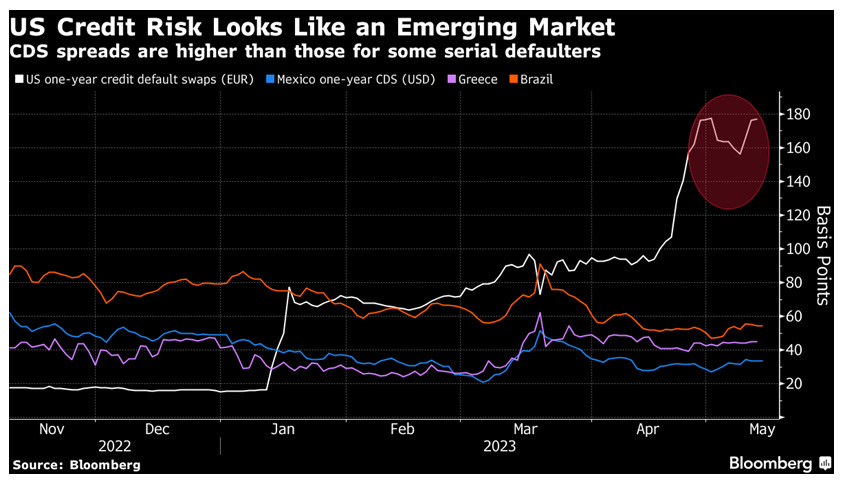

This marks the ninth consecutive monthly decrease in a row - and to think it only cost us a couple of bank blowups. US consumer sentiment tumbled to its lowest in 6 months in May, driven by concerns over the debt ceiling and its potential to trigger a recession. Long-term inflation expectations also rose to the highest level since 2011, with consumers expecting 3.2% inflation in 5 years.

Meme of the Day:

General:

Coinbase considers the UAE as a potential international hub.

Coinbase co-founder Fred Ehrsam, through Paradigm, buys $50M COIN stock for the first time in about a year,

Binance is withdrawing from the Canadian marketplace.

Jane Street & Jump pull back crypto trading over US regulatory uncertainty.

PayPal discloses nearly $1B of crypto assets on balance sheet.

Fund managers are still lured to crypto 'because of the returns.'

Liechtenstein's government plans to accept Bitcoin for payments.

Circle backs USDC with shorter US Treasurys, worries US Government will default

Jaredfromsubway. eth's MEV bot rakes in millions of dollars in three months.

Tether's Q1 2023 assurance report shows a reserve surplus of $2.44B at ATH, up $1.48B.

Galaxy Digital is moving operations offshore, citing US regulatory headache, and posts $134M first-quarter profit on a solid showing for the crypto market.

DCG releases a new statement on Genesis mediation and looks to refinance outstanding Genesis obligations.

DeFi & NFTs:

SushiSwap launched concentrated liquidity pools on 13 networks, with more coming soon.

Cosmos blockchain Neutron goes live on mainnet with replicated security (it allows chains to leverage the security of the Cosmos Hub).

ETH staking deposits top withdrawals for the first time since Shapella upgrade.

Uniswap trading volume outpaces Coinbase for 4th consecutive month.

MakerDAO founder proposes a plan for upgraded versions of DAI and governance token.

Aave DAO passes the proposal to deploy on Layer 2 Metis Network.

Major update coming for X2Y2.

Blur introduces two new vital changes: Bidders must cancel their bids first before accepting lower bids, and they introduce phase 1 of filters for bid spoofers. Blur users open $95M loans backed by NFTs in 10 days.

Sidenotes:

crvUSD redeployment done.

Wormhole announces the incorporation of Bitcoin.

Arbitrum DAO accumulates 3352 ETH in revenue.

DEUS Finance loses $6M following stablecoin hack.

BitDAO - Optimization of brand, token, and tokenomics.

zkLend is live on Starknet.

Funding:

Fedi has raised $17M in a Series A round.

Limewire raised over $16M for revival.

Blockworks raised $12M at a $135M valuation.

Pudgy Penguins raised $9M to create an IP brand.

Decentralized wallet developer Odsy Network raised $7.5M at a $250M valuation.