Crytpo Alpha Recap

24.01.2023: Genesis filed for Chapter 11. Flashbots is targeting unicorn status. Aave V3 coming. Sequoia Capital announced its fifth seed fund.

Last week ended with a bang as we saw an incredible rally on Friday into the weekend. The liquid staking narrative pushed x2-x3 in various projects while projects like APTOS (seriously, nobody knows why despite a squeeze) hit ATHs and went into price discovery. Bitcoin is at $23K and ETH at $1,6K, up 40% and 38% since the beginning of the new year.

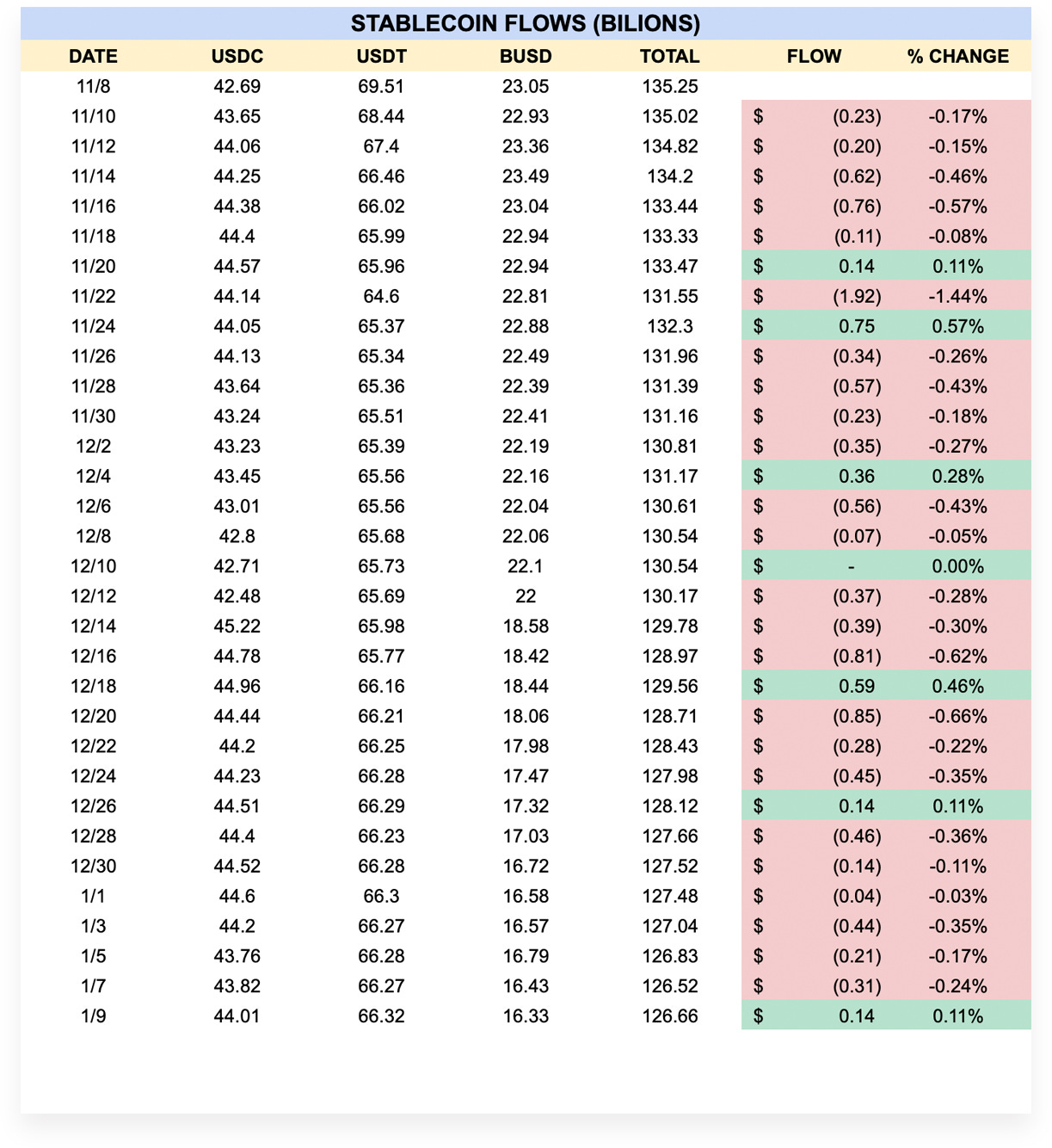

We are at an exciting point. Everything looks bullish, which means sidelined money feels the FOMO from being stuck. Late longers are often punished for entering longs at a bad price, causing a mini-liquidation cascade. Those are the dips I’m waiting for. Retail is not yet back. It’s still the same PVP game, as no new money flows in. You play against experts and degenerates.

I know it sounds silly, but the Genesis bankruptcy filing was priced in. Seeing the last CeFi domino fall didn’t hinder the market from going degen-mode. The lending arm of trading firm Genesis filed for Chapter 11 bankruptcy protection late Thursday. The filing included a list of its top 50 unsecured claims, totaling more than $3.6B. Most of the claims come from individual creditors. As the public spat continues, Gemini (Winkelvoss’s baby) tops the list with $766M. Genesis creditors back Winklevoss promissory note claim as possible bankruptcy looms and insist they were misled about the financial health of Genesis.

GM! Sharing is caring. Be a chad and share this newsletter with your colleagues.

Meme of the Day:

General:

Bain and Paradigm bet on ZKPs. They co-led the $15M seed round ($55M valuation) into Ulvetanna with participation from Jump Crypto.

Decentralized exchange aggregator 1inch Network has developed a hardware wallet.

Circle's Cross-Chain Transfer Protocol (CCTP) is getting closer to launch.

Flashbots, the Ethereum infrastructure startup, is looking to score a unicorn valuation and seeking up to $50M and is running a reverse pitching process. Paradigm is leading the round.

OKX published its third monthly Proof-of-Reserves report showing $7.2B held in "clean" assets like BTC, ETH, and USDT, none of including its native token.

National Australia Bank (NAB) is launching a fully backed stablecoin called AUDN on ETH/Aglorand.

FTX's new CEO, John Ray III, floated the notion that the crypto exchange could be restarted.

Crypto infrastructure firm MoonPay acquired web3 creative agency Nightshift for an undisclosed amount.

Founders Fund, the venture capital firm co-founded by billionaire Peter Thiel, closed almost all of its eight-year position in crypto shortly before the market began to crash last year, generating about $1.8B in returns.

DeFi & NFTs

Fantom has released a decentralized funding system to finance new projects, dubbed the "ecosystem vault." The vault will get 10% of all transaction fees paid on the network, which will be granted to projects.

Decentralized exchange (DEX) Osmosis will conduct its v14.0.0 upgrade, termed "Neon," in line with a broader plan to expand product integrations and make cross-chain trading more lucrative for traders.

MakerDAO's community voted for keeping Gemini USD (GUSD) stablecoin as part of the protocol's reserve system for DAI.

Cross-chain bridge protocol Stargate integration with Metis marks its first blockchain expansion beyond the LayerZero ecosystem.

Ethereum scaling platform zkSync is partnering with Espresso Systems, a crypto infrastructure company, to enable private transactions on its network.

Trader Joe DEX plans to expand to Arbitrum / BNB chain to bolster the utility of its native governance token.

Paxos wants to increase USDP stablecoin volume on MakerDAO.

A governance proposal for ENS DAO, proposed liquidating 10K ETH to cover operating costs over the next two years. The DAO's treasury currently holds 40,7K ETH and 2.46M in USDC.

Yuga Labs has blacklisted addresses related to Blur, SudoSwap, LookRare, and NFTX that don't mandate NFT royalties in Bored Ape's Sewer Pass mint.

Rarible is expanding its white-label marketplace-building tool for Polygon-based collections.

Sidenotes:

Aave V3.0.1 deployed across all testnets.

Rage Trade is integrating Stargate Finance.

Harpie launches on-chain 2FA.

BLUR postponed its token release date to 14th February.

Permit2 has gone live on Uniswap, enabling gasless token approvals.

Funding:

Sequoia Capital announced its fifth $195M seed fund dedicated to early bets across the U.S. and Europe.

SSV DAO, the DAO behind the decentralized staking protocol SSV.network, is starting a $50M ecosystem fund to help mature Distributed Validator Technology (DVT) infrastructure.

ZK tech developer Nil Foundation raised $22M at a $220M valuation led by Polychain Capital.

Multichain web3 wallet Cypher raised $4.3M.

Obligate, a startup offering blockchain-based regulated debt securities, announced a $4M seed extension round led by Circle Ventures.

Web3 credential protocol Gateway raises $4.2M.

Blue, which offers know-your-customer (KYC) and anti-money-laundering (AML) identity verification products for traders on decentralized finance (DeFi) protocols, has come out of stealth with $3.2M in funding.

Crypto Twitter: