Crytpo Alpha Recap

13.02.2023: Su Zhu unveils new OPNX exchange. Tether reports $700M Q4 Profit. Sushiswap aquires Vortex. Aave's GHO stablecoin goes live on testnet.

The SEC continues its warpath as BUSD stablecoin ($16B market cap of $132B total stablecoin mc) issuer Paxos was threatened by a lawsuit and immediately stopped its issuance. As a result, BUSD market cap will only decrease over time. Interesting fact: SEC is not going after USDP (Paxos dollar), so they would instead target Binance than Paxos in general. Meanwhile, Tether nears 50% of stablecoin market, it’s highest share in 14 months.

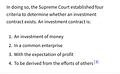

Crypto has adopted USD as a stablecoin of choice, organically and without any pressure. It begs the question of how a stablecoin can be considered a security when it cleary doesn’t meet the Howey test criteria. America is truly their own enemy.

BUSD is a NY-regulated stablecoin, so there is a bad feeling the SEC could go after USDC ($40.8B) next. This also would have a knock-on effect on DAI, which has substantial USDC backing. At this point, those are just rumors, but markets are in derisk mode, especially as CPI is looming around for Tuesday. It’s an action-packed week of economic data dump with hourly earnings, manufacturing data, housing stats, initial jobless claims, PPI, and more. CPI inflation figures are due out at 8:30 a.m. on Tuesday. Est. MoM 0.4%; Core 0.4%. Est. YoY 6.2%; Core 5.5%.

GM! Sharing is caring. Be a chad and share this newsletter with your colleagues.

Meme of the Day:

General:

Su Zhu unveils new OPNX exchange for trading trapped crypto funds. A waitlist is now open for trading claims and derivatives related to funds stuck on failed exchanges.

The founder of ChatGPT developer OpenAI is on a funding roll as of late. OpenAI's Sam Altman is looking to raise $120M at a $3B valuation for his crypto project Worldcoin.

Tether reports a $700M Q4 net profit in the latest attestation report.

Genesis unveils proposed sale plan with DCG and bankruptcy creditors.

Binance has added a zk-SNARK system to its proof-of-reserves (PoR), enabling users to verify assets held on the crypto exchange are backed 1:1.

DeFi & NFTs:

Aave's GHO stablecoin goes live on Ethereum's Goerli testnet.

The value locked in Rocketpool has doubled to $1B in the last two months.

Uniswap DAO completed the vote for the proposed BNB deployment; it passed amid intense debate among delegates about crypto-bridging solutions.

MakerDAO community proposed creating a liquidity market called Spark Protocol, a fork of Aave's v3, for lending and borrowing crypto assets focused on DAI.

SushiSwap acquired Cosmos-based derivatives DEX Vortex and will roll out a rebranded perpetual dex on Sei Network around Q2.

Bitcoin Punks are the first byte-perfect uploads of the original Ethereum CryptoPunks onto the Bitcoin Blockchain using Ordinals.

Web3 payments firm MoonPay partnering with NFT marketplace LooksRare.

Sidenotes:

Lending protocol Silo is live on Arbitrum.

Camelot announced a partnership with Lyra.

Optimism distributed its second airdrop, 11.7M tokens, to 300k addresses.

Launching Sushi Studios - a decentralized brand licensing & incubator framework.

Liquidity Protocol live on Aztec.

MakerDAO integrates Chainlink oracle to help maintain DAI stability.

Funding:

Digital assets protection firm Coincover has raised $30M in a round led by Foundation Capital. The UK-based startup raised a $9.2M Series A in July 2021.

Venture capital firms Bitkraft and Fabric Ventures led a $6.5M round into the web3 customer loyalty program Cub3.

Caldera, a web3 infrastructure platform, raised $9M to help developers create app-specific layer-2 blockchains led by Sequoia and Dragonfly Capital.

Crypto Twitter: