Osmosis Report

An overlook of the leading interchain DEX, its current developments, and a potential revamp of the tokenomics to benefit holders.

Disclosure: The author holds OSMO and is not sponsored or affiliated with the project or any of its members. This content is for informational purposes only, and you should not make decisions solely on it. This is not financial advice.

Key Highlights:

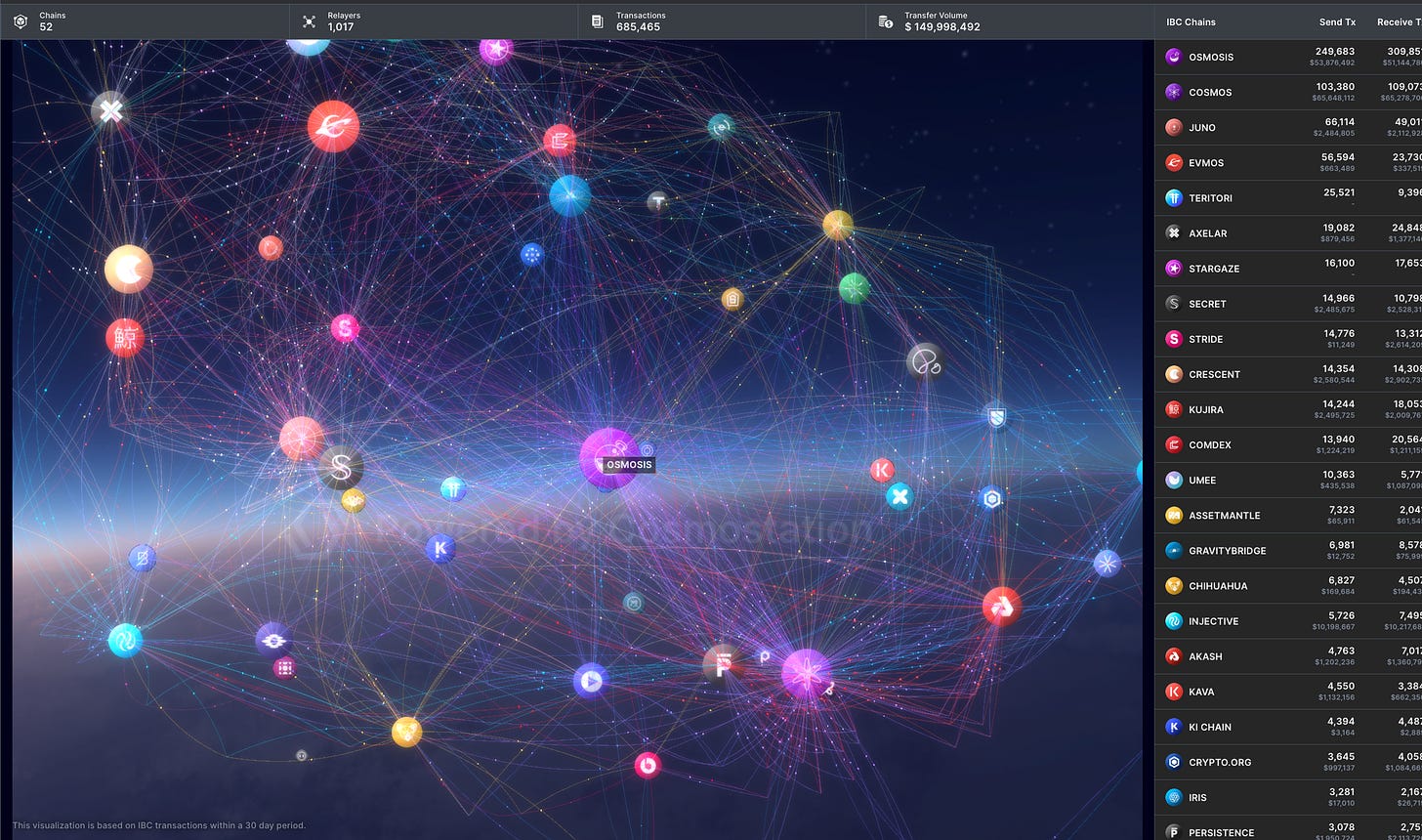

Osmosis is an AMM and the leading interchain DEX, boosting the highest numbers in TVL and IBC transfer volumes.

Inflationary tokenomics and no value accrual for holders define it as a farming token. However, Osmosis is not only DEX but also a sovereign blockchain, having over 60 projects built on top.

As the protocol matures, it's currently transitioning to a Concentrated Liquidity (CL) model and discussing a potential tokenomics revamp. The focus is shifting to target traders as their primary customers since LP bootstrapping was successful.

The rollout of key features like CL will give traders more control, increase efficiency, and reduce the level of incentives needed providing more value capture for stakers and holders.

Liquidity in Cosmos is fragmented; as a result, Osmosis introduced Liquidity Outposts. It's leveraging liquidity to any IBC-enabled chain with a CosmWasm implementation, manifesting the defacto hub status for aggregated liquidity.

What is Osmosis?

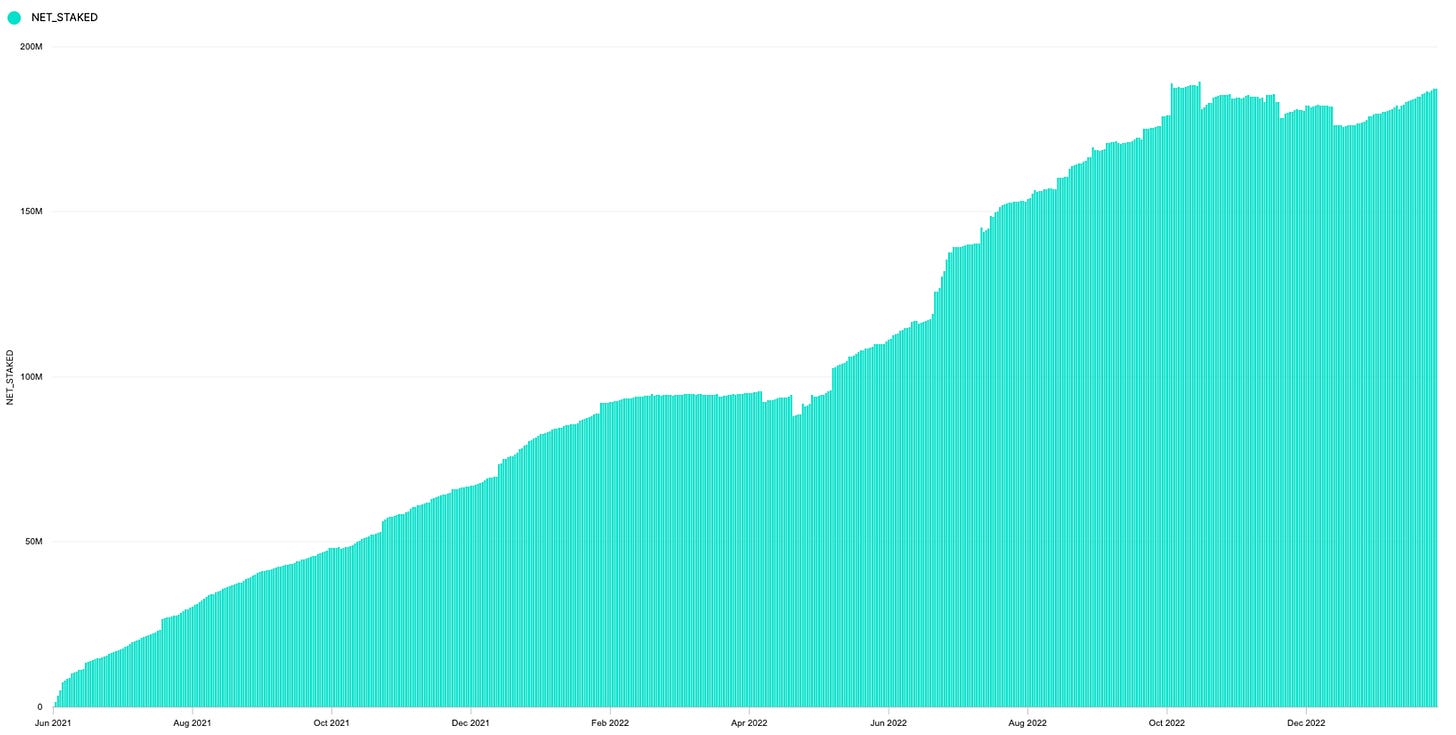

Osmosis is an advanced automated market maker (AMM) protocol created using the Cosmos SDK. It's the largest interchain DEX built on its own sovereign L1 blockchain and serves simultaneously as a blockchain and an application. It launched on Jun. 19th, 2021, with 50% of its genesis drop going to Atom stakers.

It was the first app-chain to see significant IBC transfer volume and kickstarted DEX activity in the ecosystem. The application operates similarly to other AMM like Uniswap or Balancer. It's powered by the native OSMO token, which can be used for staking and governance. OSMO rewards are also issued via liquidity incentives for LPs.

While there is currently no value accrual to Osmo holders (highly inflated issuance on top), this report looks at whether Osmo is more than a DEX/farming token and what it means in the multichain paradigm in the future. Osmosis can be analyzed as an independent L1 network and a separate DeFi protocol. With over 60 projects building on top, exciting developments are happening. And with a potential revamp of tokenomics, Osmosis could play an integral part in the IBC narrative.

Background

Osmosis was founded in January 2021 by highly respected Cosmos OG Sunny Aggarwal, Josh Lee, and Dev Oja, with parent company Osmos Labs responsible for code development. All three began at Tendermint, working on the underlying architecture of the Cosmos ecosystem, and eventually found back together. Sunny is the most outspoken person (he showed up on stage at Cosmoverse wearing medieval chainmail armor for the sole purpose of making a pun about mesh security) and co-founder of Sikka, currently the 11th largest validator on the Cosmos Hub. And he is also an advisor for Kava. Much of the inspiration behind Osmosis came from an Ethereum-based DEX, Balancer, and its ability to offer multi-asset liquidity pools. The protocol emphasizes UI/UX from the start being aware of the importance of building easy-to-use products for mass adoption. The branding is a standout and would make every BSC fork proud.

Quick Overview

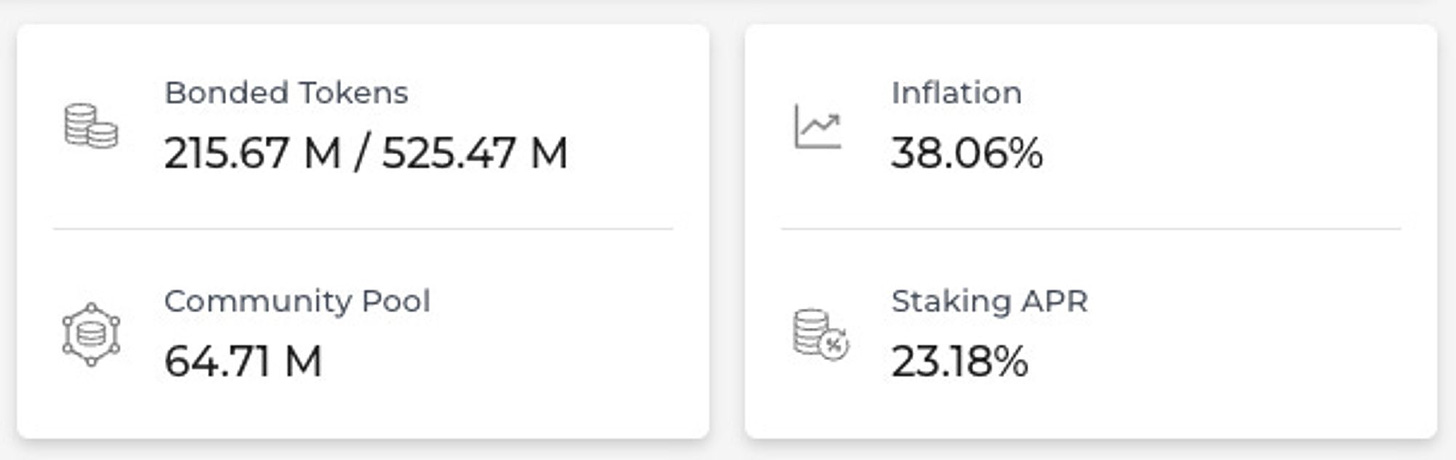

Data per Feb. 5th 2023

Validators: 150, Nakamoto Coefficient: 8

P: $1.02 / ATH: $11.25 / ATL: $0.67

TVL: $197M / MC: $556M / FDV: $1.07B / MC/TVL: 2.74 FDV/TVL: 5.18

Community Pool: $65M / Project Treasury: $110M

Daily active wallets: 24.36K / Daily TX: 150K

Funding: $21M via a token sale

Lead-investor: Paradigm, co-investor: Robot Ventures, Nascent, Etheral Ventures, Figment, Bossanova, Do Kwon.

In June 2022, an upgrade with a bug led to an exploit within LPs. The chain was emergency halted within minutes and resulted in a total loss of $5M, eventually compensated via treasury. As a result, IBC rate limits (sets min/max net percentage change in the quantity of an asset by governance) were introduced. There is no audit to date, although CertiK audit has been ongoing for several months.

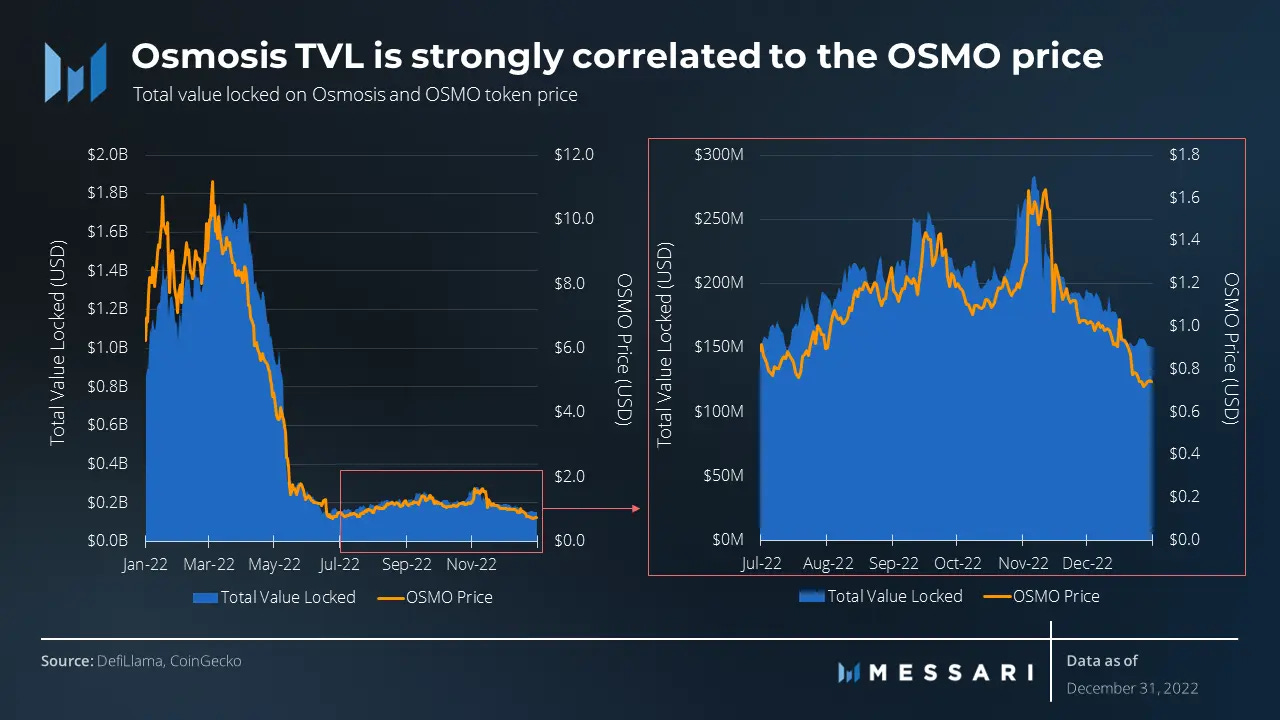

It's important to note that the annihilation of the TVL is highly correlated with the implosion of Terra since UST was the only notable stablecoin back then. It never recovered as bridged assets via Axelar are currently the only viable option. However, Circle will launch native USDC in Q1, issued on a new chain called Noble.

How does Osmosis work?

Osmosis has optimized its design to be a sandbox for automated market AMMs and allows developers to build customized AMMs with sovereign liquidity pools. The application operates similarly to other AMM functioning DEXs — liquidity providers (LPs) are responsible for supplying liquidity to asset pools for traders. It relies on a deterministic pricing model to ensure the respective weights of tokens in each pool remain consistent. The team prioritizes offering asset pool customization, allowing changes to market-maker functions, swap costs, token weighting, and more within the DEX. Through the customizability offered by Osmosis, such as custom-curve AMMs, dynamic adjustments of swap fees, multi-token liquidity pools - the AMM can offer decentralized formation of token fundraisers, interchain staking, options market, and more for the Cosmos ecosystem. Osmosis attempts to align the interests of multiple stakeholders, such as LPs, DAO members, and delegators. One mechanism is how staked liquidity providers have sovereign ownership over their pools and, through the pool governance process, allow them to adjust the parameters depending on the pool's competition and market conditions.

Earlier in December, Osmosis launched a new stablecoin trading exchange called stableswap. It's leveraging a "curve algorithm" that concentrates tokens in asset pools so traders can exchange large amounts of stablecoins with minimal price impact or fluctuations in value. With the increasing expansion of Cosmos, stableswap pools will get a great deal of use, especially as the ecosystem further matures.

Accessibility and onboarding of the ecosystem

Besides app.osmosis.zone, there is a second permissionless version called frontier.osmosis.zone more experimentally. There are 52 zones in the IBC universe, and Osmosis is connected to 50. Doing a monthly volume of $279M while Cosmos as a hub only has $171M and third place Axelar $69M. Axelar is also the official canonical bridge partner, enabling wrapped assets from the Ethereum ecosystem.

However, Cosmos needs to be better with its limited options for onboarding users from other ecosystems. So most choose to onboard via CEX and withdraw via Osmosis to evade high fees. The team also integrated Moonpay, allowing fiat on ramping via credit card, but the fees make even ETH bridging look cheap. So Osmosis, as IBC in general, remains somewhat isolated in terms of liquidity. But inside the ecosystem, the experience is flawless. Moving between chains with a simple deposit withdraw-click on Osmosis can't be done any better. As for the wallets, the standard is Keplr. It's what Metamask is supposed to be and has a powerful dashboard for various activities (governance, staking rewards).

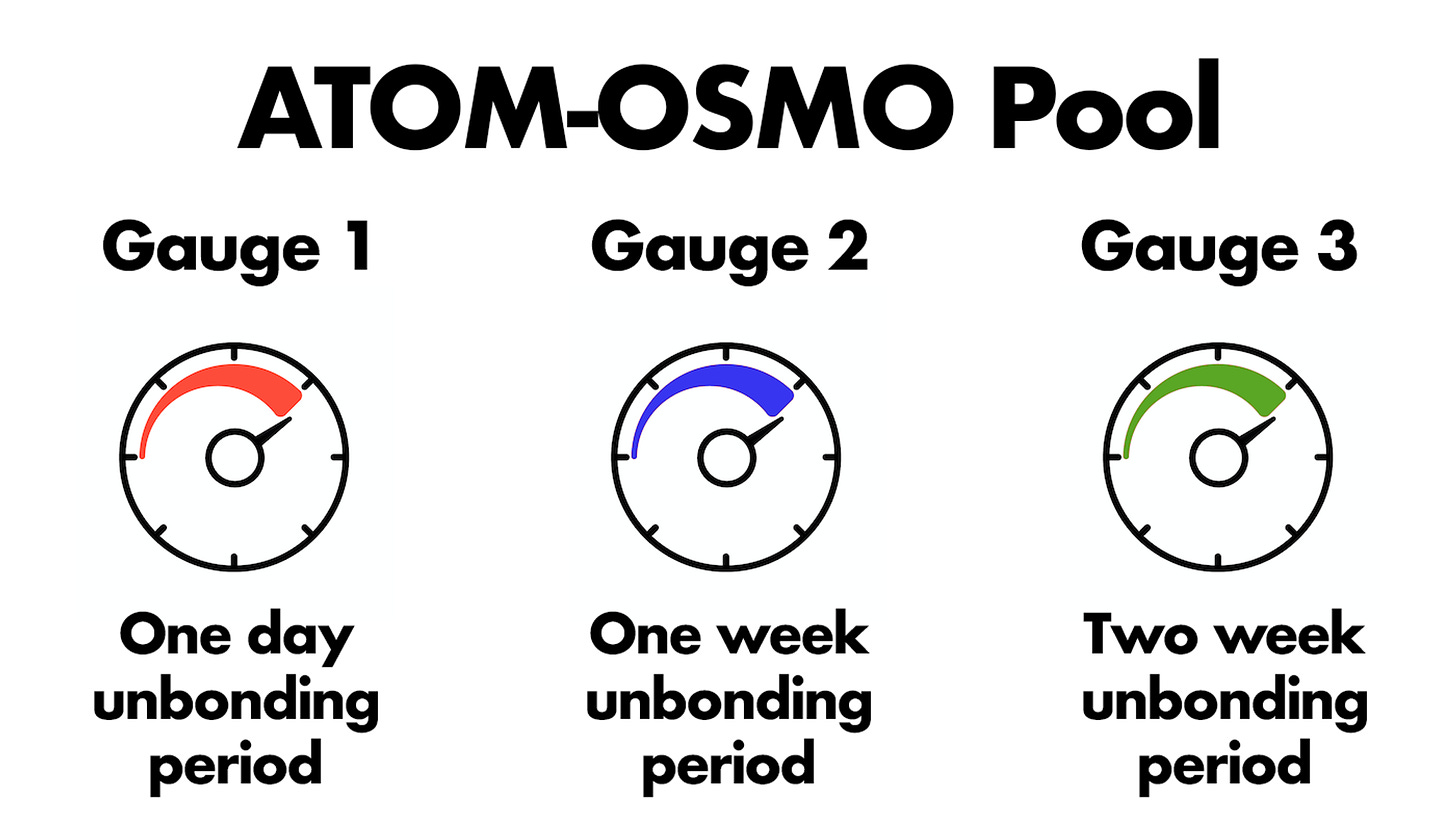

Liquidity incentives and fees

Unlike most Cosmos SDK chains, where tokens are distributed per block, Osmosis has daily epochs and releases new tokens at the end of each epoch without any vesting. To ensure abundant liquidity, the DEX institutes incentives and exit fees. LPs can choose the period (1 day, 7, 14) for which they willingly want to bond their tokens. A bonded LP position can be eligible for multiple gauges, as 14 days are often topped with external incentives. Protocol governance (by stakers) plays a critical part as OSMO rewards are decided by holders. If bonded liquidity gauges are the carrot for long-term liquidity, exit fees are the stick. When LPs withdraw capital from liquidity pools, a small fee is charged as an LP token. Osmosis provides in total three sources of revenue: transaction fees, swap fees, and exit fees, in addition to liquidity mining. Neat: you earn rewards even during the unbonding time, and for ease of use, there is also a single asset with an auto swap function.

Is OSMO just a farm & dump token?

There are intensive discussions to revamp the incentives model and the tokenomics (see detail under token economy) as there are rising voices regarding the net negative yield. Currently, the flow of LPs is selling rewards and re-compound in LPS, effectively creating pressure on the token as both actions require selling the token. Inflation over 38% can't be compensated through staking or LPs, forcing existing holders to a disadvantage.

Superfluid Staking

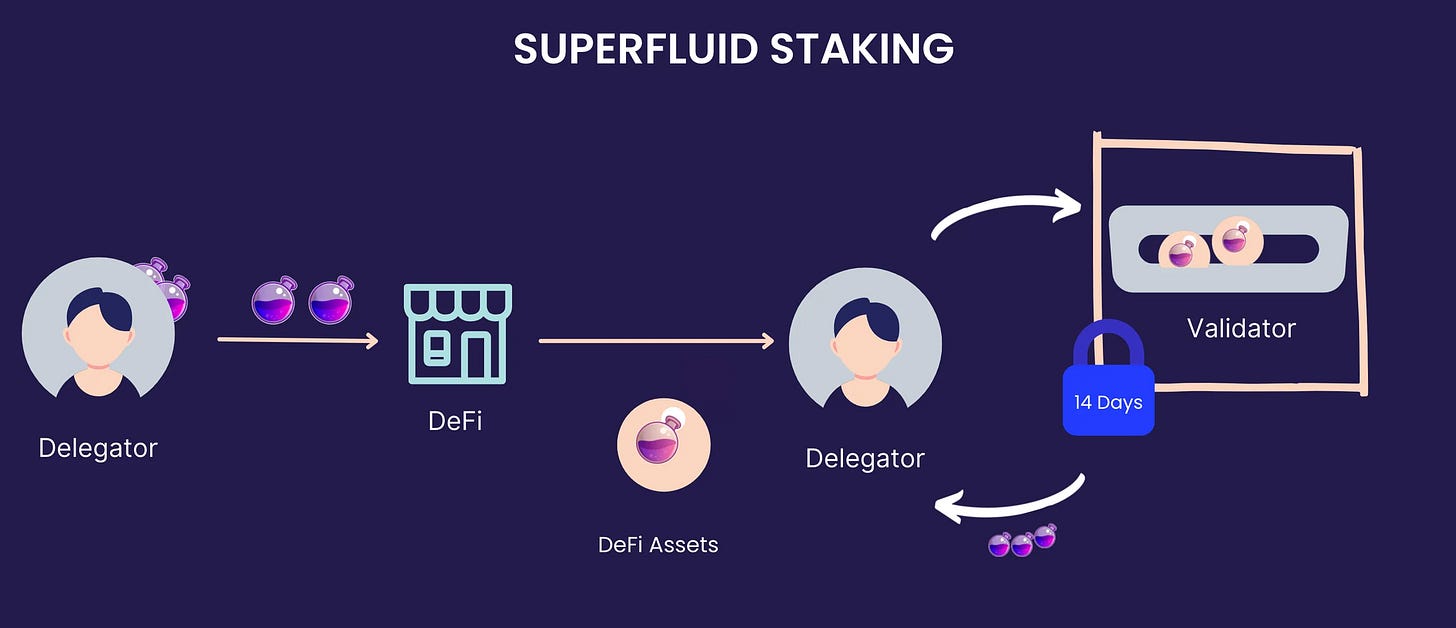

Multichain ecosystems (compared to a rollup-centric ecosystem like ETH) face the challenge of bootstrapping their own security. The solution: superfluid staking. This method allows LPs to provide liquidity with their native OSMO tokens while simultaneously using them to bring security to the underlying network. It's considered one of the most significant advancements in proof-of-stake since liquid staking.

Superfluid staking takes bonded liquidity from an asset and stakes it to the network. The fact the asset is already bonded to local liquidity pools only helps simplify the network's balance between security and economic liquidity. It allows LPs to double their rewards through yields generated from trading fees and staking rewards for securing the network. On the back of superfluid staking, the Osmosis team is also working on Interfluid Staking, allowing users in the ATOM/OSMO pool to stake 50% of the underlying ATOM in their LP position.

Current key developments

The team is known for relentless shipping as significant changes are happening. With the latest v14 upgrade, IBC hooks for cross-chain swaps were integrated. They also added geometric TWAPs like Uniswap v3, making it more resistant to manipulation and volatility. While the introduction of Liquidity Outposts (LO) is the most exciting change. But it doesn't stop here. As the DEX is now 1.5 years into incentivizing early adaptors, it's time to change with the introduction of Concentrated Liquidity (CL). The rollout of key features will give traders more control, increase efficiency, and reduce the level of incentives needed.

Liquidity Outposts - a game changer?

The Cosmos ecosystem needs to catch up to the likes of Ethereum when it comes to attracting liquidity. But does every L1 need to have its own DEX? Liquidity is fragmented, as several projects like Juno compete in the space. Osmosis is introducing Outposts, leveraging liquidity to any IBC-enabled chain with a CosmWasm implementation. A way for a smart contract to be deployed on an external chain as users can access the same convenient interface and gain access to Osmosis liquidity without leaving the external chain. This leads to liquidity aggregating in one place as trades are performed via the same trading route. It's a simple solution to bootstrap liquidity, with Mars Protocol being the first project. With Levana Protocol to be rumored the second with a new perpetual DEX. General volume still remains relatively low compared to the mania pre-Terra failing.

Concentrated liquidity is coming

With the introduction of CL (final testing underway), Osmosis no longer needs deep liquidity pools, as the same slippage can be achieved by 1/10th of the liquidity. CL is a combination of an AMM and an order book DEX. This new model entails some changes as LP for retail will become more complex, but on the other hand, earnings for swap fees will increase. It makes it more capital-efficient, but LPs are exposed to a higher impermanent loss risk as sophisticated market makers (MM) will come in and provide the lion-share of liquidity to most pools. According to Sunny, Lps' are more of a service provider and not the primary customers but rather traders (hence the initial focus on UI/UX). Secondary to that is providing the most value capture for stakers and holders. Which ultimately means bringing in sophisticated market makers and reducing rewards to tame inflation. A new era for Osmosis. With lower slippage and better prices for traders.

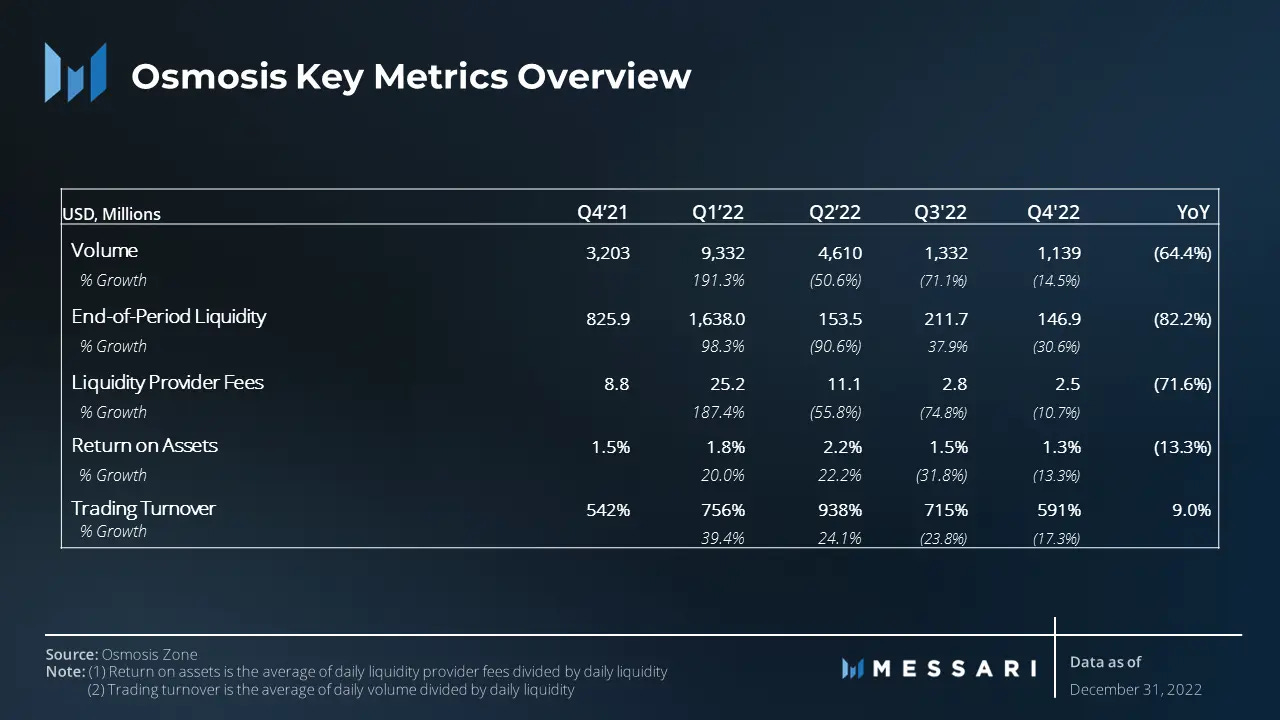

Growth numbers

Osmosis used to have dashboards but removed some functionality in their analytics. There is not much data around as most are outdated and/or not really accessible to the public. Current generated fees daily on a 7-day average is roughly $32k, which is still higher than the likes of MakerDao, Optimism, or Avalanche.

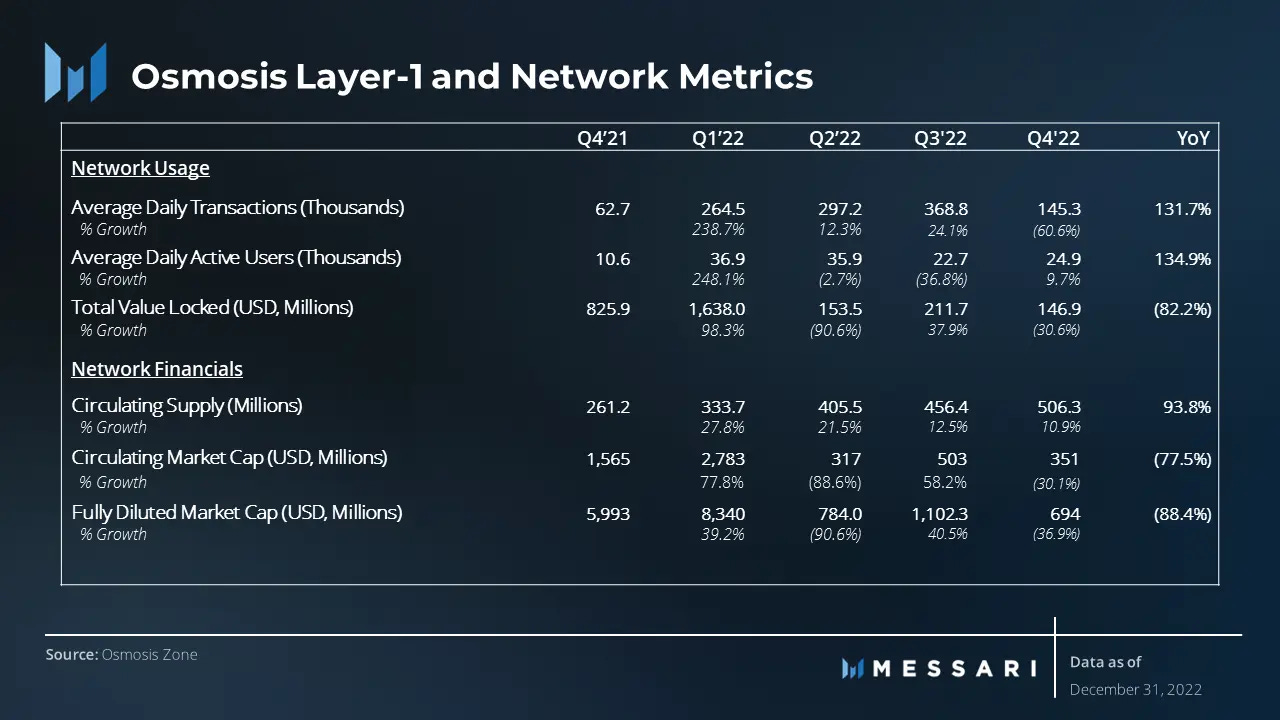

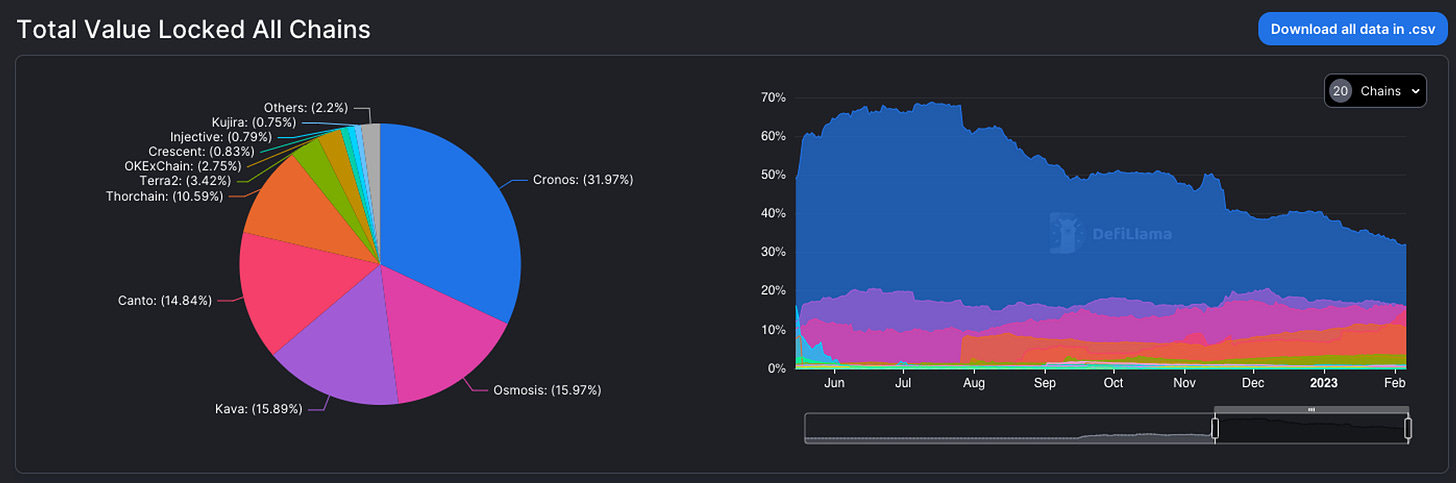

In terms of TVL, the chain ranks 12th across all protocols with $197M ($16M in stablecoins) soon in reach of Solana ($267M). However, TVL is a flawed metric since it simply depends on a price of an underlying asset.

It also has the second-highest TVL in the Cosmos ecosystem, only beaten by Cronos - the chain of centralized DEX crypto.com.

The project is well funded, with 25% of the daily emissions going to a developer pool. The actual payroll and cost structure of Omsosis is private, as no data is published. However, with the funding ($21M) and daily rewards, the protocol has a big purse and a runaway for multiple years. Active developers see a strong uptrend after the Terra implosion back in May, and also active users seem to reverse, with a slight uptick since mid-January.

Token Economy

Osmosis has a total supply of 1B tokens and launched with an initial supply of 100M. 50M tokens were airdropped to Atom stakers, and the other half went to a strategic reserve controlled by a multi-sig DAO. The amount of OSMO that each address received is proportional to the square root of its ATOM balance at that time, with a special 2.5x multiplier for staked ATOMs. Over 62% of the supply is currently staked.

It has a "thirdening" schedule where token issuance is decreased by one-third yearly. This process will continue until OSMO reaches its maximum supply of one billion (Y1: 300M, Y2: 200M, Y3: 133M, etc.). Similar to Bitcoin's halving (cut by half every 4 years), it is highly inflationary in the early stages but with a decreasing issuance.

The current inflation of ~38% is relatively high, and as staker net issuance is still ~14.9%. The typical OSMO reward from LP emissions is around half of this of the staking rewards (23%). Or in other words: Your allocation gets diluted even with staking. The current incentive structure is 36% community pool, 14% LPers, 22% stakers, and 25% DEVs.

So why are people still staking?

Cosmonauts are familiar with securing a network and engaging in on-chain governance like no other L1. While airdrops are one of the biggest value propositions for ATOM staker, it's similar to Osmosis, as users often get rewarded. Furthermore, users need to stake their rewards to avoid even more dilution. Superfluid staking added flexibility and more yield. And governance plays a vital role since stakers control yields and grants to other projects and directly impact the direction of the protocol.

Upcoming catalysts and potential risks

The narratives continue to be strong, and there are good times to be a Cosmonaut. Launching native USDC and eliminating a potential bridge hack (as seen with Nomad) should bring in more liquidity. StableSwap, its version of the Curve 3pools, will allow becoming the go-to space for users to access and trade a multitude of stable tokens. Osmosis aims to be the Curve and Uniswap instead of being different products, as there are a lot of potential use cases like staking derivatives. The move to Liquidity Outposts is a clever move leveraging the liquidity and remaining undisputed. Starting with Mars (credit protocol) and Levana (perpetual DEX). The much-anticipated launch of the dYdX chain and the upcoming Gnoland airdrop will put Cosmos in the spotlight.

As for risks, Osmosis depends on Atom and its IBC vision. If Cosmos fails, so does Osmosis. A small red flag is co-founder Sunny. Osmosis is loud and feisty, often engaged in heated discussions and shooting against the Hub. They fight off competition, sometimes not silent. While Sunny isn't as popular as other culprits (Do Kwon, Zhu Su, Samani, SBF) it's something to monitor as history wasn't pleasant in most cases. While there is no serious competition from current projects, upcoming protocols like SUI or Duality DEX could eat into TVL and market share. It remains to be seen if Osmosis can continue to be successful, turning its first-mover advantage into substantial and consistent dominance. Governance (as seen in other protocols like Uniswap) is also a double sides sword, as great validators can overturn decisions if existing stakers don't participate in governance.

Conclusion

Despite underwhelming tokenomics, Osmosis remains the second-best asset after Atom. As Osmosis is a DEX chain, many may view the OSMO token simply as a farm token and deem that it has little value. However, as Osmosis is an app blockchain, it's a leveraged bet on a multichain world where Osmosis is the central hub for liquidity. Currently, you pay a premium due to inflation, but revamp of tokenomics through current stakers is still on the table and would turn the only downside upside down. But unless we see a significant revamp, the token will mostly trend down as we are probably still in a bear market till the end of the year. So, there is a high probability we will see significantly lower prices until the next cycle.