The rise and fall of FTX

Special: the biggest blowup in crypto and what the contagion will look like

I don't even know where to begin with. I wanted to share my thoughts on Wednesday, but the ongoing situation is developing with such speed that I had to iterate multiple times and postpone it. Most assumptions of my original draft became true and exceeded my worst expectations.

On Tuesday, we saw the second biggest exchange, FTX, and Sam Bankman-Fried (or SBF as he is called in the industry) imploding, which was unthinkable for most. If the Luna collapse (~ $50bn wipeout back in summer 2022) was Bear Stearns, this is a Lehmann Brothers case. Just without a bailout. It's like if John Wick gets shot but dies 25 minutes into the movie.

I, myself, lost money. However, I was aware of a possible bank run and a short-term duration mismatch. I thought someone would refrain from defrauding the public in such a public manner after SBF tweeted his guarantee of full GAPP audits and 1:1 asset backing. Because this is a one-way ticket to jail. I was wrong. Missing out on trades vs. losing a chunk of my portfolio was a terribly miscalculated opportunity cost. Upon reflection, I remembered an old quote: "If you panic, panic first." There is little to no downside to panicking early because, eventually, the rumors become a self-fulfilling prophecy. The game theory for a bank run is straightforward.

Is there any good news? Much is still unclear, and the potential contagion will set back the industry for months, if not years. The market won't die (it's already flat), and looking back in three years, it will be completely fine. It just slows the growth after that omega nuke. ETH didn't die. It was a company from the Bahamas. CeFi failed but DeFi lives. Here's everything you need to know about Alameda Research and the collapse of FTX.

GM! Sharing is caring. Be a chad and share this newsletter with your colleagues.

Short Bullets overview:

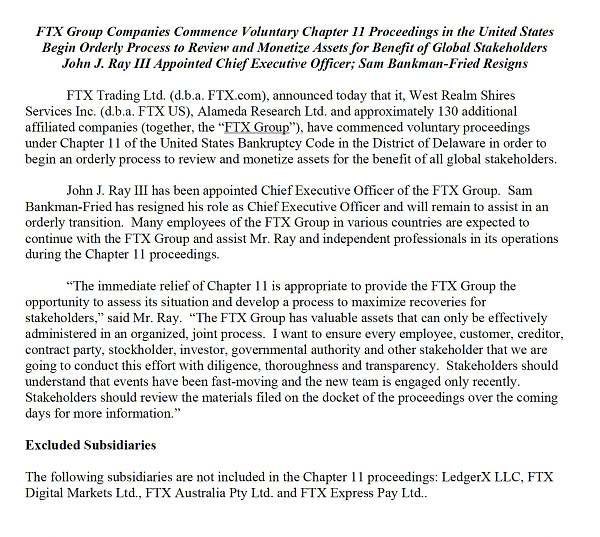

FTX, FTX group (130 affiliated companies), and Alameda Research have filed for bankruptcy (Chapter 11), all founded by SBF.

SBF is out as a CEO and currently under supervision in the Bahamas. John J. Ray III will step in as the new CEO (he cleaned up the Enron mess).

The entire FTX Venture Team quit. Earlier last week, most of the legal and compliance team also abandoned the ship.

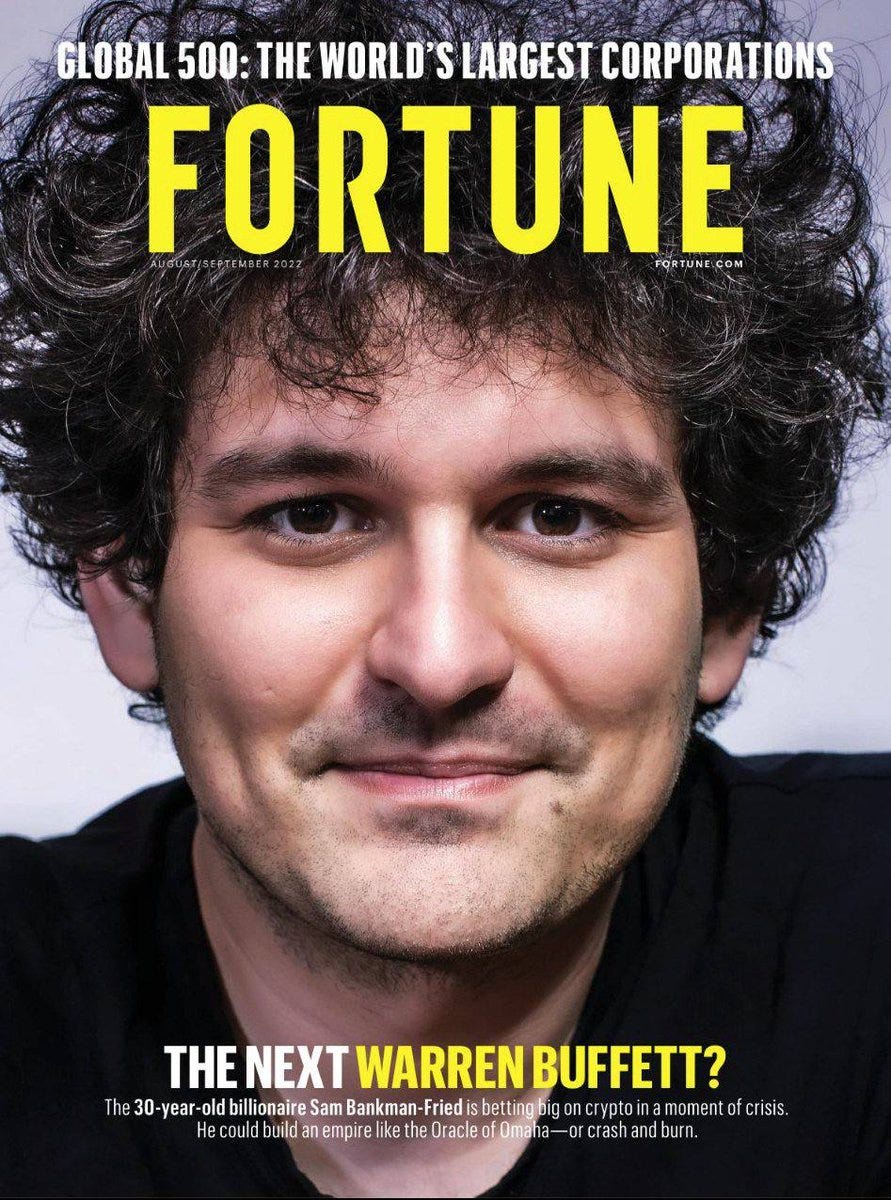

SBF was the poster boy of crypto. Second biggest campaign doner for Biden. Bought the naming rights of the Miami Heat stadium. Owns 10% of Robinhood. Has exposure to Elon Musk’s SpaceX and Boring Company.

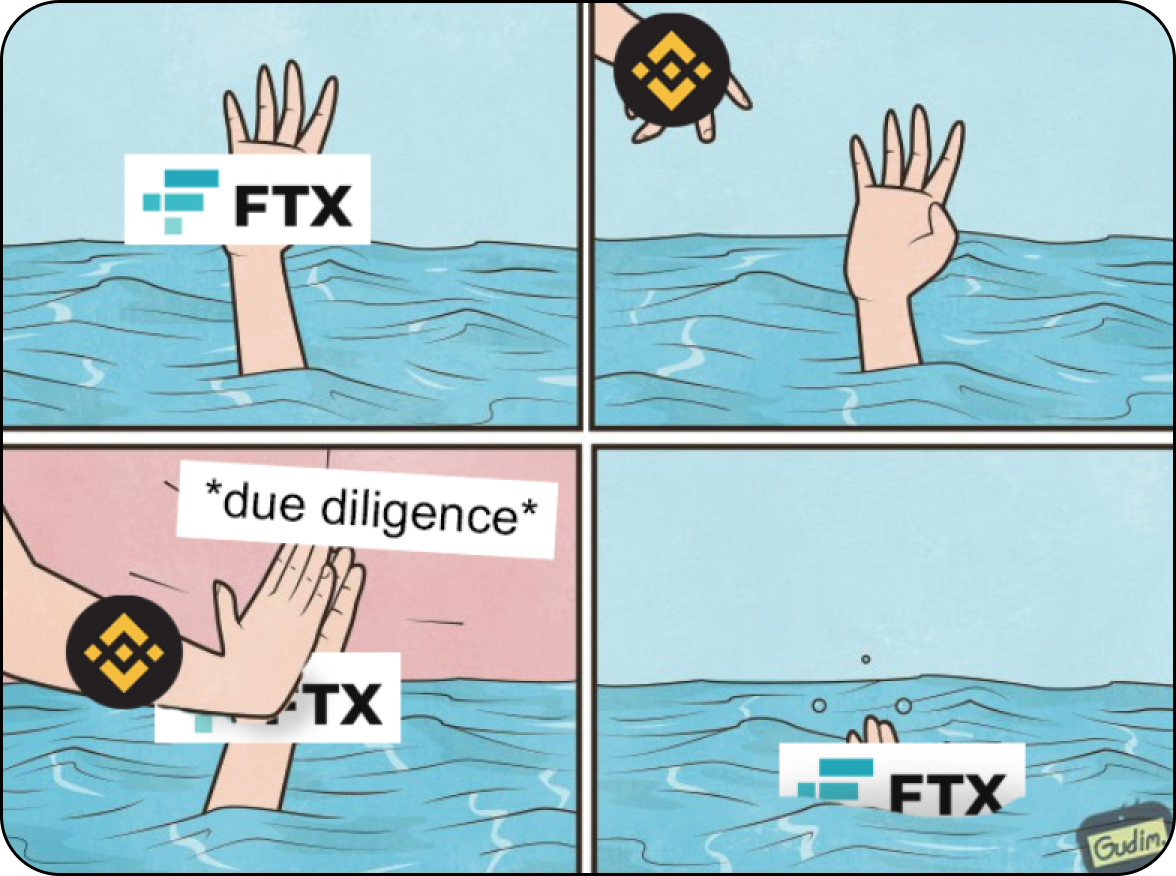

At first, Binance signed a letter of intent and came to the rescue. After less than 24h of due diligence, the deal fell through on Wednesday. If the richest man in crypto can’t bail out FTX, then it’s unlikely anyone can/will.

SBF was regarded as a highly successful predator since he had an asymmetrical advantage (dumping on retail) by owning an exchange, a market maker, and a VC arm. It’s like if you would own Citadel, Fidelity, and a16z simultaneously.

FTX had $16b in customer assets and lent more than half to Alameda, the quantitative trading firm and a market maker. Owing FTX about $10bn by now.

Reuters confirmed that SBF had a backdoor and could move funds without triggering internal audits between the two “separate” entities.

After the Luna collapse and Three Arrows Capital implosion, SBF went on to save Voyager and BlockFi. Nobody knew that Alameda was in big trouble as a counterparty to both. So they needed to defend the solvency of their banks, and FTX had the liquidity to do so.

Alameda Research’s chief executive and senior FTX officials knew that FTX had lent its customers’ money to Alameda to help it meet its liabilities according to WSJ.

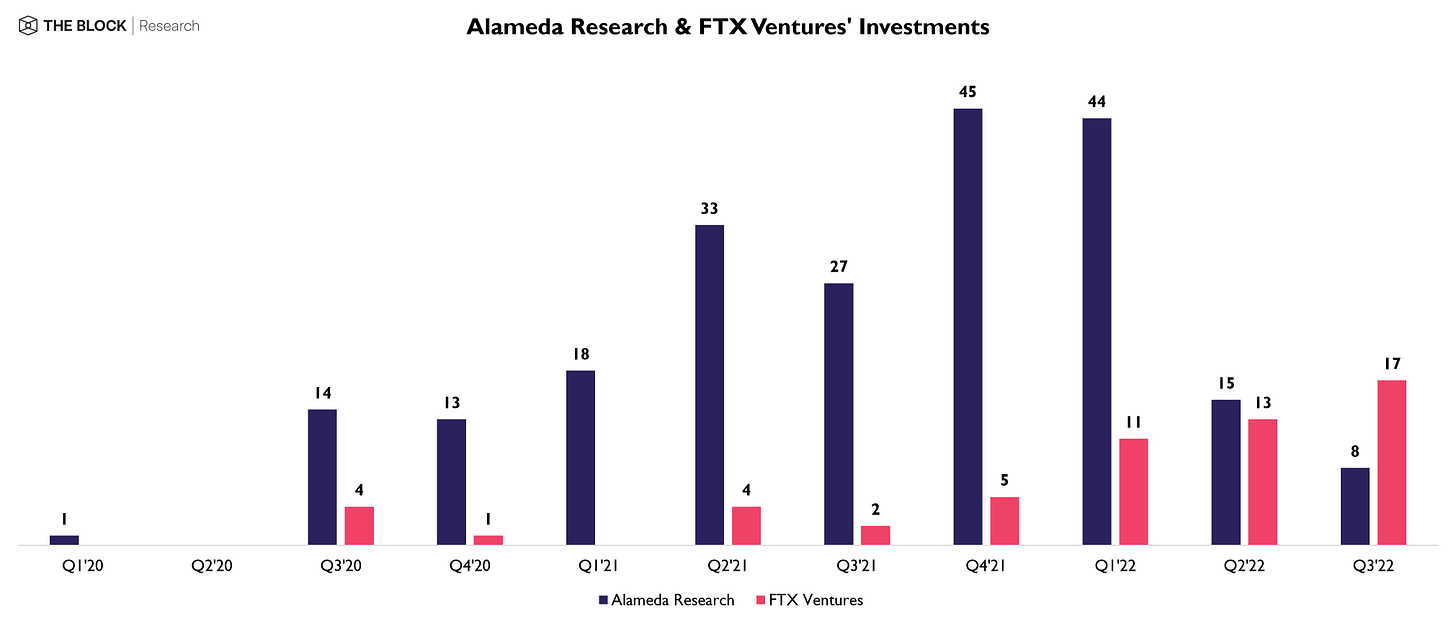

FTX Ventures has invested in 250+ portfolio companies. The complete contagion picture is still unclear. We are preparing for more pain.

SBF invested in funds that were invested in FTX. He poured hundreds of millions into Sequoia Capital, Paradigm, Multicoin, and Altimeter.

Contagion begins to spread. BlockFi paused withdraws and hired bankruptcy counsel. Multicoin lost 10% of AUM. Galaxy revealed a $76m loss. Genesis Trading reported $175m. Sequoia has already marked their FTX investment down to $0. Star Atlas lost half of their runaway.

Regulators all called crypto out. There are also rumors that Congress is investigating Gensler for helping SBF.

And if this isn’t already crazy enough, FTX got exploited on Saturday. While user withdraws were all halted (except for some local Bahamians), a black hat stole $650m of assets. Around ~200m could be recovered by a white hat so far. Smells fishy, insider work.

Backstory: Why Sam Bankman-Fried was the big deal

They say if you aim for the king, you better not miss. And, oh boy, Changpeng Zhao (known as CZ) didn’t miss. Calculated or not, his bombardment by catapults not only killed SBF right on the spot, the whole castle collapsed and buried half of his troops. At first glance, it looked like Binance saw an opportunistic opportunity to go after a competitor. But the engineered bank run did expose a complete fraud and mismanagement of funds of the highest order. Even though CZ might have had his motives (he is still the biggest profiteer of it), we should all be thankful after. The truth hurts, but it’s needed, and the market will heal itself.

So who is Sam Bankman-Fried, a guy who had the biggest one-day collapse ever among billionaires and lost $16bn? How can a shop with 300 employees, making 8 figs a day in revenue (7figs per month per employee on avg), fumble so hard?

Sam is an MIT graduate (physics) who specializes in arbitrage trading strategies. He is known for his altruism and intended to give his whole fortune away (plot twist: He already did).

He began his professional career in 2013 as a trader at Jane Street Capital. In November 2017, he founded Alameda Research and rose to fame with his version of the “kimchi premium strategy” - but for Japan (slightly lower than Korea). He pocketed up to a 10% difference in price by buying Bitcoin in the U.S. and selling it in Japan. At its peak, in January 2018, he says he was moving up to $25 million worth of bitcoin daily. The quantitative trading firm went on a killing spree over the following years and made $1bn in profits in 2020. It earned a reputation for exceptional returns and a less sterling reputation for quietly dumping on retail after it pivoted to become a market maker.

Eventually, he grew frustrated with the quality of the major crypto exchanges. Infrastructure wasn’t as sophisticated back then, and SBF decided to develop a derivatives exchange aimed at professional traders moving large sums.

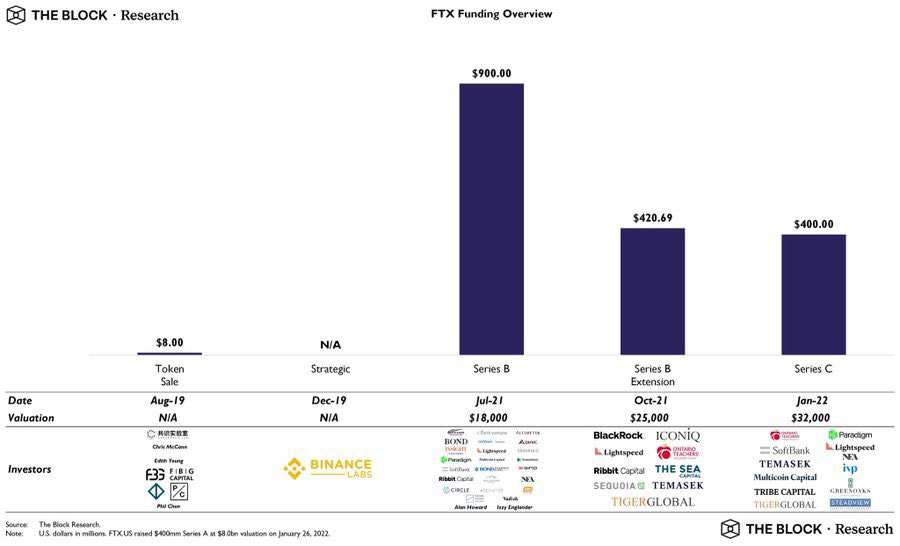

In 2019, he took some of the profits from Alameda and $8m raised from a few smaller V.C. firms and launched FTX in May 2019, marketed as “built by traders, for traders.” Alameda was involved with most exchanges back then, and SBF had a good relationship with C.Z. So he quickly sold a slice to Binance for about $70m. But what is the main issue of a new exchange? Attracting Liquidity. How does one get the ball rolling? SBF’s answer was Alameda Research as an L.P. Since its inception; there have been questions about the relationship between entities as a conflict of interest.

In 2020, he ranched off FTX.US, taking a more conservative angle in handling the strict regulatory environment of the U.S. (based in Chicago). The international business was based in the Bahamas to take advantage of “clearer” crypto regulations.

In just a few years of catering to the more-sophisticated trader, FTX has gotten huge. Keeping the employee count low, they had a profit margin of ~50% with basically no overhead and made SBF a billionaire. In total, FTX raised $1.8bn, with the latest round in January 2022 valued at $32bn.

With increased competition, tensions rose as the two companies increasingly took divergent tacks with regulators. SBF was testifying in the U.S. Congress, while Binance faced regulatory probes worldwide. When Binance met heat from regulators back in 2021, FTX bought out Binance shares for $2.1bn in FTT and BUSD. It was the end of a strategic partnership since FTX became a threat to Binance, and they chose to divest.

It’s no secret that SBF had big ambitions of winning over regulators and was well-connected as a big downer. Lately, he came under severe backslash from the crypto industry after publishing regulations proposals. Many claimed that SBF was trying to kill DeFi and push for regulatory capture. This was the first opening, labeling SBF suddenly as an “enemy of crypto.”

The attack:

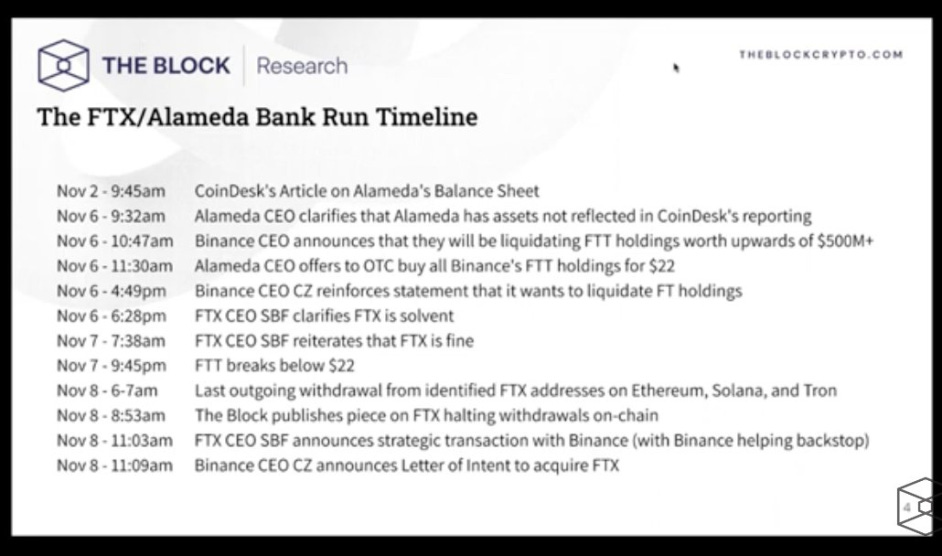

The second opening for CZ came when CoinDesk leaked Alameda’s balance sheet. It showed Alameda had $14.6bn in assets against $8b of liabilities. Most net equities were tied in completely illiquid altcoins. The biggest: $5.8bn in FTT, their exchange token. The problem? FTT only had a $3bn market cap at the time. The math didn’t add up. Former CEO Caroline confirmed the balance sheet but stated that >$10bn of assets weren’t reflected. It still looked terrible. Much collateral was denominated in FTT. A token FTX launched to raise funds for itself. Remember? When FTX bought out Binance, they partially paid out in FTT tokens, giving CZ a considerable chunk of the supply. But first, let me explain the Token.

What is FTT?

As with other exchange tokens, FTT owners got certain benefits through staking

Discounted trading fees, access to airdrops, free withdrawals

1/3 of FTX’s trading revenue was used to buyback and burn the supply weekly

So supply is decreasing over time while the price goes up due to buy pressure

It had a remarkably low circulating supply to relative holdings

Market cap at that time: $3.35bn, fdv > $7bn, all while liquidity was low

In other words: there wouldn’t be enough buyers for the position since holdings were higher than the circulating supply.

So if the price of FTT went down to a specific price, it would create margin calls for Alameda since provided collateral is shrinking. And here comes CZ in. He announced publicly that Binance intends to sell all of its FTT holdings worth $500m due to recent revelations. Caroline quickly and publicly offered CZ an over-the-counter deal to buy all tokens for $22 each (slightly below market place, which was declined. Strange, since he could have got a better deal OTC than on any market sell. It also led to speculation that perhaps Alameda had loans that could be liquidated at that price.

So the target was to sink FTT's price after all. Fears over the insolvency of Alameda and FTX by association began to amplify. And it took only a short time until FTX's $600m stablecoin holdings were gone.

The bank run and collapse:

Due to the close relationship between Alameda and FTX, this discovery based on leaked internal documents was explosive. FTX created the FTT token out of thin air, raising concerns about the real-world, open-market value of FTT tokens held in reserve by affiliated entities. That's when more rumors began circulating, and the FUD machine went into overdrive. Allegations of FTX insolvency began to circulate. Despite SBF reassuring, all user funds are 1:1 backed.

It resulted in mass withdrawals of over $6bn throughout 72h

CZ's announcement of market selling FTT caused havoc across markets

Sell pressure against FTT pushed against the stated $22 level

Alameda did try to save the "peg" of FTT by selling vast amounts of Solana, but eventually, it broke

By the morning of the 8th, FTX had paused all withdrawals of user funds. Meanwhile, the price of FTT crashed by over 88% in a single day. There was a multi-billion dollar hole in FTX, wiping out the collateral. Shortly after, SBF announced a takeover by Binance by a non-binding letter of agreement.

The next day, Binance backed out from the deal, stating: “The issues are beyond our control or ability to help.”

At first, what looked like a cheap shot from Binance exposed that assets weren't backed. Unlike Voyager, Celsius, etc., where their terms of service allowed them to lend or rehypothecate your assets for yield, FTX states explicitly that the title to assets remains with the customer. This means FTX was literally stealing customer funds. SBF came out with an apology on the 10th, stating FTX US was OK and only FTX Trading (international) was in trouble. Meanwhile, Alameda was winding trading down.

It was clear they needed to file for bankruptcy without a cash injection, and SBF sought a $9.4bn package for the rescue. One day later, Alameda, FTX Trading AND FTX US declared bankruptcy (chapter 11).

Crypto was officially fucked. And while billions of user funds were stuck and not accessible, it got even weirder. Justin Sun agreed with FTX to allow TRX, BTT, JST, SUN, and HT holders to swap assets from FTX 1:1 to external wallets, which resulted in inflated prices. Meanwhile, some Bahamas KYC accounts were withdrawing other people’s funds. By bypassing the balance transfer block by selling NFTs (user x buys inflated NFT from insider account, insider withdraws money for user x for a commission) with a volume of $50m until it is paused.

And if that doesn’t sound crazy enough: On Saturday night FTX got exploited. Over $600m of funds were siphoned out of FTX’s crypto wallets. All while moving digital assets to cold storage because of the bankruptcy. Roughly $200m could be recovered by a white hat. Even worse? It went far beyond an on-chain hack:

"FTX has been hacked. FTX apps are malware. Delete them. Chat is open. Don't go on FTX site as it might download Trojans," wrote an account administrator in the FTX Support Telegram chat. The message was pinned by FTX General Counsel Ryne Miller.

Documents exclusively obtained by the Financial Times show that as of Thursday, FTX Trading LTD (the international exchange) had: $9bn of liabilities and $900m of “liquid" assets. Another $8.7bn of thinly traded crypto and illiquid VC bets. This balance sheet is from before the hack occurred. The biggest asset that FTX recorded on its books as of Thursday was $2.2bn of Serum (SRM). Another token they created themselves. The current total market value of Serum is below $80m. A low circulating supply combined with a high FDV. Sounds familiar.

Whatever the outcome of the FTX crisis, it is abundantly clear that the crypto industry will face significant challenges due to the fallout. SBF lobbied for DeFi regulations in recent months to influence the government's rules on the space.

So where did it go wrong so badly?

The surprising step-down of Alameda co-CEO Sam Trabucco in August and FTX US CEO Brett Harrison in late September paints a different narrative today. They knew all along. It’s confirmed by Reuters and The Block that SBF had a secret backdoor. He could move funds between FTX/Alameda without triggering internal audits or accounting. If a user deposited $1m on FTX, Alameda could draw a $1m line of credit from FTX. The potential conflict of interest between Alameda and FTX from the early days never was resolved.

According to WSJ, executives have known that FTX was using customer funds to help troubled Alameda, which later led to the bankruptcy of FTX. It was co-founder Garry Wang, CTO Nishad Singh, Caroline, and SBF.

After the Terra collapse in May, the $10bn hedge fund Three Arrows Capital collapsed as a result in June. Companies like BlockFi, Celsius, and Voyager were on the brink of bankruptcy. The market was highly distressed, but only one was not: SBF. The predator of crypto was once again winning. He provided a $250m credit facility for BlockFi. And did try to save Celsius and Voyager.

It turns out Voyager owned Alameda for $370m. Alameda was in big trouble as a counterparty. So they needed to defend the solvency of their banks, and FTX had the liquidity to do so. Likely, SBF is required to bail out entities with extensive FTT holdings to prevent forced selling.

Remember, Luna had a peak market cap of around $40bn and UST of approximately $18bn. We saw significant losses from 3AC, Celsius, Voyager, etc., but the math only added up now: It was Alameda all along. The whole system was based on an illiquid token as collateral and used customer deposits with too much leverage. Alameda was insolvent all along but was saved with an inflated FTT token as collateral, only to collapse afterward and ultimately let to the fall of FTX.

Alameda pledged illiquid collateral to borrow money to finance bets. They got margin called as markets went down this year, leading to the theft of FTX user funds to put out fires.

Coinmetrics analyst Lucas Nuzzi claims to have evidence that FTX transferred funds to Alameda in September, possibly as a loan to cover Alameda's losses.

Another theory by Westie and Alex explains how the liquidation engine of FTX broke down, leaving Alameda with huge losses.

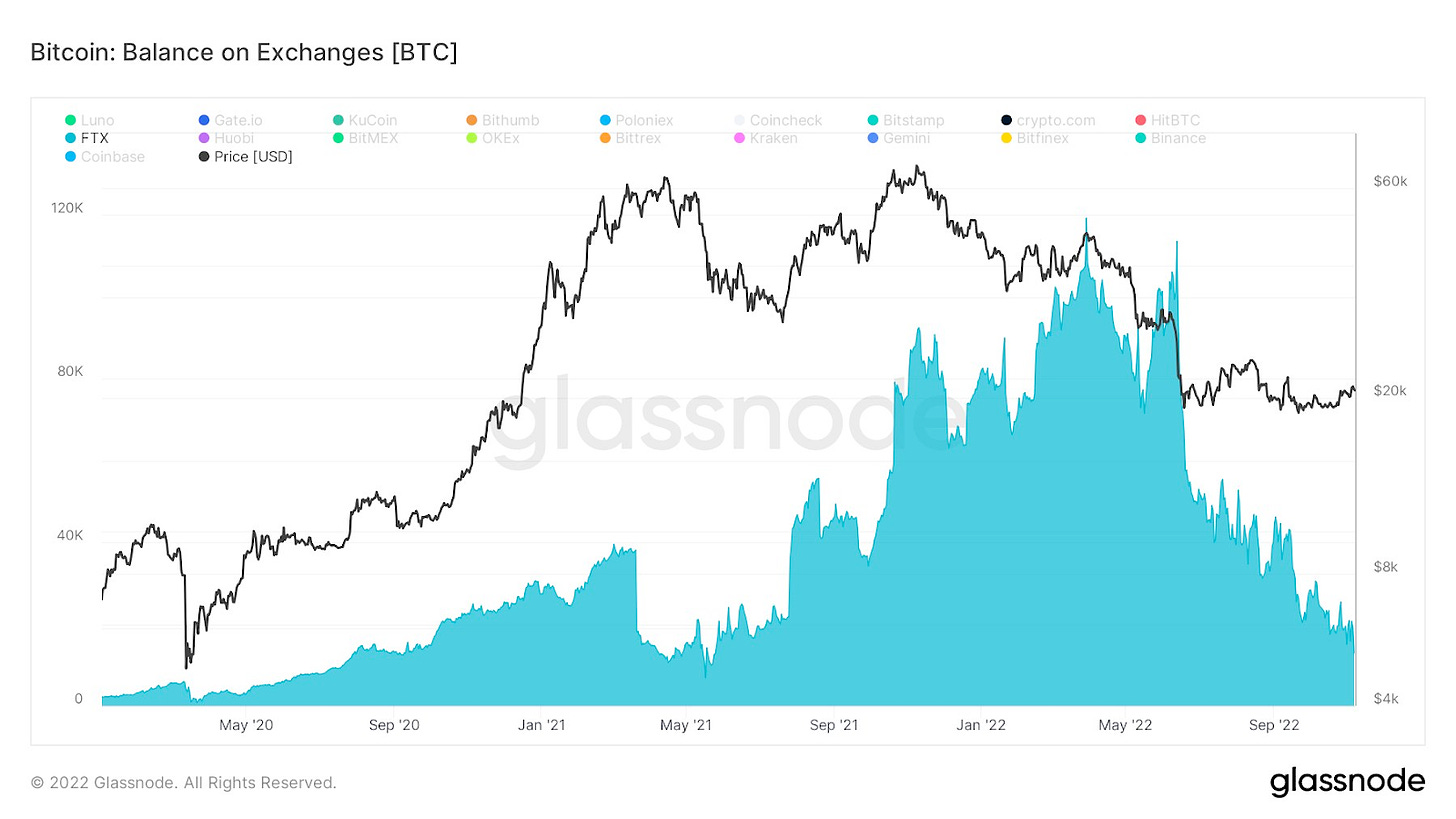

Interesting to note is the BTC holdings of FTX. A sharp decline since the Luna collapse past spring. Which is when Alameda was alleged to have become insolvent and received loans from FTX. The red flags were all over it. Just nobody could connect the dots, not even his employees.

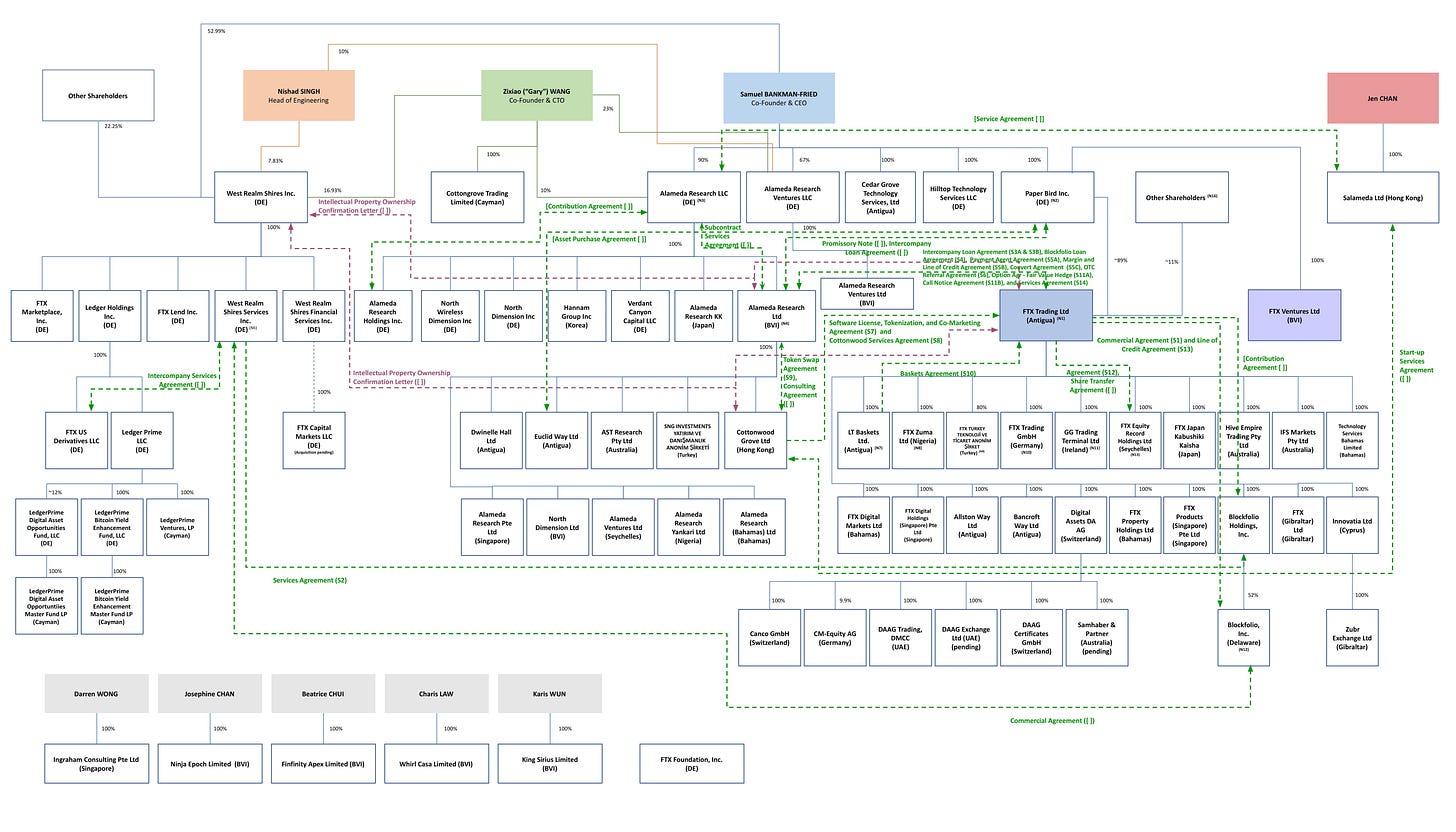

Below is an attempt by the Financial Times at the corporate structure of the SBF imperium. Take a moment to survey the task awaiting liquidators and law enforcement agencies. Fundamental relationships are at FTX Trading Ltd (Antigua). FTX provided intercompany loans and credit support to the supposedly 'independent' Alameda business.FTX Ventures, Alameda Research, and FTX Trading were separate structures. They shouldn’t have a commingled balance sheet. So, if one fails, you wind up one and move on unless you have massive intercompany loans. There seems to be intercompany loans between FTX Trading Alameda and between Alameda and Paper Bird.

FTX fraud is a repeat of the story of the worst of human greed. They are hiding FTX liabilities in off-balance sheet SPVs (Alameda) a la pre-08 Wall St. Inappropriately using customer funds to cover levered trading losses a la MF Global.

It makes sense now why the Aptos launch was rushed and poorly executed. They needed to cash in on their investment. It gets even more complicated if you look at the Alameda Research (which was absorbed into FTX Ventures) venture arm. They invested in over 255 companies at rapid growth.

Is this a net negative or positive?

Surprisingly, both, depending on what perspective you take on. We witnessed the implosion of a TradFi guy who makes Bernard L. Madoff look like an amateur. A centralized exchange (CEX) imploded due to greedy behavior. All while on-chain worked without sweat and showed its resilience. ETH didn’t break. It was a centralized entity due to the mismanagement of customer funds.

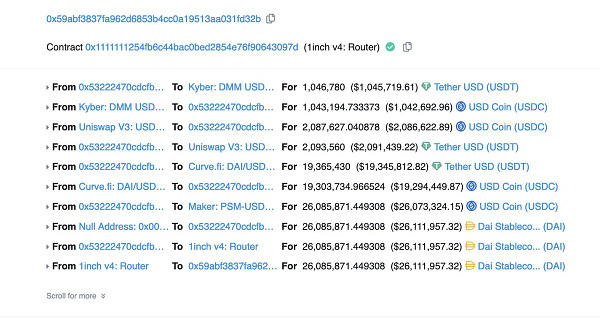

Of course, it won’t matter at this point. Distinguishing between decentralized finance (DeFi) and CeFi will be impossible for the general public. The space will be scrutinized. The truth is only CeFi needs more regulation. And new standards like proof of reserve (developed by Nansen), paired with proof of liabilities, will be a must-have. After all, this incident moreover showed why decentralization is of utter importance. Because it exactly prevents this type of behavior through code. In crypto, the code is the law, and a protocol like Aave is regulated through that. Everything is transparent on-chain. The proof of reserve is there to see for everyone on-chain. Through over-collateralization, you can only borrow up to a certain percent of your supplied assets and would be automatically liquidated for the protocol to stay solvent.

However, being on-chain and having self-custody over your assets (aka you are your “own bank”) comes with responsibility. It’s not something for people who type in “Google” into the starting screen of their browser, which is already set to Google. And don’t get me started on the UI / UX of some solutions. So CEX are needed because it allows normies and institutions to enter the space. It’s also severely required as a fiat onramp gateway. And both got annihilated. The space can only grow if money flows in, and it will need a miracle to regain this trust.

So exposing this Ponzi is a net positive. It also validated the core theory of crypto and makes an utterly bullish statement for the future of decentralized exchange and DeFi. Again, a net positive. So, all good? Hell no!

The contagion:

An awful lot of funds with known exposure to FTX have been suspiciously quiet in the wake of the collapse. Odds are, that’s not because they’re healthy. Off-chain damage will soon come to light, which could put downward pressure on multiple on-chain assets. Users have lost all funds and are unlikely to recover more than 10 cent on the dollar, if even so, in a couple of years. Retail lost, but a lot of smart money also went bust this time.

Meanwhile, all eyes are on the Solana ecosystem due to the massive involvement of FTX. They were amongst Solana’s first investors and also developed Serum. A central order book for liquidity providers to backstop liquidations of all major lending protocols. Due to the security breach of FTX, the community recently did a hard fork. The serum program update key was not controlled by the SRM DAO but by a private key connected to FTX. It’s not clear what was affected.

The Solana foundation reported ~1M on FTX (< 1% of total cash), -3.24m shares of FTX, ~3.43m FTT, ~134.54m SRM exposure, and limited Defi exposure.

Furthermore, FTX has issued wrapped versions of numerous tokens (like soBTC), which were used widely across lending and AAM platforms and are now without backing. A race to the bottom.

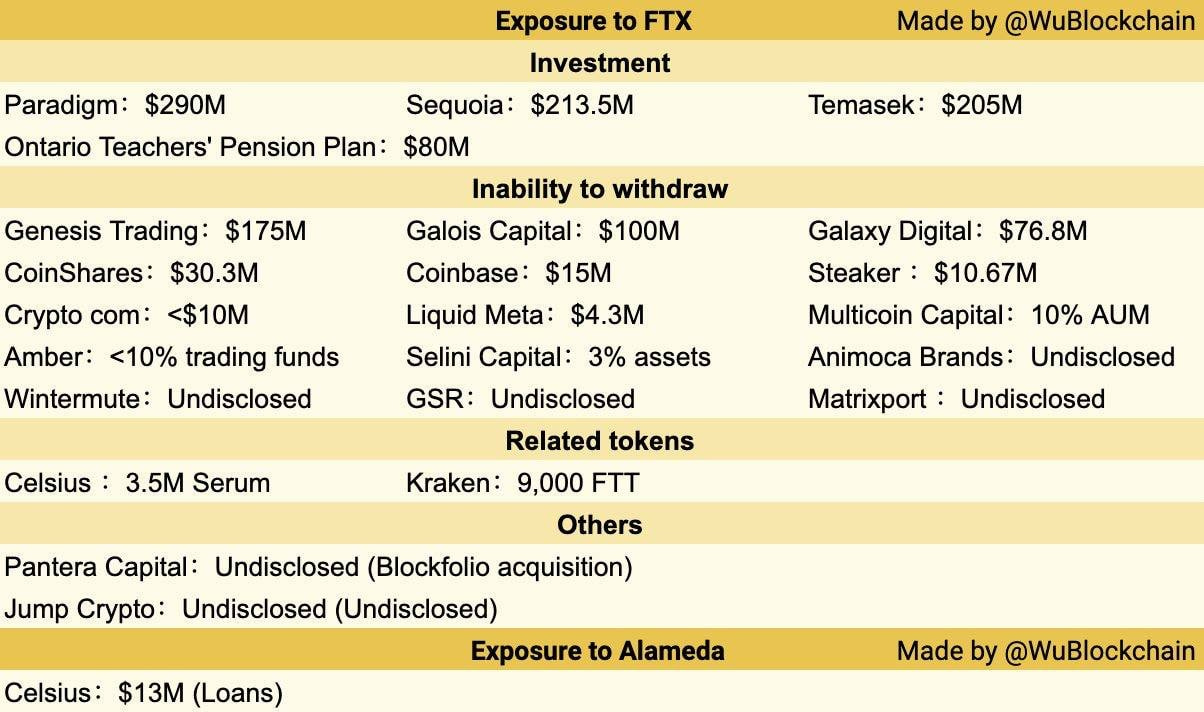

Below is a quick overview from WuBlockchain. DCG, Sino Global Cap, and Jump Crypto still didn’t inform us about the damage. Star Atlas, the AAA blockbuster game, stated that their runaway of multiple years was cut in half due to FTX exposure.

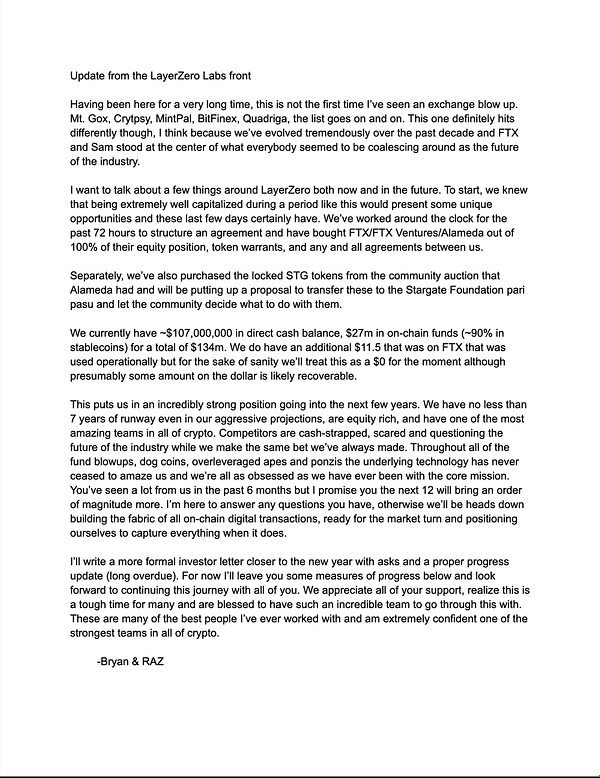

BlockFi is still halting withdrawals. As liquidity dries up, we will see more custodials going bust, more projects losing their treasury, and markets slowly bleeding to death as bad news become the norm over the next few weeks. All while, overall, the macro is getting better. A lot of people will capitulate, which could present lifetime opportunities. Although I know a lot of projects will fault, I do genuinely hope we see more Bryan’s that are more committed than ever to turn this ship around. Be safe out there.