Crypto Alpha Recap

03.04.2023: Euler attacker returns funds. Uniswap V3 license expired. Arbitrum governance drama. DefiLlama added unlocks tracking. Noble is live on Cosmos.

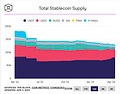

It was a relatively quiet week besides another wave of attacks (CFTC issued civil charges against CZ/Binance). However, stablecoin supply has been close to flat for the past three months hovering in the ~130b range. USDC saw an outflow of $10B. There’s not much new money coming in - PVP mode only. BTC dominance is approaching multi-year highs providing a hopium of a slight altcoin rotation.

Macro: Inflation has left the building, and the banking crisis has burst through the brick wall. Total deposits at U.S. banks are down a record $1 trillion as a lot of money went to market funds which just hit a record high.

The Fed’s preferred measure of inflation, personal consumption expenditures (PCE), rose less than expected in February, with prices gaining 0.3% for the month. Consumer spending also went lower at 0.2%. While GDI (Gross Domestic Income)–fell by 1.1% in Q4, the biggest drop since the onset of the pandemic. Oil prices surged after OPEC+ surprised markets by announcing a production cut exceeding 1 million barrels per day.

Special Nugget:

Osmosis new tokenomics?

I already wrote a lengthy article about Osmosis and why inflationary tokenomics and no value accrual for holders hinder the project. There are currently discussions on Commonwealth to address those issues by:

Reducing daily emissions by 50%, double the time between Thirdening events

adjusting emission ratios

Decrease the Superfluid Risk Factor to 25%

It would allow for a positive net yield due to decreasing inflation (36% > 18%) and a 2% yield increase to 11% on LPs. The Cosmos rebirth will likely happen in Q3 with the DYDX mainnet (private testnet just launched) going live, and an inflow of native USDC is coming with Noble.

Meme of the Day:

General:

Euler hacker returns $176M (84%) of stolen funds amid ‘ongoing’ negotiations and begs forgiveness. Law enforcement agencies may continue pursuing the hacker for a different reason because he sent 100 ETH to a wallet controlled by the state-sponsored North Korean crime syndicate Lazarus Group.

US-based Gemini is preparing to launch an overseas derivatives exchange offering perpetual futures.

U.S. government sold over 9k BTC (seized from Silk Road) for $215.7M, plans to dump another $1.1B.

Crypto news site The Block got a new CEO and reported 27 layoffs following admitted ties to SBF.

DeFi & NFTs:

Uniswap V3 License has officially expired, and now anyone can fork it.

Cosmos-based L1 Noble is live. It’s an issuance platform for native USDC (no bridge risk) in the Cosmos and the IBC ecosystem. It will catalyze hundreds of millions in liquidity over the coming months and is what foundation protocols like dYdX (Q3 launch) await.

Arbitrum sells tokens amid 77% disapproval and has clarified that Arbitrum Improvement Proposal (AIP-1) is merely a “ratification” and has already sold governance tokens for fiat, causing a huge backslash.

ConsenSys has released a public testnet of its zero-knowledge Ethereum Virtual Machine (zkEVM) and has given it the name “Linea.”

Solana-based wallet Phantom now supports EVM apps on Ethereum, Polygon, and Solana.

Ethereum’s Shapella Upgrade, enabling staked ETH withdrawals, is set for April 12th.

Solana-based NFT marketplace Magic Eden is launching on Ethereum in April to support native ETH NFTs.

Amazon NFT marketplace could feature NFT art and artists like Beeple and Pudgy Penguins.

Sidenotes:

DefiLlama added unlocks tracking.

Nexon Finance is the first lending protocol live on zkSync Era.

Lido will sunset support on Polkado & Kusama due to a few key challenges that led to unmet financial expectations.

Loopring staking is live.

StarkNet alpha v0.11.0 is now live on mainnet,

Yama Finance is live on Arbitrum. Leverage up to 17x on GLP.

Pancake V3 launching on April 3rd.

Crypto Twitter: