Crypto Alpha Recap

19.01.2023: HashKey raising $500M. Silvergate reports $1B loss. Aave is about to release V3. Coinbase is leaving Japan. Polygon fork successful.

A brief of fresh air for the markets. The producer price index fell 0.5% in December, way more than anticipated. Bank of Japan released its beige book, and investors expected a policy change, but it did not happen.

During each bear cycle, conditions worsen until those vulnerable to being forced out of the market (traders, narratives, and projects not equipped to last) are fully purged. That transition from weak to strong is still in play, with Genesis finally planning to begin its bankruptcy filling. Seeing Coinbase and Metamask trimming the fat is starting to paint a bullish picture.

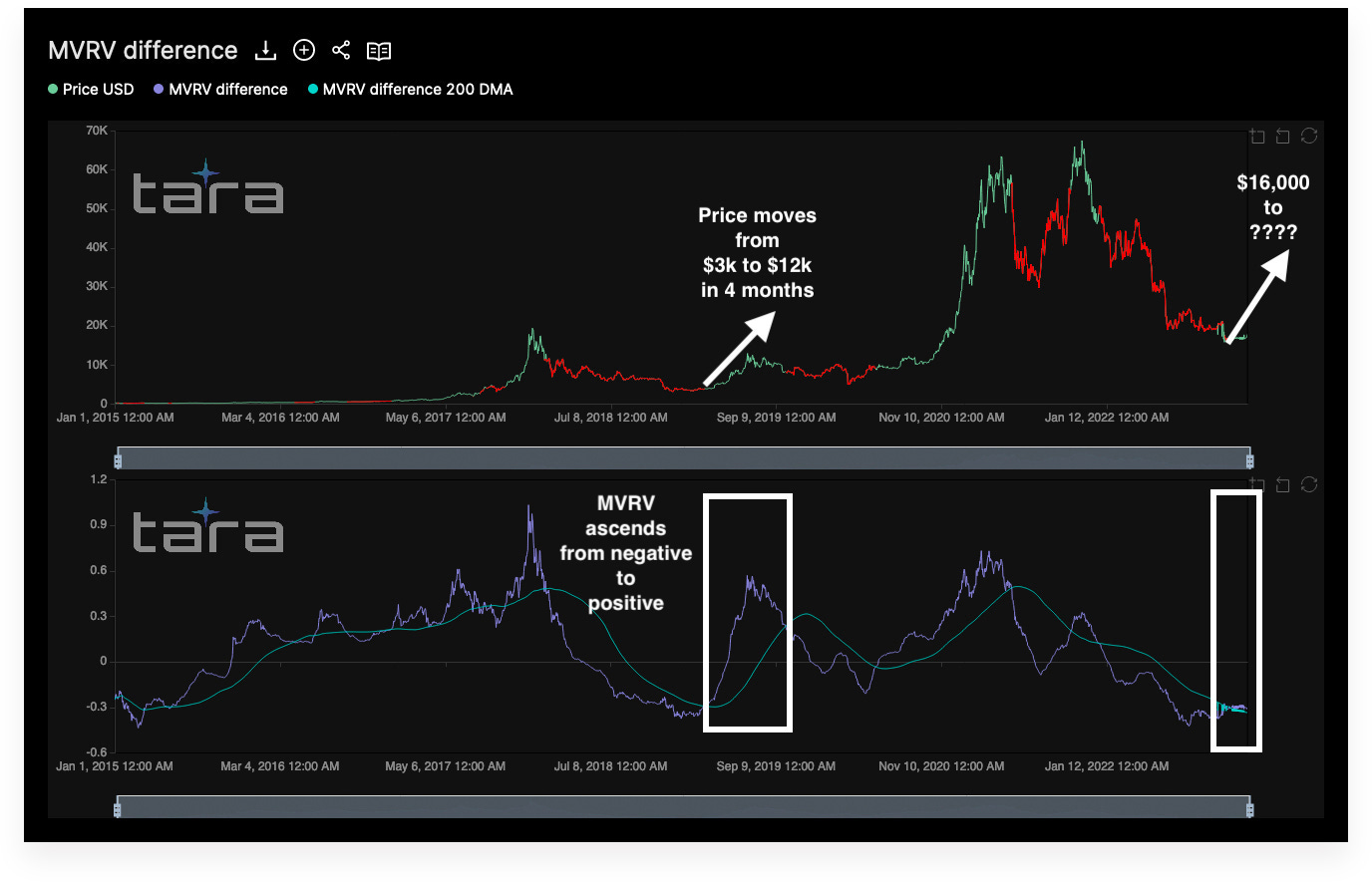

Before Christmas, I wrote about the MVRV flashing a temporary bottom while Bitcoin was under $16,5k. It remains profoundly negative, with a current score near minus -.30 at the time of writing.

MVRV: It's the ratio of Bitcoin's market value (MV) versus its realized value.

So the average cost basis of coins being transacted today is still 30% higher (~$30K) than today's prices of ~$21K. Any time MVRV has moved above its 200-day MA (green ribbon), it has not stopped rising until it's into positive territory. Some hopium, at least.

And while there is still a reasonably high probability that early January price levels will be revisited again at some point in 2023, a strong piece of data suggests any such retest would present a prime buying opportunity.

GM! Sharing is caring. Be a chad and share this newsletter with your colleagues.

Data Dump:

The recent trend to self-custody continues as market participants withdraw Bitcoin from CEX.

Distressed miners (or what’s left) finally see some relief. This attempt to model the cost of BTC production using Difficulty (input) and Issuance (output) shows price moved above an estimated cost of $17,6K (x1.41, orange) per BTC.

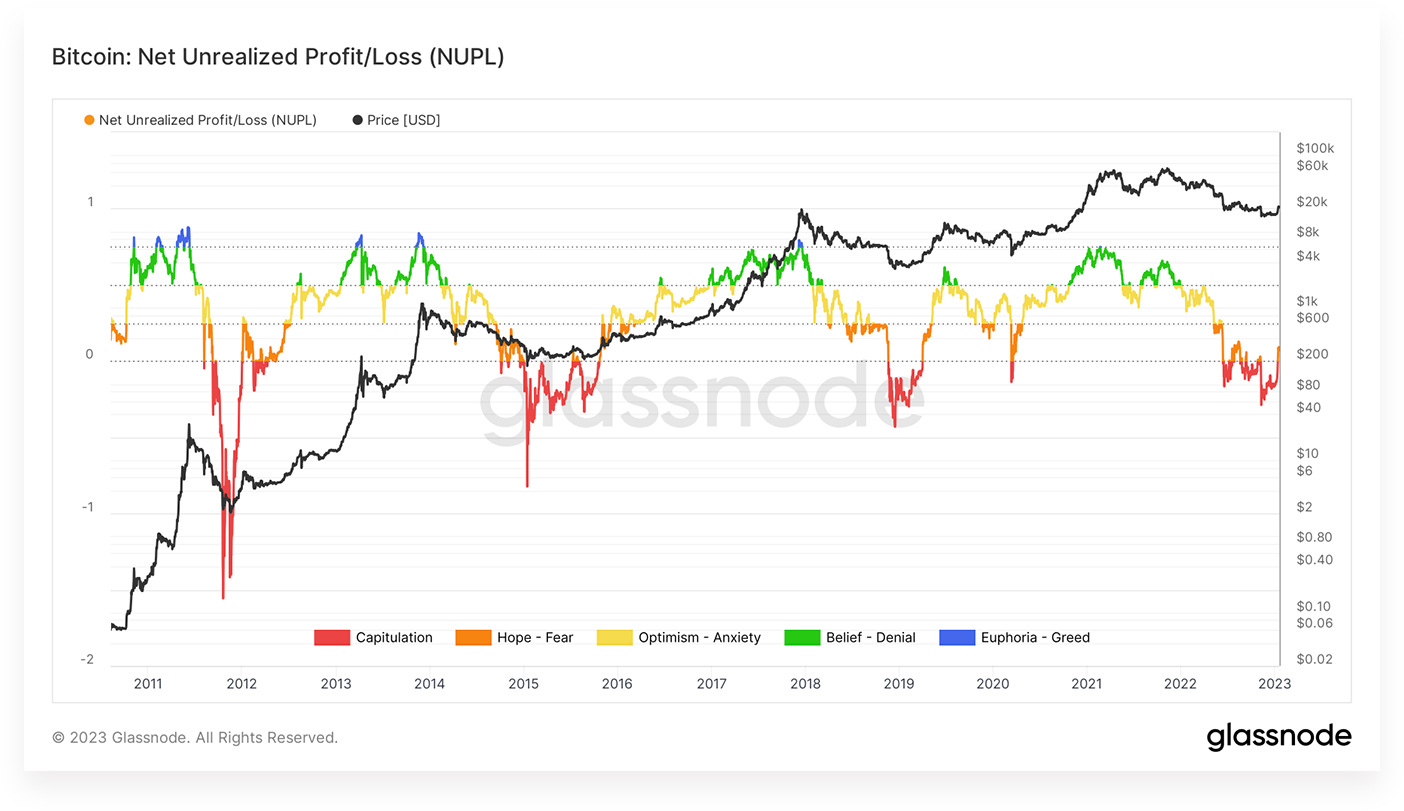

And while we didn’t reach peak Euphoria (blue) like in the last cycle tops, we sure hit the bell for the capitulation (red).

General:

HashKey Capital has closed its third fund by raising $500M. The fund had initially targeted closing at $600M, but "timing matters more than the size."

Bitcoin mining difficulty jumps 10% to a record high.

Crypto-focused bank Silvergate reports a Q4 loss of $1B.

Circle, the company behind the USDC stablecoin, taps Deloitte as the new auditor and doubles down on Proof of Reserves. It's also Coinbase's accounting firm of choice.

According to sources close to the matter, Genesis creditors are negotiating the terms of a possible Chapter 11 filing.

Coinbase follows Kraken and has shuttered its operations in Japan due to "market conditions."

ConsenSys (MetaMask / Infura) cuts 97 employees or 11% of the workforce.

Venture investing titan Tim Draper is launching a web3 deals syndication platform, Draper Round Table.

21Shares unveils the world's first crypto staking index ETP. The index represents the first-ever basket product of crypto assets that provide exposure to staking rewards while tracking the performance of underlying staked cryptos through a single ETP.

DeFi:

BNB Chain completed the 22nd Quarterly BNB Burn via BNB Auto-Burn of over $500M of its native tokens.

Polygon zkEVM mainnet launch soon teased by co-founder Sandeep.

Optimism transactional activity has steadily bumped on the scaling, crossing over rival Arbitrum’s activity, which has fallen nearly 50% since its November peak.

MakerDAO voting to limit DAI exposure amid concerns about exposure to Gemini in the event of the latter’s bankruptcy.

Sidenotes:

Aave is about to release V3 on Ethereum.

Timeless LBP concluded with $2.57M committed by 600 community members.

Vela Exchange, a perpetual DEX, launches beta on January 31st.

Option Liquidity Pools live on Dopex.

Polygon fork successful - only 15 of 100 validators voted.

Solflare, a wallet on the Solana network, brings “priority” gas fees.

Funding:

Parfin has raised $15M to provide web3 infrastructure solutions to Latin America.

Pantera and Archetype co-lead a $12.5M Series A funding round for Obol Labs to decentralize ETH validators.

Mobile games publisher Carry1st has closed a $27M funding round to advance its publishing and digital content creation platform in Africa.

Fintech firm Arch launches a crypto lending product and raises $2.75M

Decentralized finance protocol Elixir raised $2.1M. The seed round includes investment from FalconX, OP Crypto, ChapterOne, and Bitmex founder Arthur Hayes.

Intella X, a web3 gaming platform, raised $12M from investors that include Polygon, Animoca Brands, and Magic Eden ahead of the Q1 launch.

Crypto Twitter: