Crypto Alpha Recap

15.12.2022: SBF finally arrested. Gemini with a data breach. Arbitrum protocols on the move. FED raises 50bps while inflation data came in lower as expected.

Believe it or not, SBF is finally behind bars and waiting for his extradition hearing in February. Questions are whether other executives, such as co-CEOs Caroline Ellis or Sam Trabucco of Alameda, will face charges. Those two lost money as a counterparty against retail - despite having a god mode on FTX (no liquidation, special latency to front-run retail, whole order flow insights, unlimited credit line). Trabucco, in particular, escaped most of the recent public mobbery.

The first time in 4 years that we have had two consecutive inflation reports with downside beats. As we close the year, YoY sits at 7.1%, its lowest level all year and a full 2% off its peak. However, Core sits at 6% and is still sticky with a high of 6.6% on the year, with the year’s low a touch lower at 5.9% seen back in the summer.

On Wednesday, the Federal Reserve reaffirmed its hawkish stance, tightening further by hiking the target range for its benchmark short-term interest rate from 50bps to 4.25% to 4.5% as expected. The Fed estimates its benchmark rate to top out around 5.1% in 2023, up from the 4.6% it previously forecasted in September. “We will stay the course until the job is done,” Powell said. In other words, more pain is coming. Inflation continues to be significantly above the Fed’s 2% target.

Crypto saw the usual volatility around such macro events, and it’s usually just best to stay flat. Despite the doom around a looming recession (bad for high-risk assets), I remain confident that we will eventually see a decoupling of crypto coming in Q1.

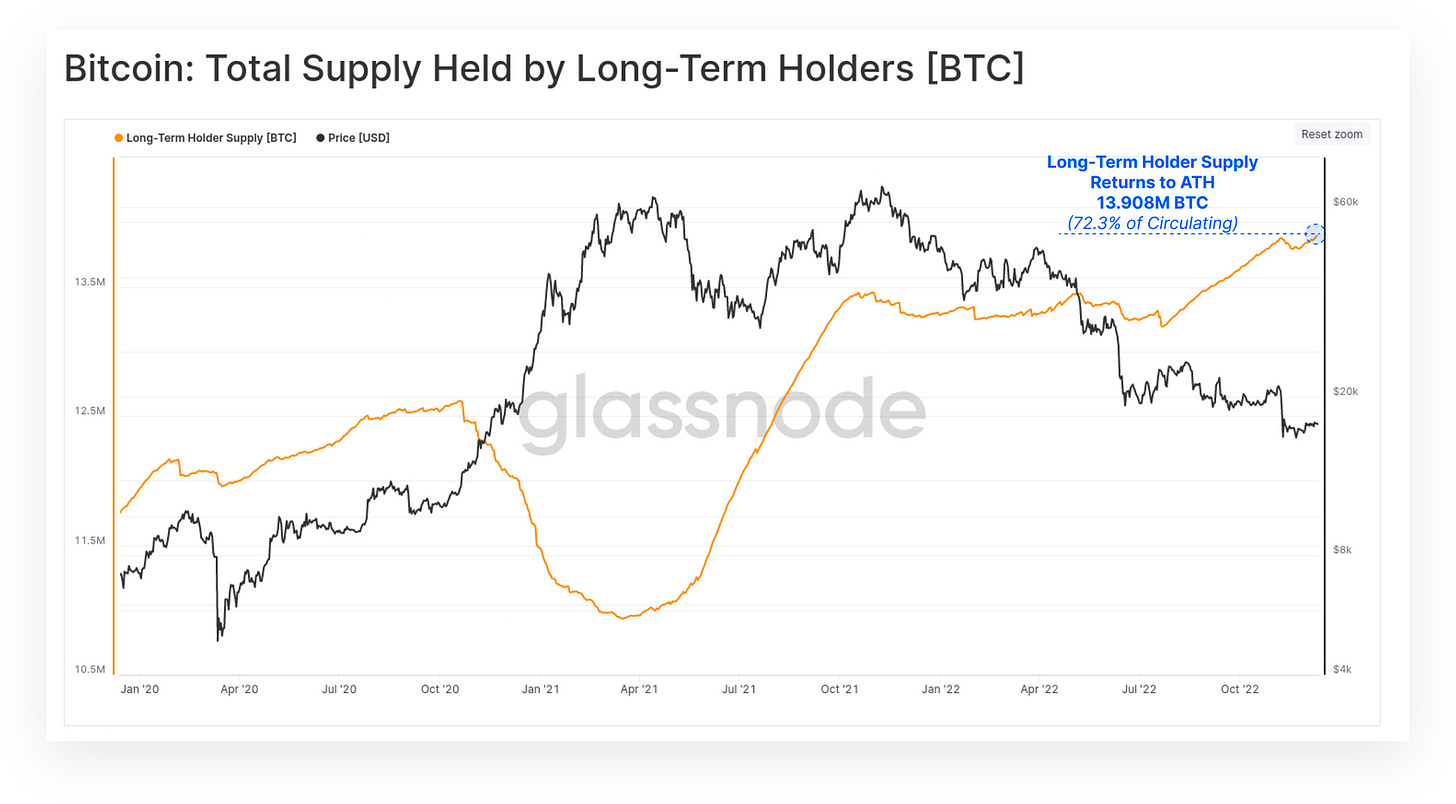

2022 was a brutal year. Despite these spectacularly large losses, the Long-Term Holder supply has reverted after the FTX fiasco and hit a new all-time high. It’s a reflection of the heavy coin accumulation that occurred in June and July 2022, immediately after the deleveraging event inspired by 3AC and failing lenders in the space.

GM! Sharing is caring. Be a chad and share this newsletter with your colleagues.

Special Nugget:

Ladies and Gentleman - we got him. SBF was arrested in the Bahamas after US authorities filed criminal charges against him. The official charges are from 3 separate agencies (SNDY, SEC, CFTC) and can be broken into 4 areas: Wire fraud, securities fraud, money laundering, and campaign finance violations. The 8 charges from the SDNY (Southern District of New York) alone carry up to 120 years in prison.

A Bahamas judge denied a bail request, and SBF faces extradition. I covered the fall of FTX over a month ago in this article and a few bombshells are now public:

According to the SEC's fraud complaint, Alameda Research (the hedge fund of SBF) had an unlimited line of credit on the exchange and always improperly diverted FTX customer assets.

On top of that, Alameda had a secret speed advantage (aka frontrunning its own customers) when executing orders on FTX, said the Commodity Futures Trading Commission.

The CFTC filing also revealed that Bankman-Fried considered closing down the crypto hedge fund in September. Instead, he mingled customer funds.

On Monday, FTX CEO John Ray (Enron cleaner) released a statement ahead of his appearance on Tuesday, detailing the firm's lack of control and laying out core structure flaws. His testimony showed obscure things like storing private keys without encryption or that FTX used Quickbooks (yes, the one for local pizza shops) for its accounting. "It's really unprecedented in terms of the lack of documentation," said Ray.

The indictment laid out the central arc of crimes alleged in recent weeks: FTX’s leadership used customer funds to power Alameda Research, especially in recent months as the trading firm’s fortunes worsened. Essentially FTX was Alameda’s piggy bank, made up of customer funds. Bankman-Fried lied to lenders and customers, the government alleged in the unsealed grand jury indictment.

It remains to be a mystery how someone can fuck up that bad with such a powerful asymmetric system. This is beyond comprehension. It’s not the last billionaire or hedge fund manager I will outperform.

Meme of the Day:

Crypto News:

Investment fund manager M31 Capital has chosen Anchorage Digital Bank to custody the $100M Web3 Opportunity Fund it launched in October.

Bitcoin miner TeraWulf ups hashrate guidance by 16%, raises $10M as shares plummet over 30%. The convertible promissory note allows a restructured deal with Bitmain.

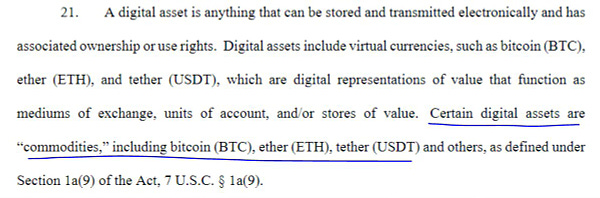

CFTC declares ETH as a commodity again in a court filing, countering previous claims that staked coins are securities according to the Howey Test.

PayPal will seamlessly integrate within the MetaMask wallet, providing customers with a simple and convenient way to buy Ethereum with PayPal.

Bitcoin Group SE, a crypto investment company, has signed an agreement to acquire the centuries-old German bank Bankhaus von der Heydt for $14M. It holds a full banking license. It is also a provider of digital asset custody and tokenization in Germany. Last year, the bank partnered with Fireblocks.

Stablecoin operator Tether intends to reduce secured loans in its reserves to zero in 2023. They also did a $3BN chain swap with Binance, converting USDT from Tron to ERC20.

Atlas Trading founders Zack Morris and PJ Matlock and other Twitter stock influencers were targeted by SEC as they conspired to manipulate stocks and earned about $100M.

Gemini appears to have suffered a data breach on or before Dec. 13, with 5.7M users' emails, account numbers, and partial phone numbers allegedly leaked due to a third-party incident.

Bitcoin miner Argo is looking to sell assets as it attempts to avoid filing for bankruptcy protection after it accidentally published drafts implying that it had filed for bankruptcy.

Discord's newly announced linked roles include support for Solana – a first for any blockchain. Servers with the Solana app installed can prompt users to link and authenticate with their wallet.

Brazil is set to launch a Central Bank Digital Currency (CBDC) in 2024.

DeFi landscape:

Arbitrum-based ETH perp protocol Rage Trade launched Delta-Neutral GLP vaults and has filled in minutes. No plans to increase the deposit cap within the next few weeks.

Contagno will launch a public beta on Arbitrum soon. For the first time in history you'll be able to trade expirable contracts fully on-chain. No order books. No liquidity pools. Pure DeFi style.

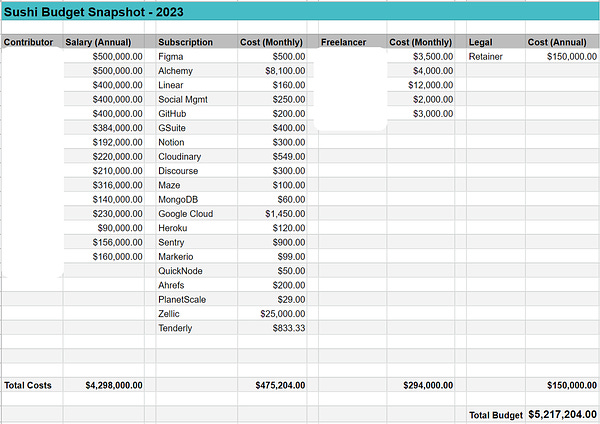

SushiSwap Head Chef discloses $5.2M budget for DAO operation in 2023.

NFT & Metaverse:

Web3 and metaverse newcomer Oasys has launched its proof-of-stake blockchain mainnet. In July, it raised $20M in a private token sale from investors, including Jump Crypto, Crypto.com, and Huobi.

BlackRock is launching a new metaverse ETF. It will track the Global Metaverse Index, leveraging patent data to identify market leaders, innovators, and specialists.

Apple plans to enable downloads of external apps outside its own App Store. A new twist in the debate about the 30% cut Apple takes from everything.

Gaming platform Forte partners with Venture Studio SuperLayer to expand beyond Web3 gaming and invested $5M.

Notable sidenotes:

Neon EVM’s Mainnet launch was delayed.

Axelar integrates Secret to offer private cross-chain messaging and NFT transfers.

Liquid staking provider Quicksilver (Cosmos) mainnet launch is in January.

zkSync 2.0 roadmap published.

CoW protocol introducing surplus-capturing limit orders.

Sturdy, a lending protocol on ETH, releasing its own token.

ConsenSys launches zkEVM private beta testnet - over 150,000 signups so far.

Funding Highlights:

Frontrunner raised $4.75M in a seed round led by Susquehanna Private Equity Investment. It's a non-custodial decentralized prediction market for sports betting built in the Cosmos ecosystem.

Maker of web3 adoptable dogs from 'outer space,' Dogami raises fresh $7M (total $14M in funding) from XAnge and Bpifrance.

Sooho.io, a provider of DeFi services, has raised $4.5M to help forge links between separate blockchains in its native South Korea.

Crypto Twitter: